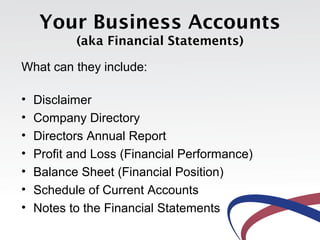

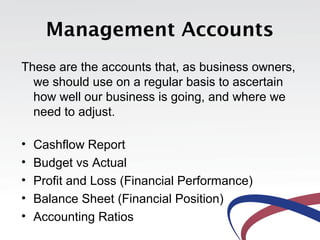

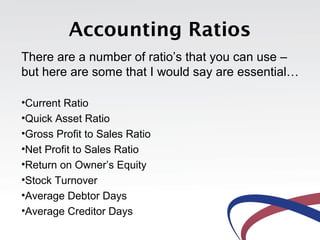

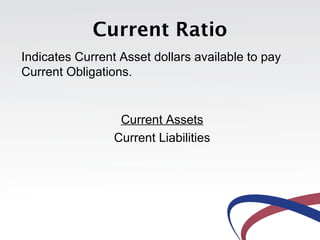

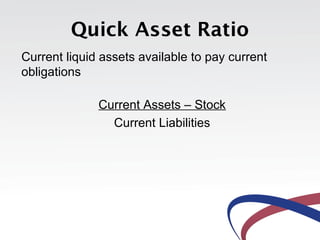

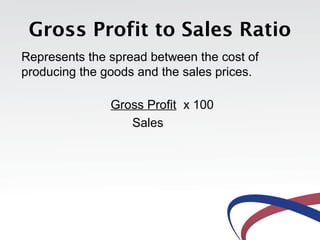

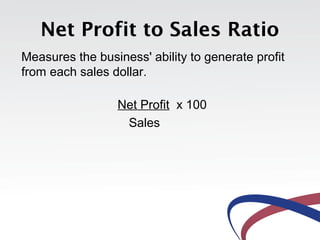

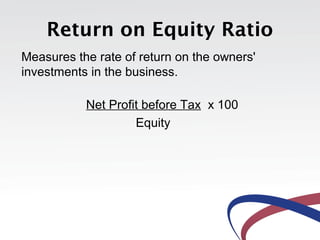

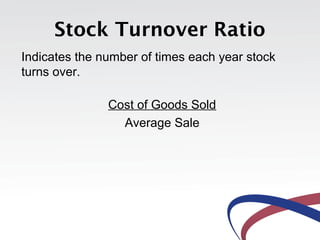

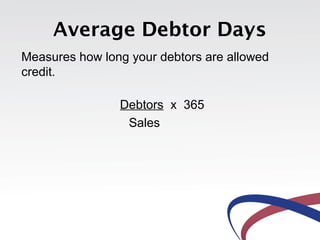

This document provides information on understanding business accounts and financial management. It discusses traditional financial statements produced for tax purposes and important management accounts that business owners should regularly review, including cashflow reports, budgets versus actuals, profit and loss reports, balance sheets, and key accounting ratios. These management accounts can help owners ascertain the business's financial performance and position, identify areas of concern, and make adjustments to improve viability. The document concludes by offering training to help businesses better monitor their finances.