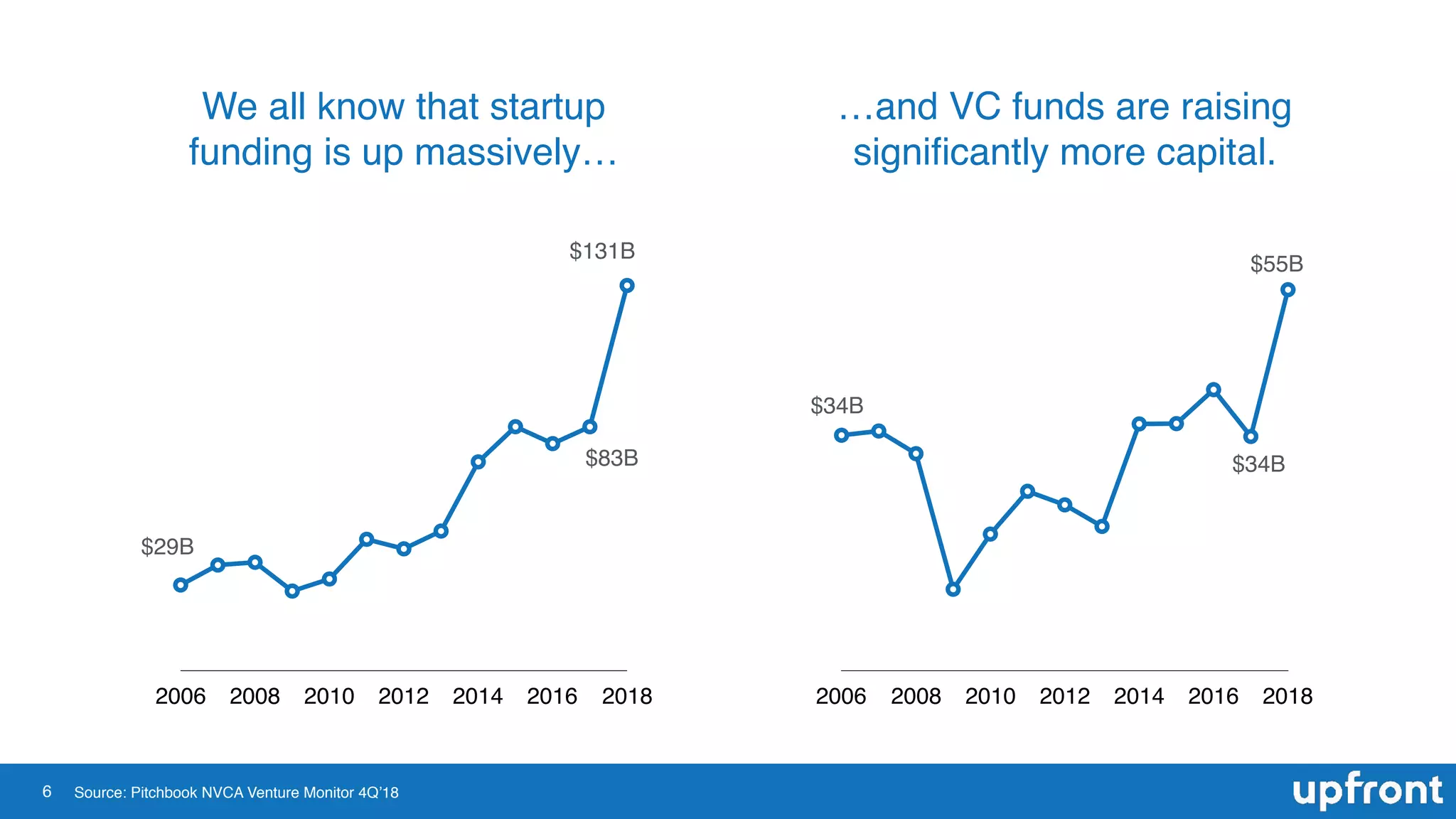

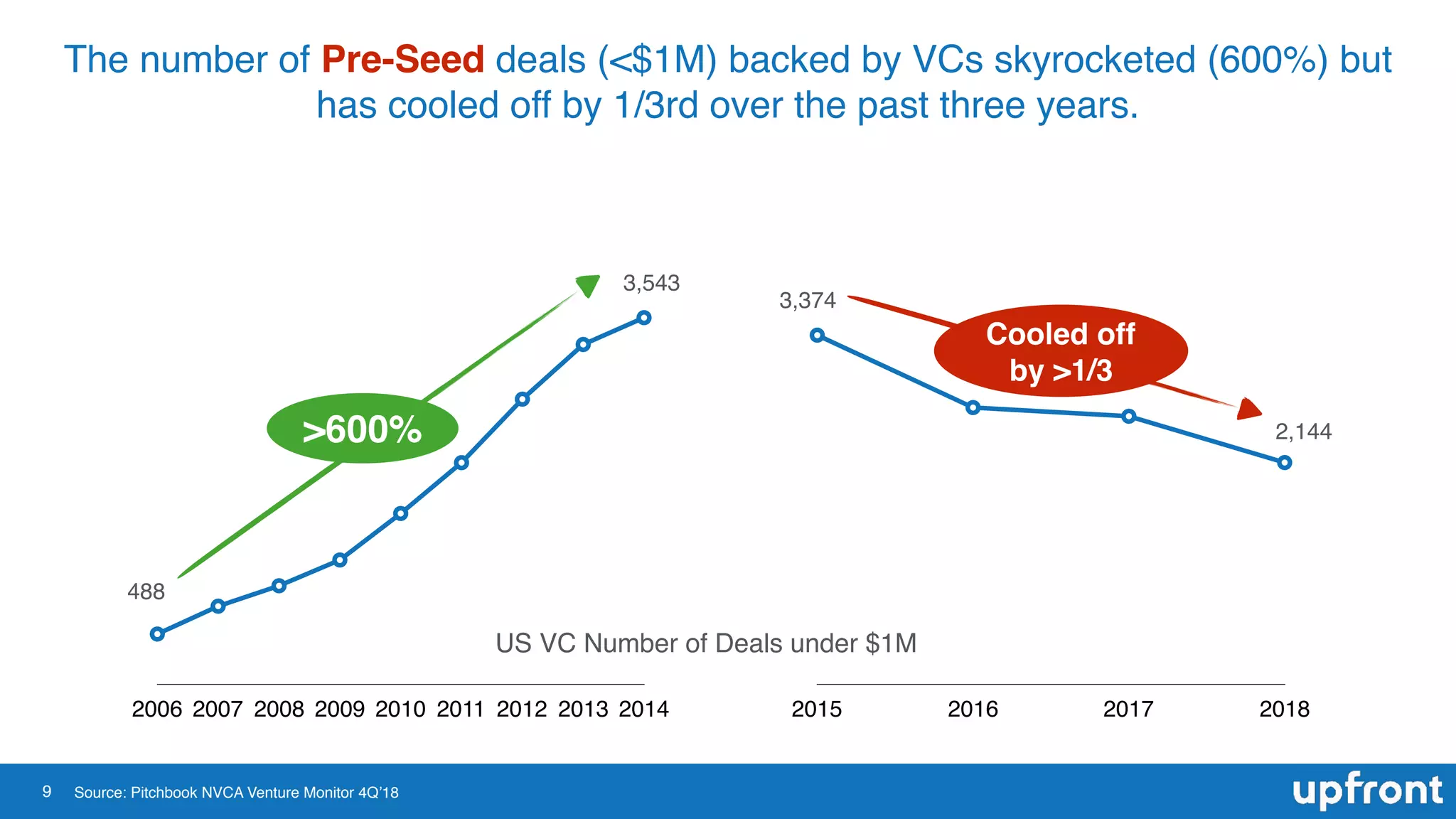

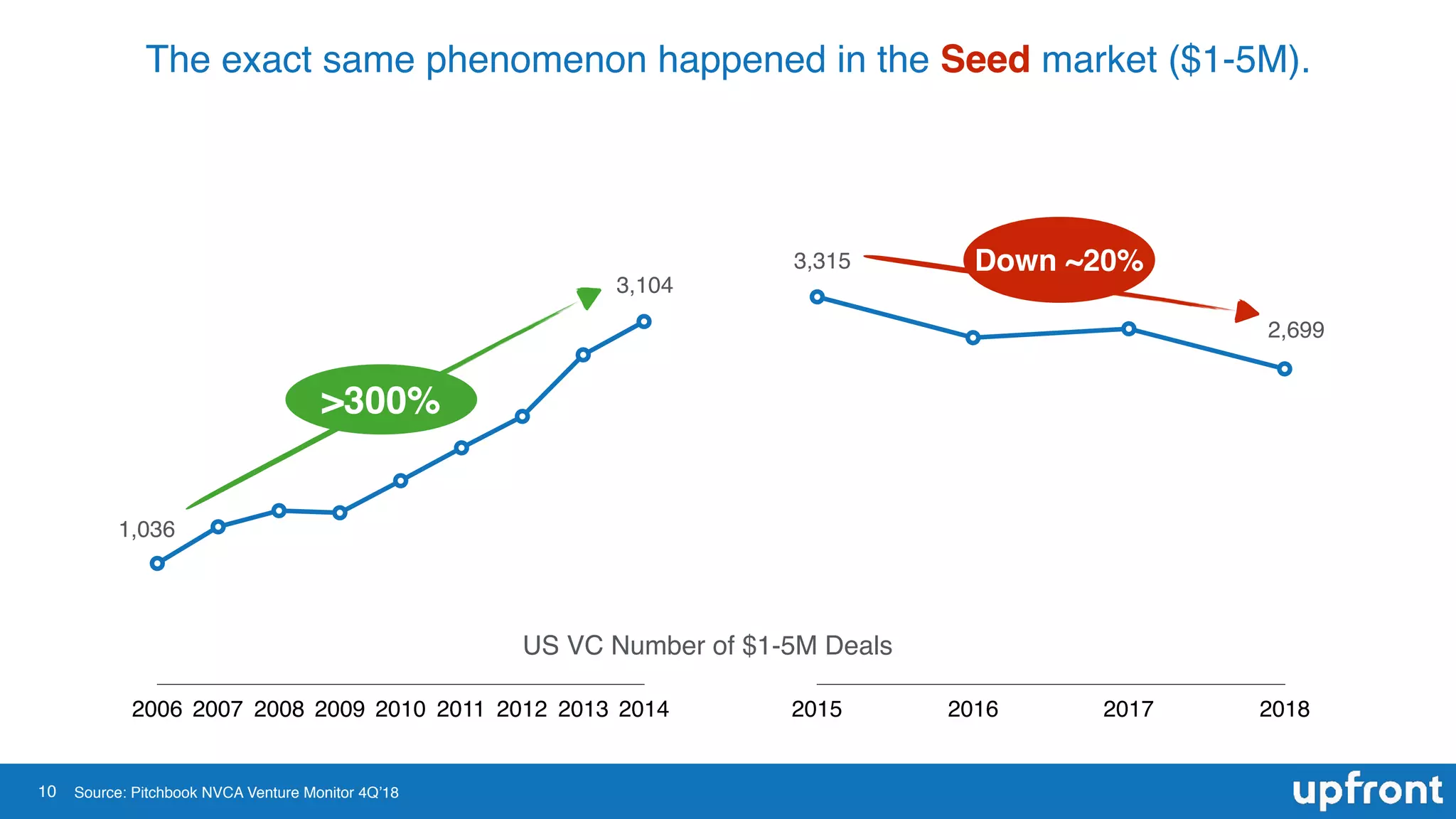

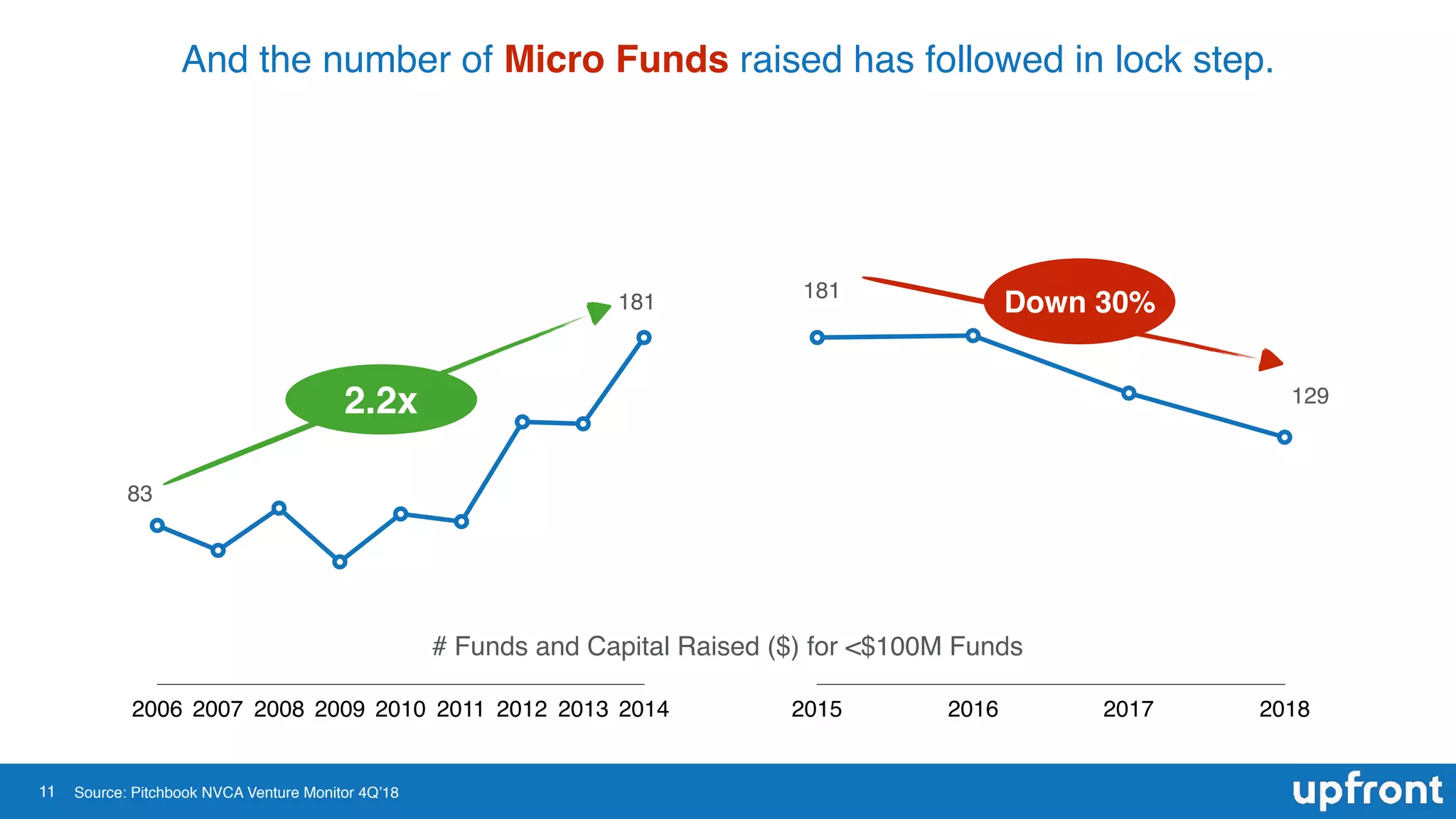

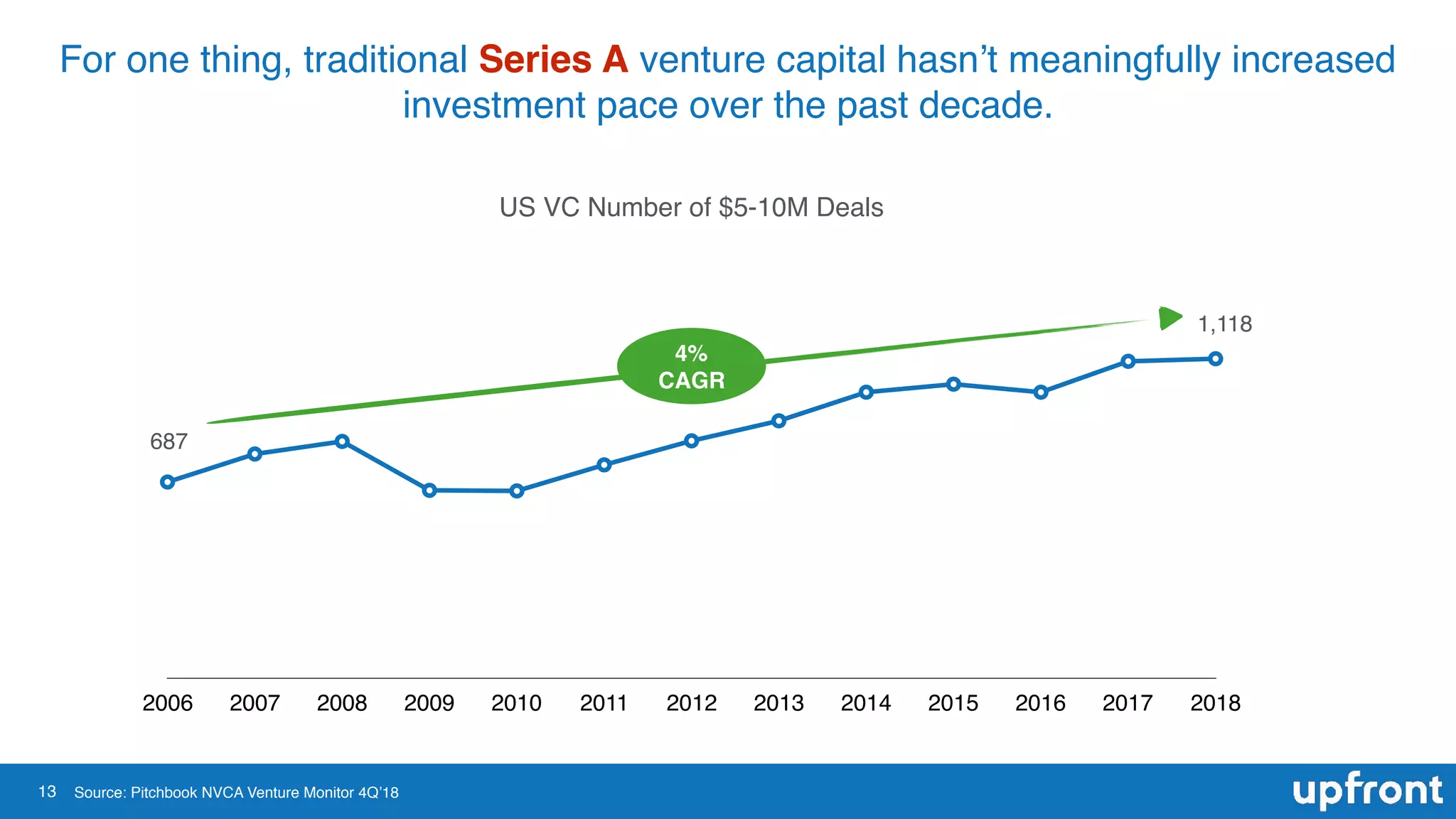

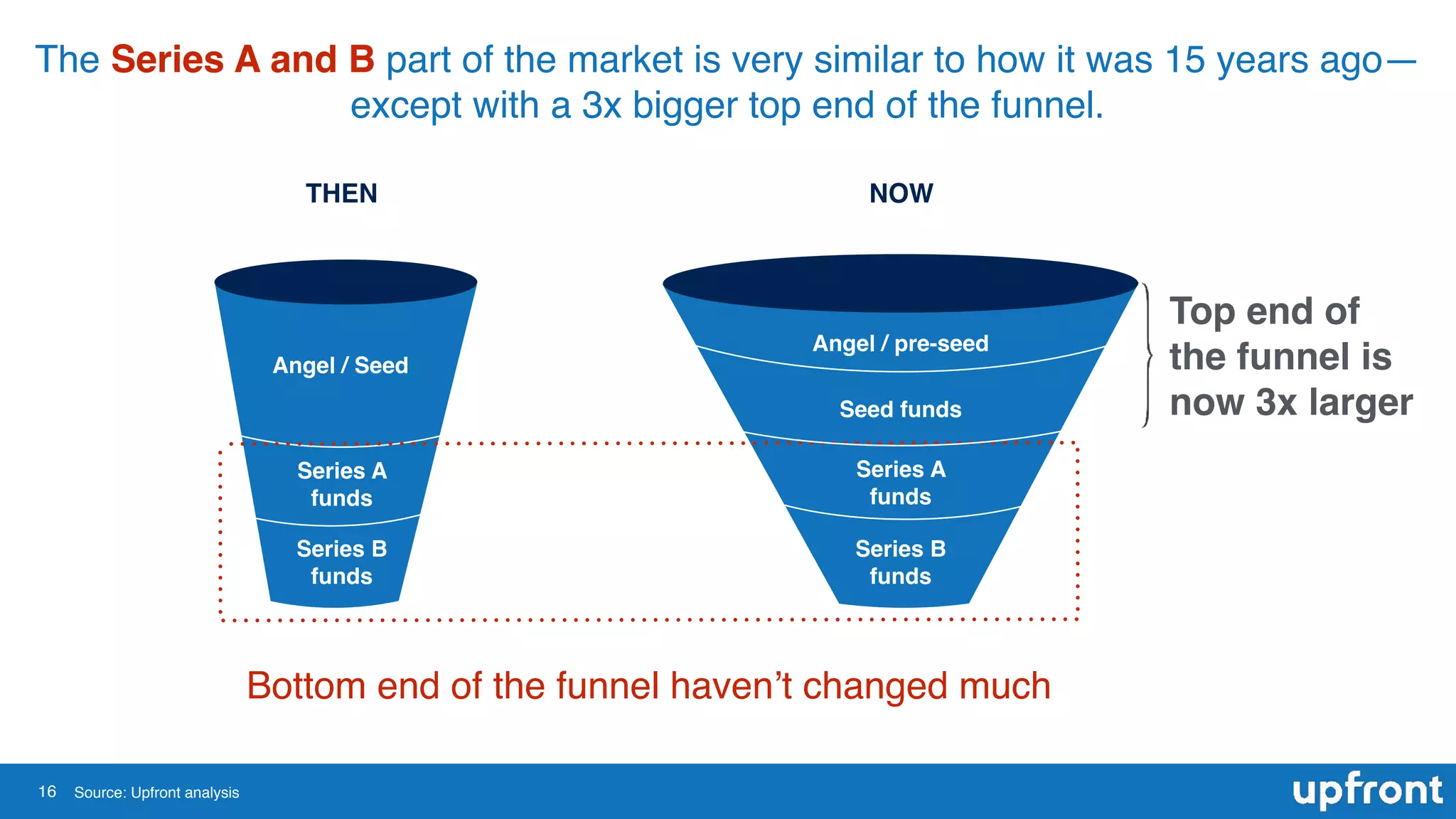

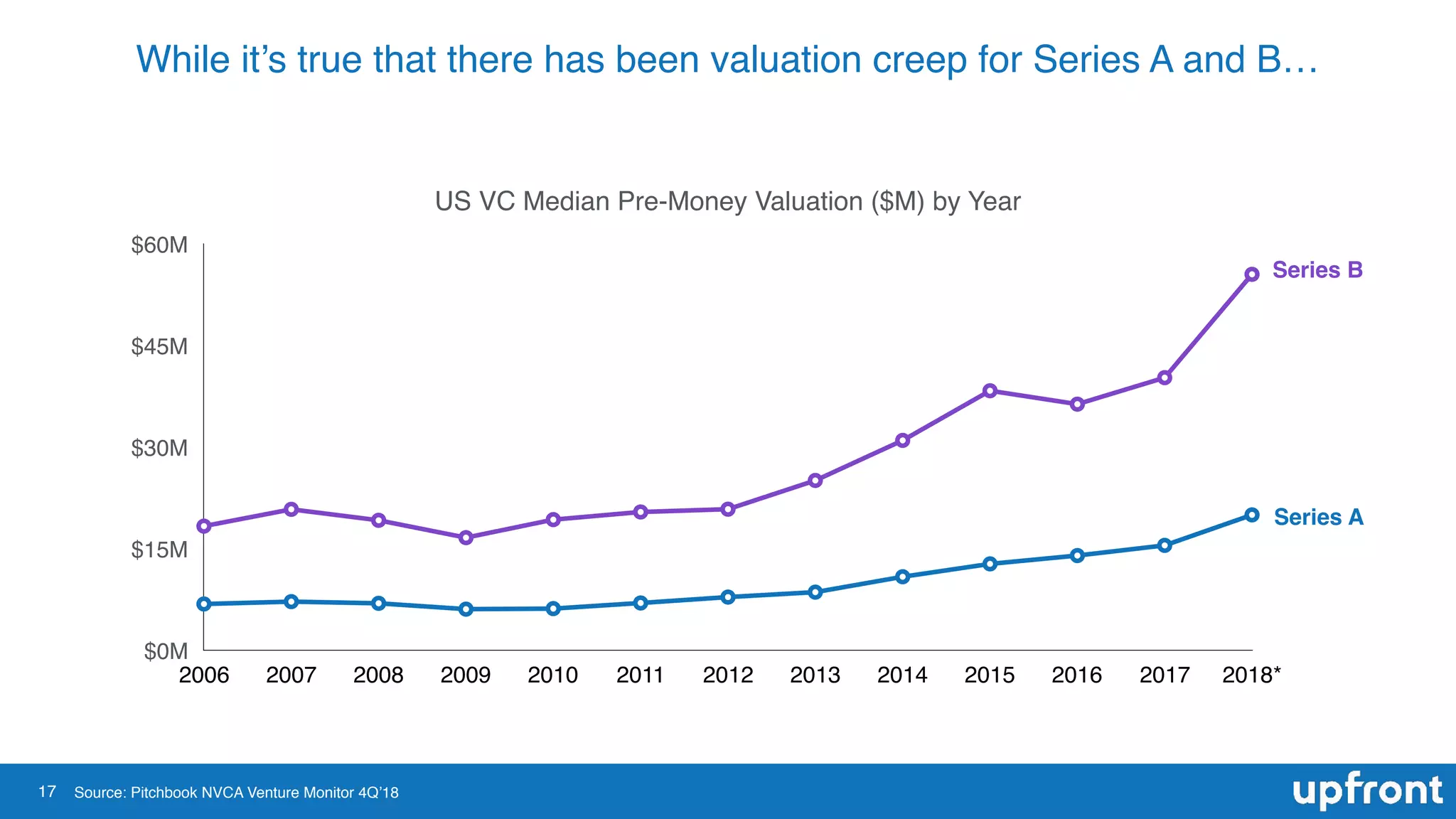

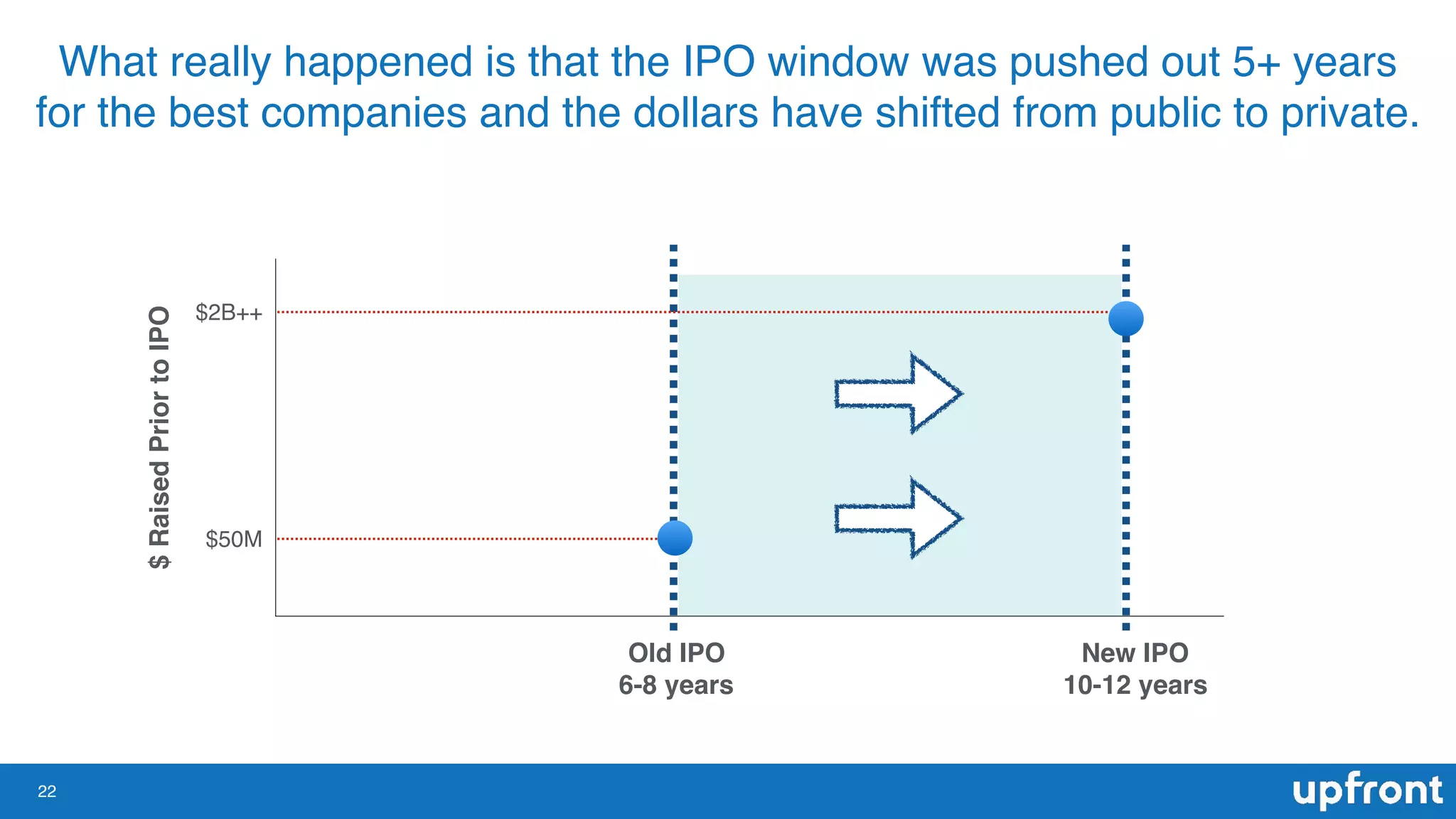

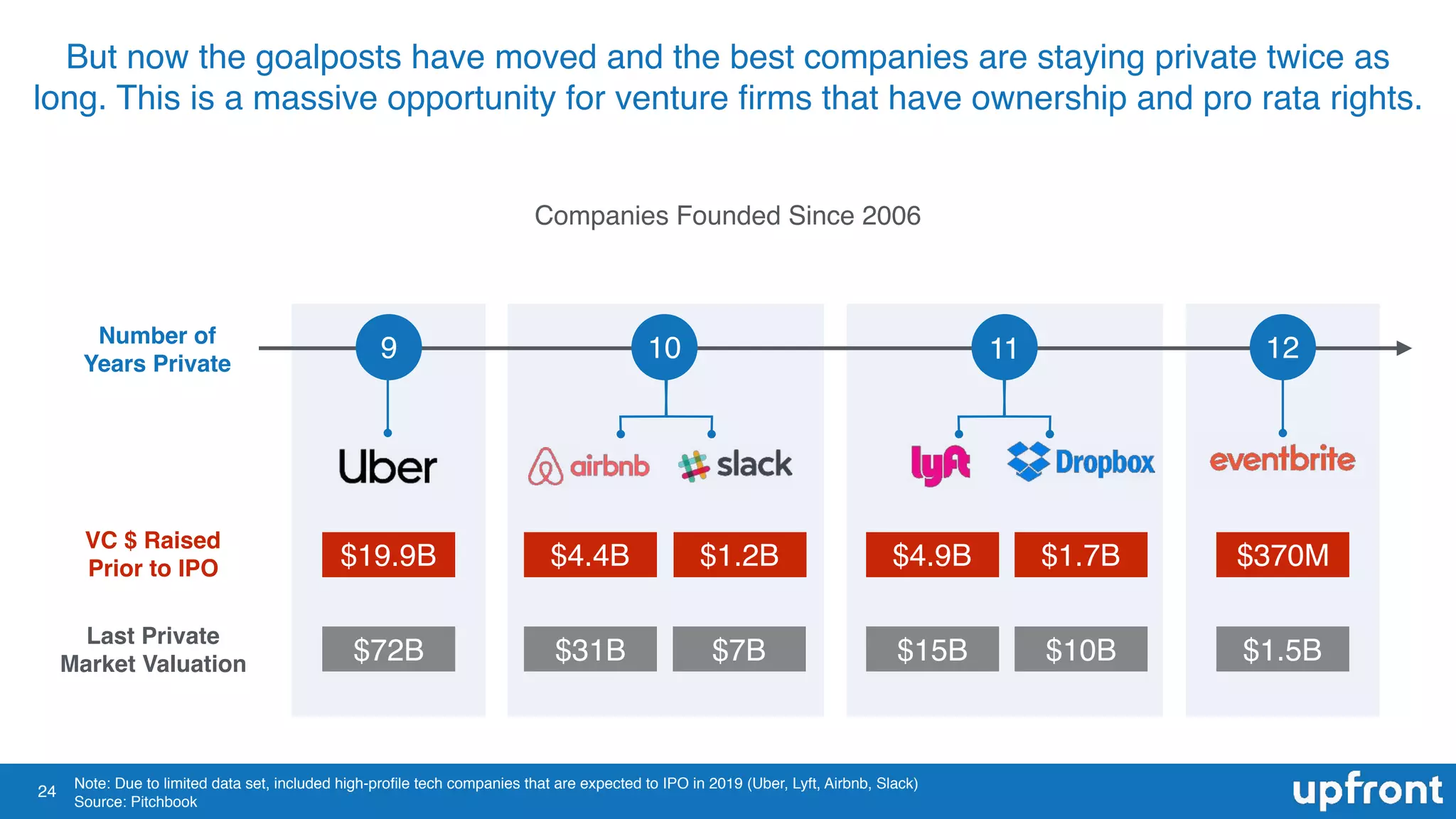

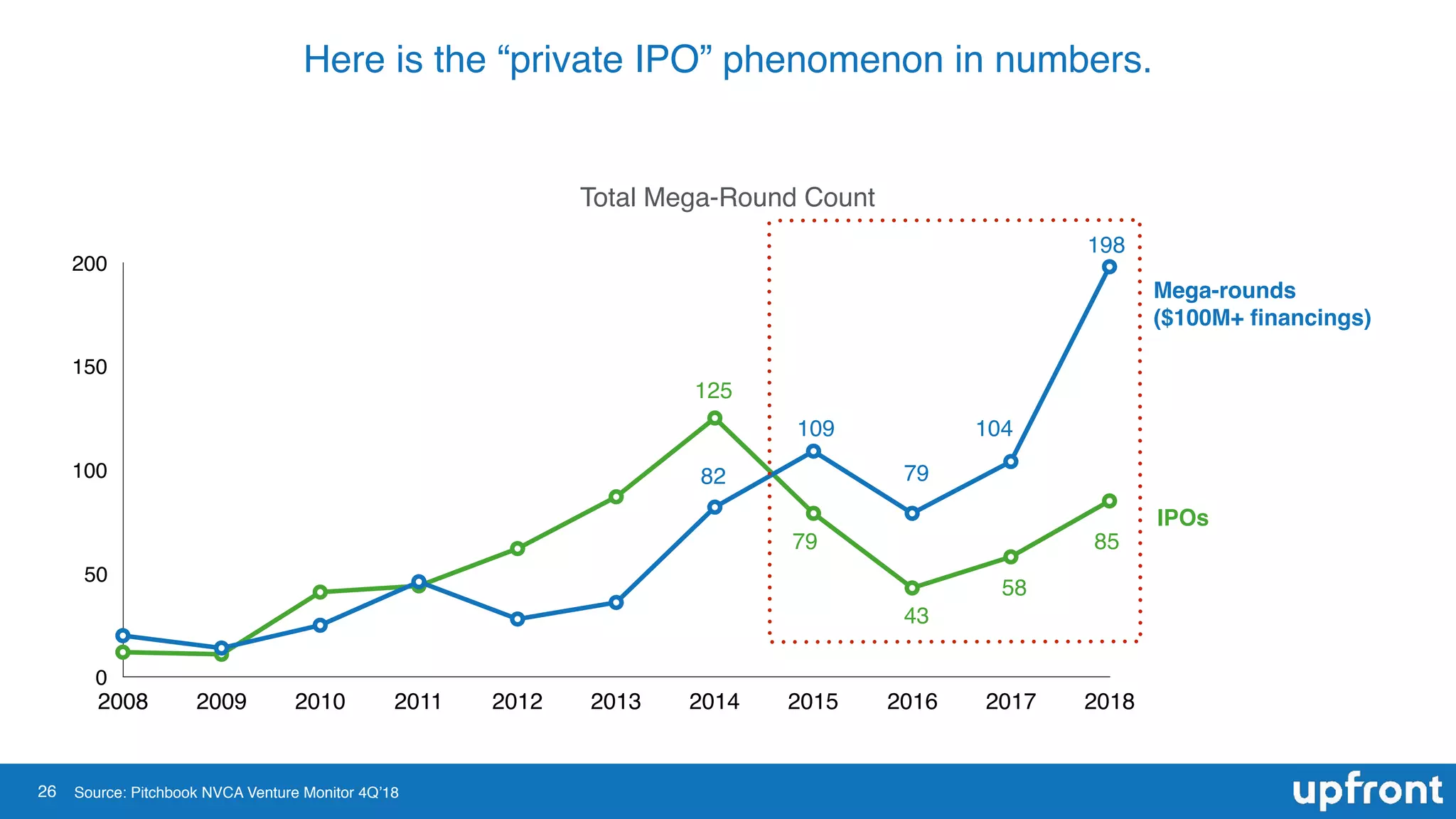

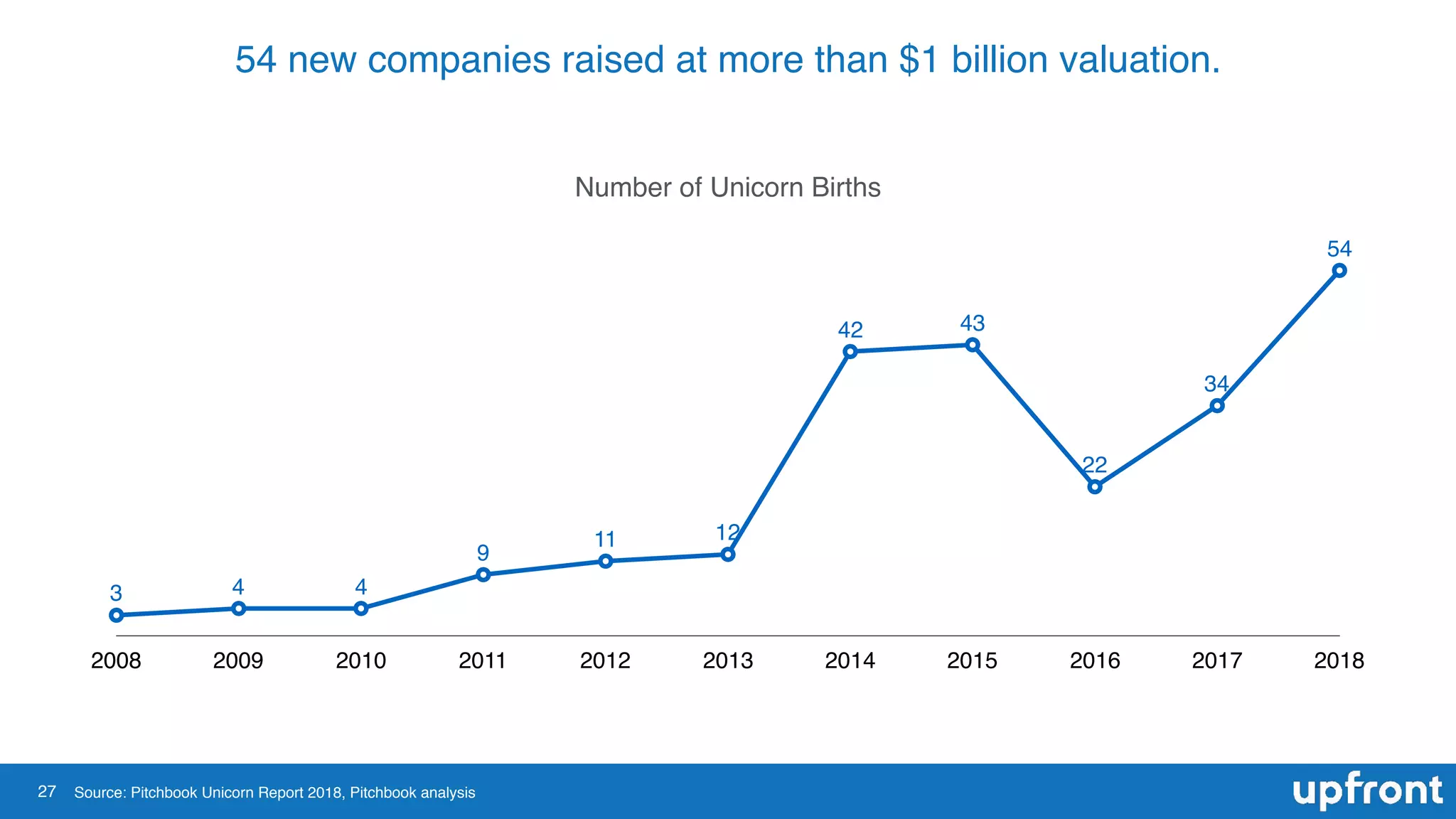

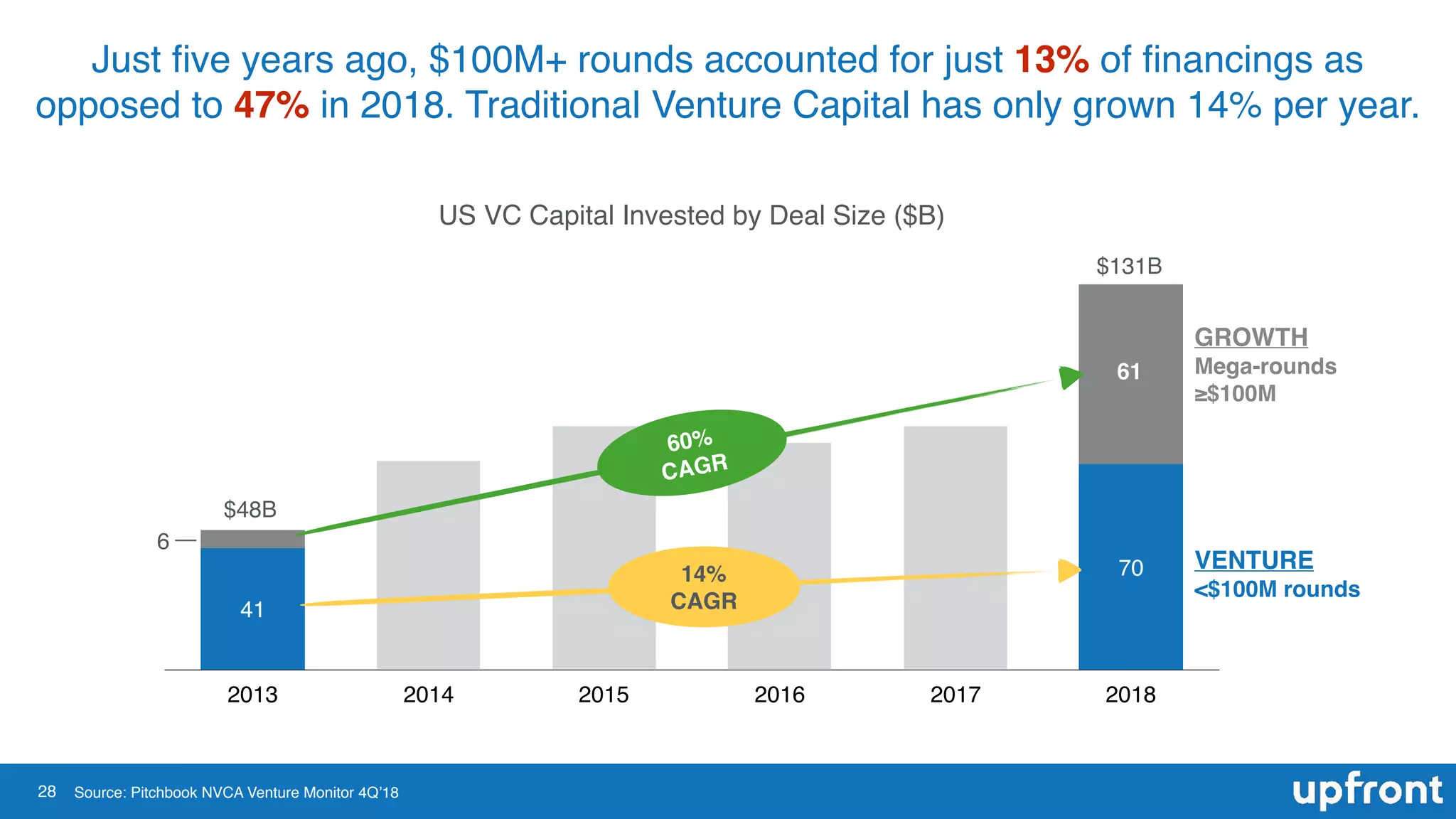

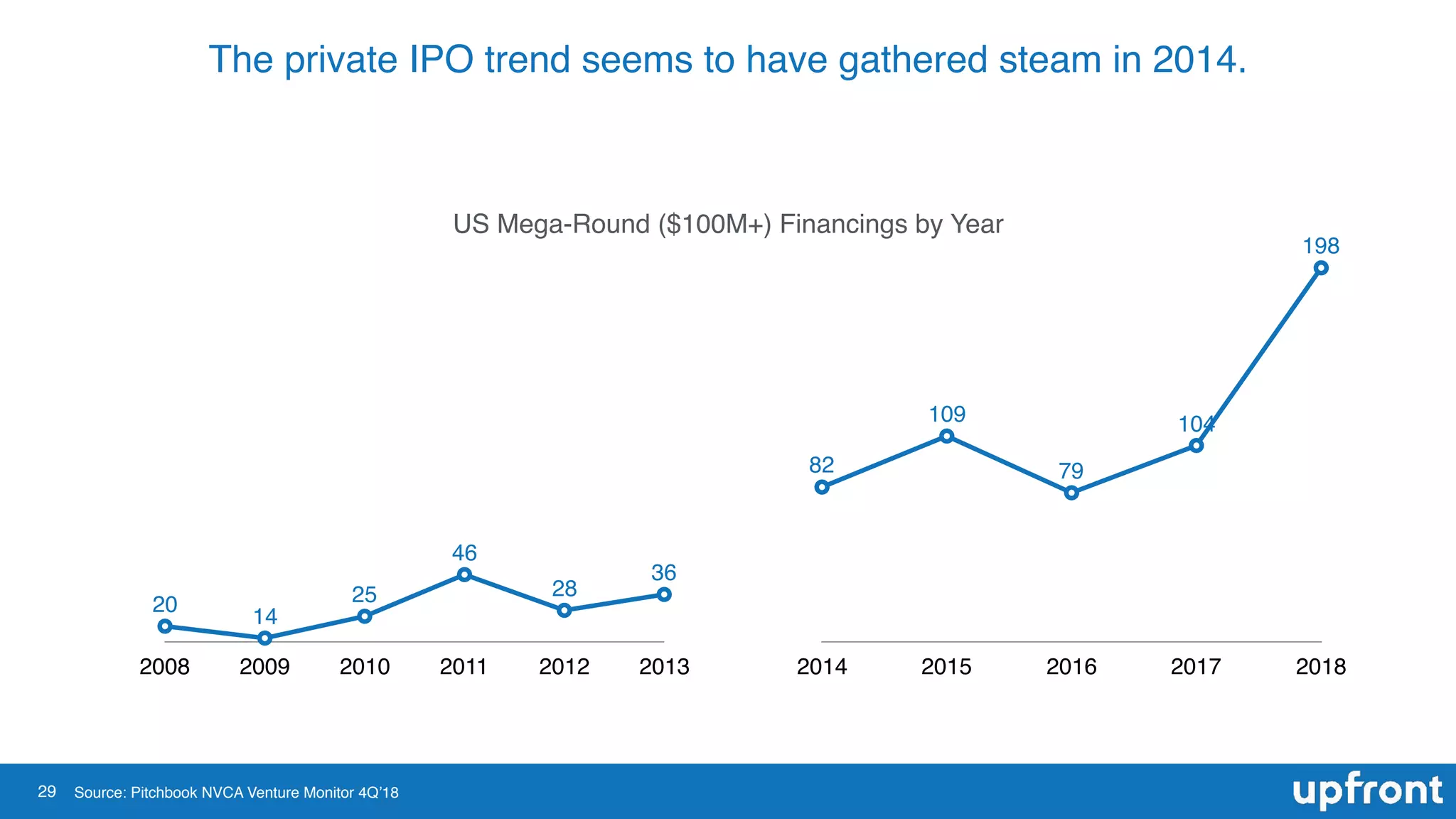

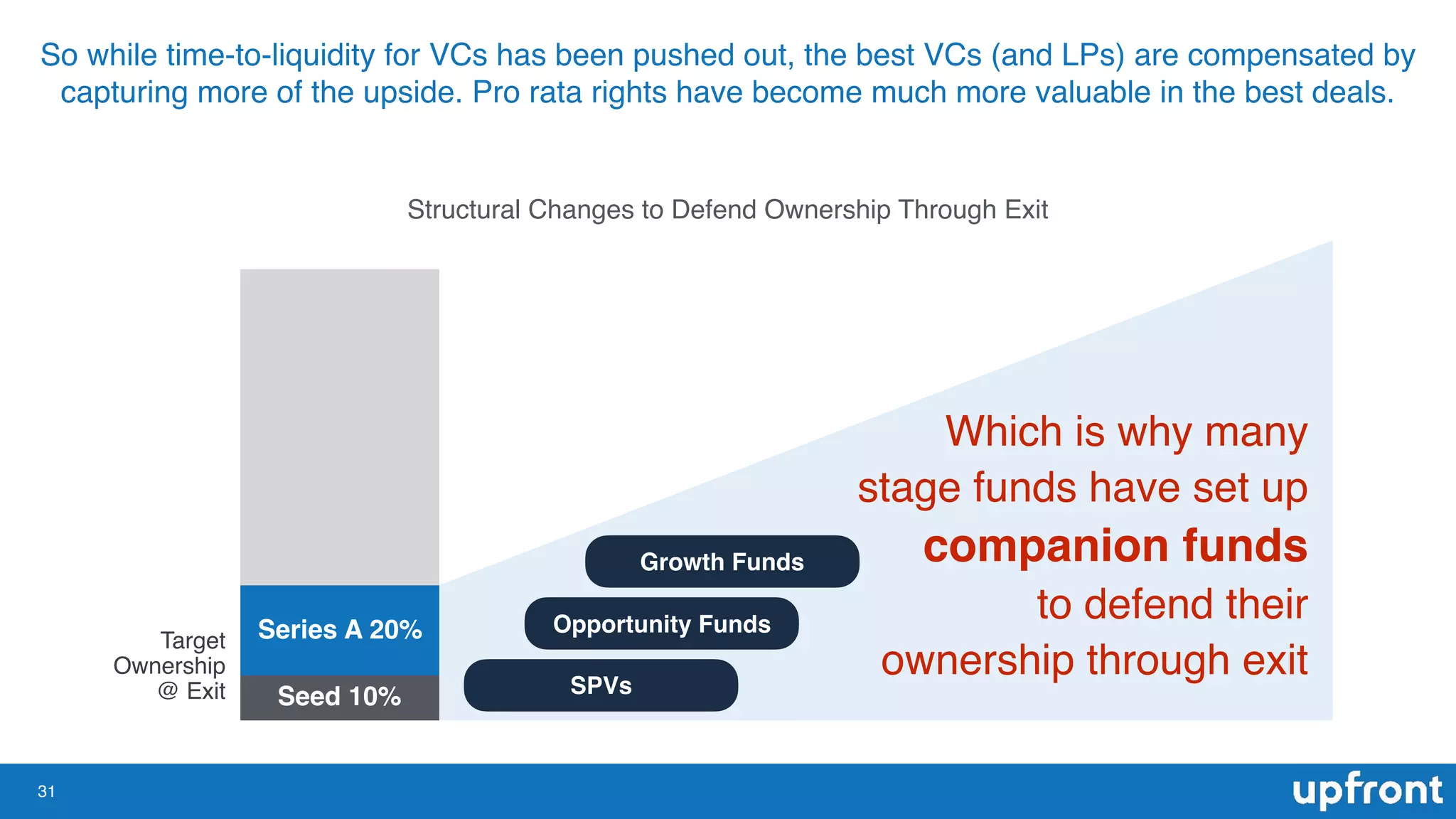

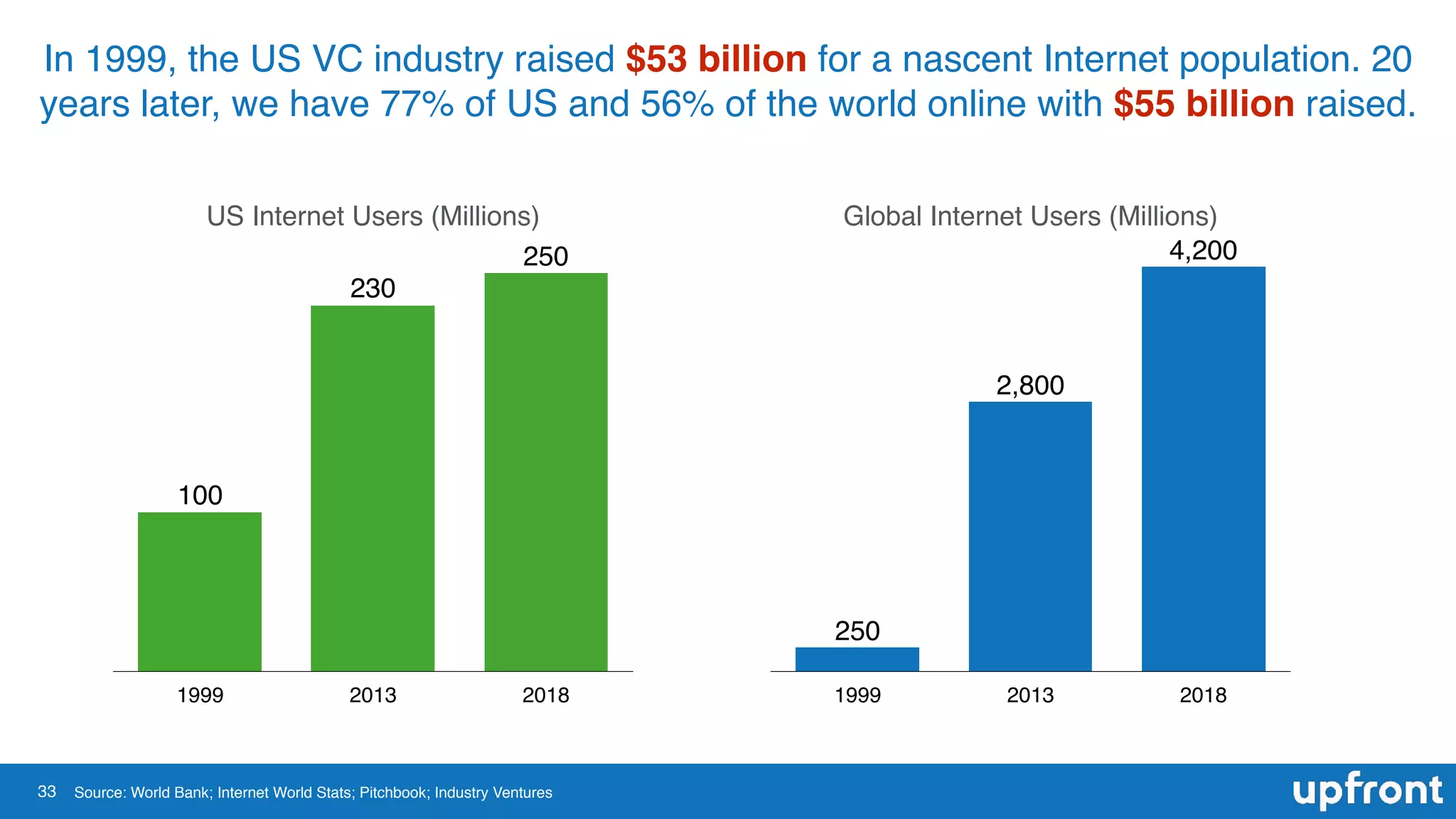

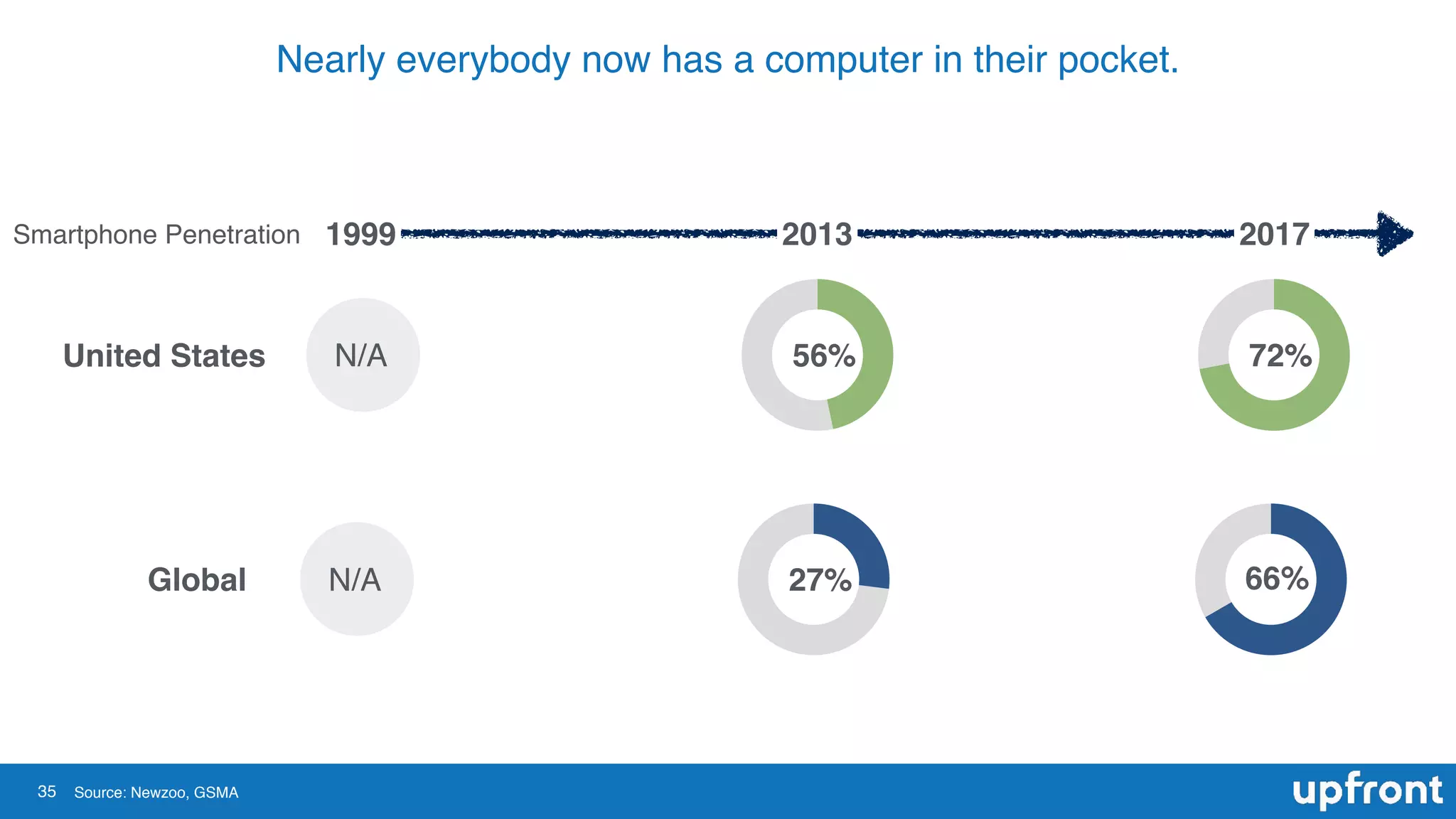

The document discusses the current state of venture capital (VC), highlighting that while some founders are moving away from traditional VC, overall startup funding has increased significantly. It observes trends such as the rise in pre-seed and seed deals, a longer time to IPO, and the dominance of mega-rounds in financing. Despite concerns about valuation creep, the potential for VC remains strong due to increased ownership opportunities and the ongoing shift of value from public to private markets.