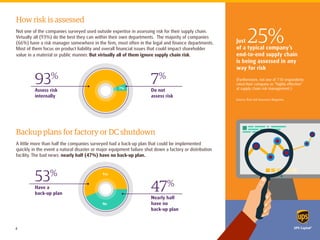

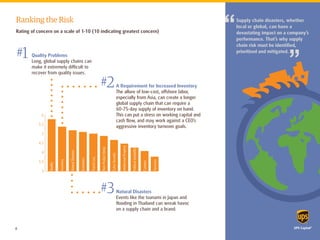

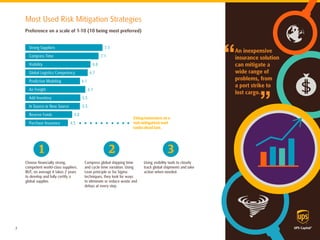

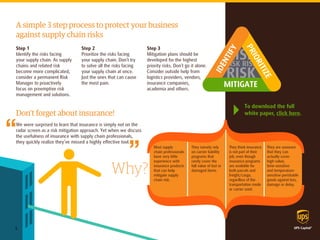

This report summarizes the findings of a study on managing risk in the global supply chain. The study surveyed 150 supply chain executives and conducted interviews. It found that while disruptions can significantly impact business performance, most companies do little to formally manage supply chain risk. They do not use outside expertise or quantify risks. On average, only 25% of supply chains are assessed for risk. The report provides recommendations for identifying, prioritizing and mitigating risks through measures like strong suppliers, visibility, insurance, and having backup plans.