The document discusses 6 global macroeconomic themes for 2021:

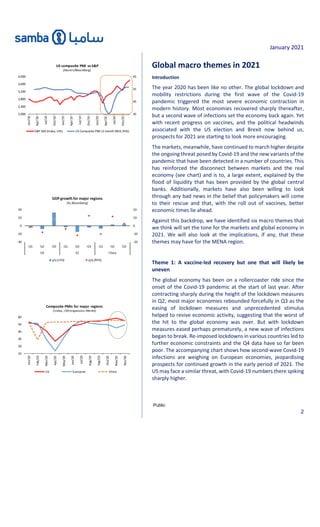

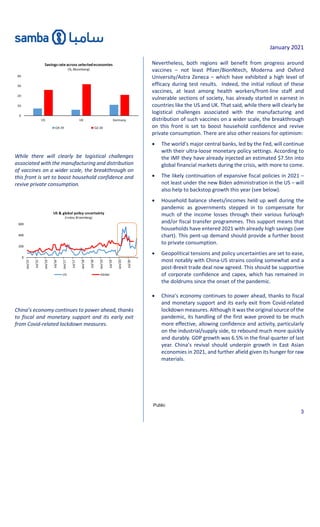

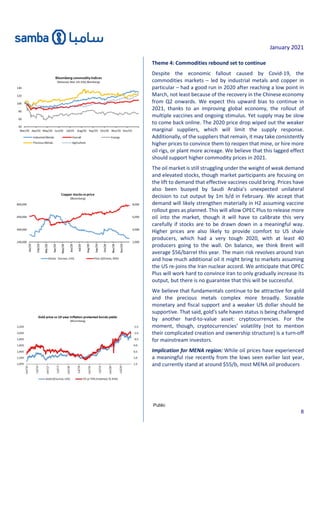

1) A vaccine-led economic recovery will be uneven across countries and sectors in the near-term.

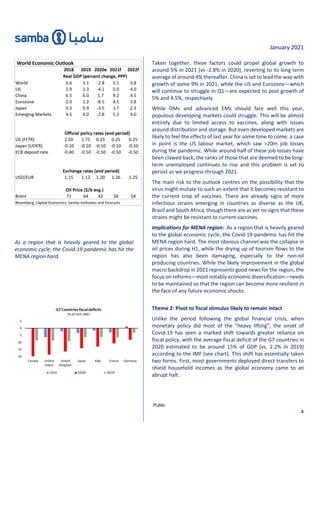

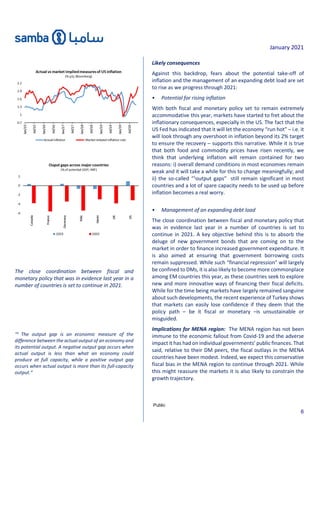

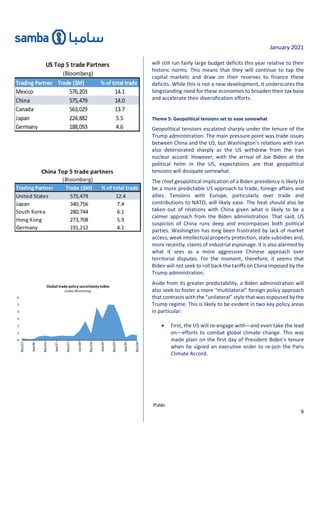

2) Fiscal stimulus policies are expected to remain expansive in 2021, particularly in the US with proposed stimulus packages.

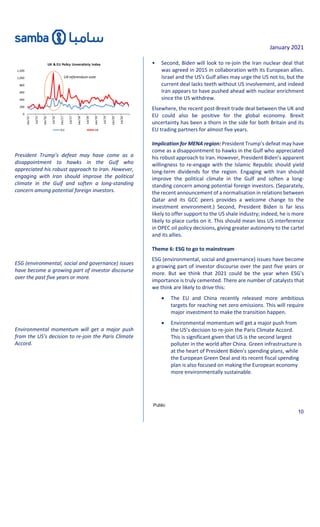

3) Continued coordination between fiscal and monetary policies will support growth.

4) Concerns around rising inflation and growing public debt loads may rise as the year progresses.

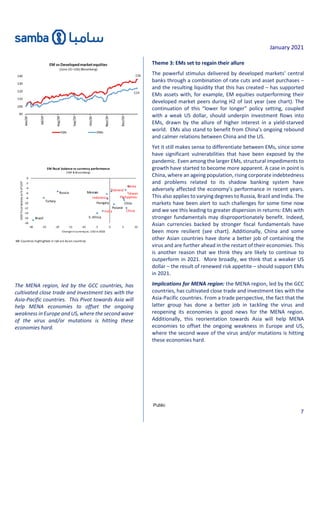

5) The MENA region's economic recovery will depend on improved global conditions and higher oil prices.

6) Overall global growth is projected to rebound to around 5% in 2021, led by China, but risks remain from new COVID variants.