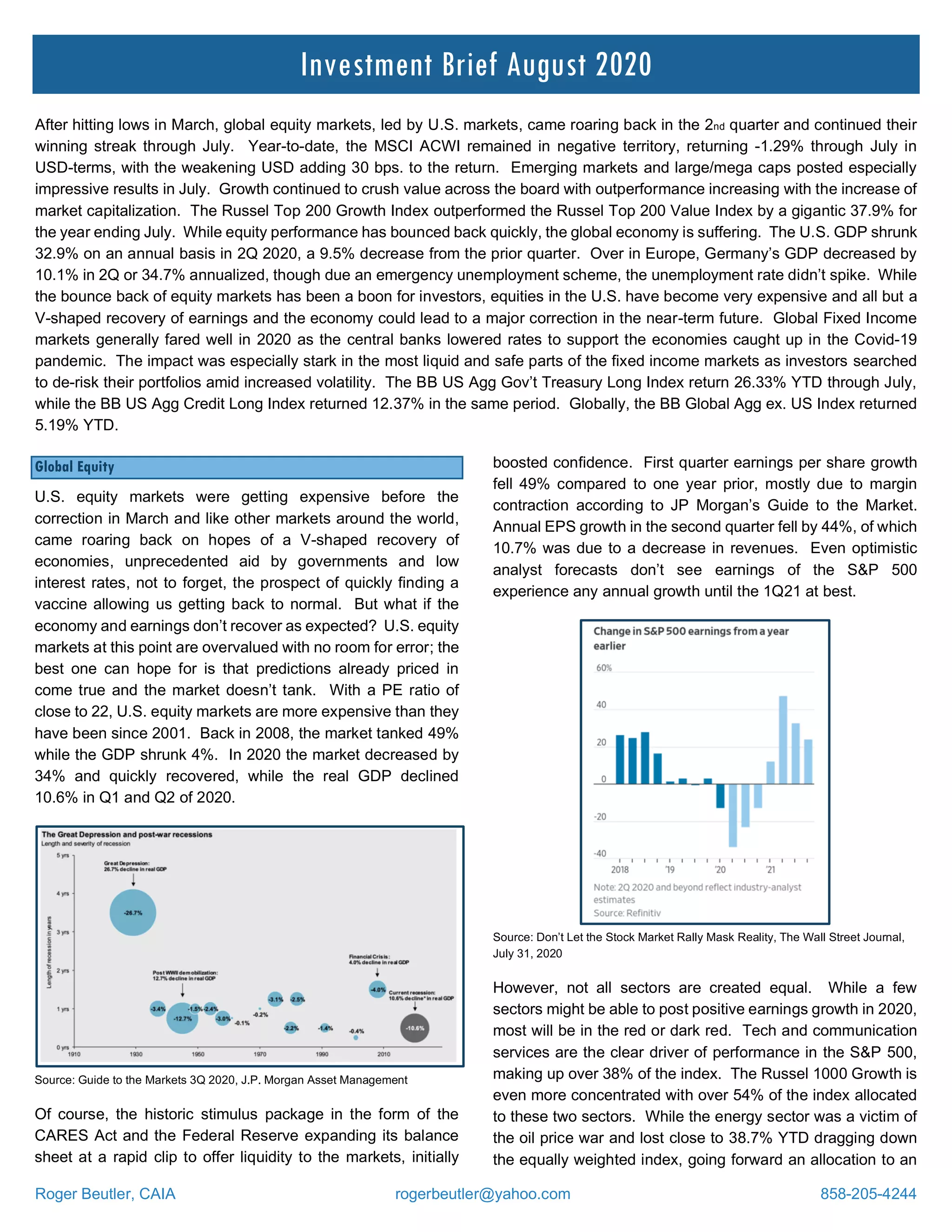

- After hitting lows in March, global equity markets rebounded in Q2 led by the US, but the MSCI ACWI index remained negative for the year. Emerging markets and large caps performed well in July.

- While equity markets recovered, the global economy is suffering with the US GDP shrinking 32.9% annually in Q2 and Germany's GDP decreasing 10.1%.

- US equity markets have become very expensive with little room for error should economic and earnings recovery not materialize as expected. Global fixed income markets did well as central banks lowered rates to support economies.

![Roger Beutler, CAIA rogerbeutler@yahoo.com 858-205-4244

equal weight index might offer some protection considering the

continued elevated volatility levels.

Source: Guide to the Markets 3Q 2020, J.P. Morgan Asset Management

Compared to other equity markets, the U.S. markets recovered

faster from their lows in March. However, U.S. equity markets

at this point are also relatively rich compared to other markets.

A sliding USD has helped some markets but fundamentals in

many markets provide more potential upside than the equity

markets in the United States.

Source: Guide to the Markets 3Q 2020, J.P. Morgan Asset Management

1 Ben Inker GMO, Morningstar Long View Podcast 7/29/20

Especially emerging markets remain compelling. GMO’s Ben

Inker recently pointed out, “…while I’ve waited for the world to

fall back in love with emerging [markets], I am getting paid very

nicely to wait.”1

Global Fixed Income

U.S. fixed income indices posted positive returns through July

in 2020, even the BB US Agg Corporate High Yield index

managed to return 71 basis points in 2020 despite an

increasing default rate.

Source: Guide to the Markets 3Q 2020, J.P. Morgan Asset Management

International fixed income markets posted competitive returns

for U.S.-based investors in 2020, often helped by a weakening

US-dollar. Fixed income markets were supported by two rate

cuts by the Federal Reserve Bank in 2020 and the Fed’s

commitment to keep rates low for as long as needed. The

pandemic had a significant impact on retailers, with 43 retailers

filing for bankruptcy protection as of August 3rd.2 Despite an

increase in default rates, the high-yield market remains

attractive and liquid, aided by the Fed’s bond buying program

to support companies through the pandemic. High-yield bond

issuance increased 50% in the first 5 months of the year

compared to 2019 according to Refinitiv. The shift to high-yield

bonds is also due to lack of investor demand in the leveraged

loan space. The biggest buyer of leveraged loans, CLOs, have

been wary to add new lower-rated loans to their portfolios amid

uncertainty of the economic outlook and cash flows, leading to

downgrades and ultimately failing overcollateralization tests.

The impact on the leverage loan market of the weakening

demand was an increase in OIDs or higher margins paid by

the borrowers, combined with stricter lending standards, all

making leveraged loans relatively less attractive for borrowers

compared to issuing high-yield bonds. While there is less

investor demand for leveraged loans, it also offers the

opportunity to selectively add to leverage loan exposure with

very a competitive risk/reward ratio. That said, “…in the

2 As pandemic stretches on… CNBC, August 3, 2020](https://image.slidesharecdn.com/investmentbriefaugust2020-200812150437/85/Investment-Brief-August-2020-2-320.jpg)