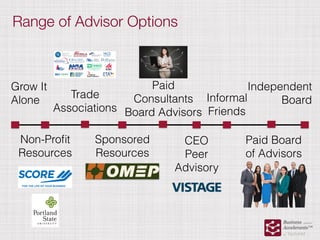

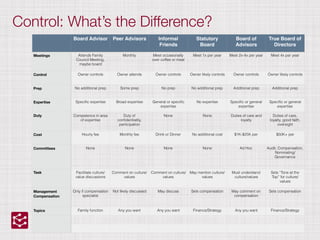

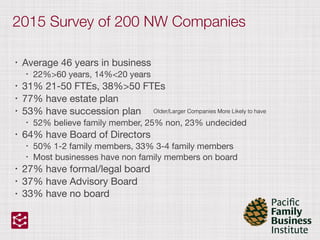

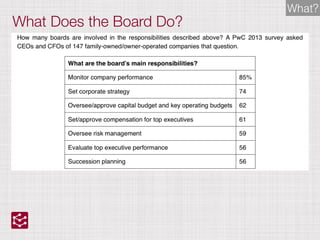

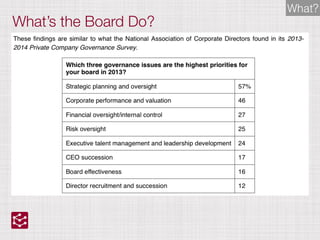

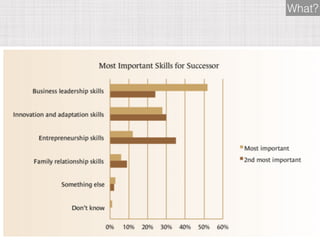

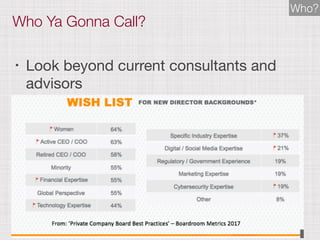

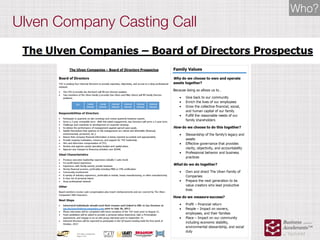

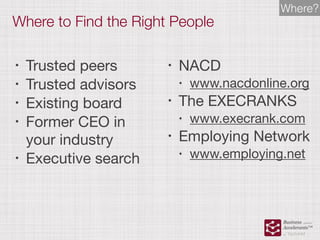

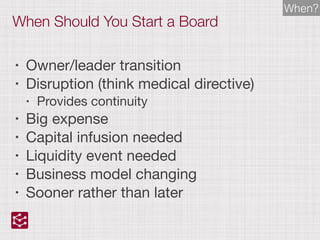

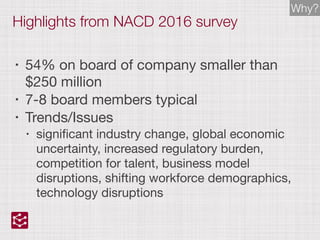

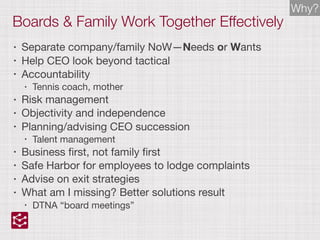

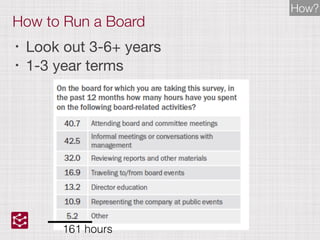

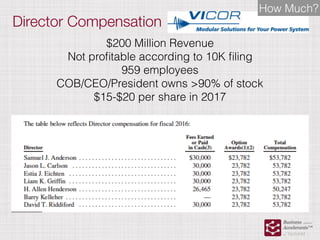

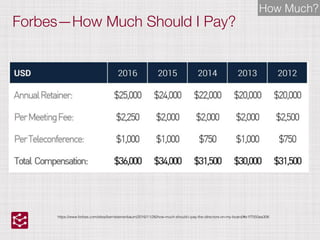

This document discusses advisory boards and their role in driving business success. It provides a range of advisory options for business owners from independent advisors to paid consultants. It also outlines the differences between board advisors, peer advisors, and informal friends in terms of meetings, control, preparation required, duties, costs, and topics discussed. The document then summarizes surveys that show many family businesses have boards of directors but few have formal legal boards. It stresses that older, larger companies are more likely to have advisory boards and outlines factors to consider when starting a board.