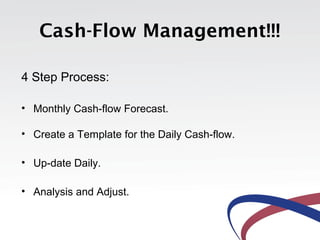

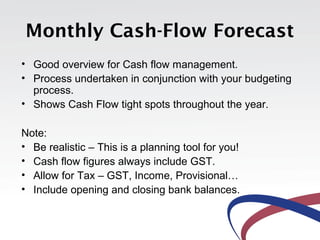

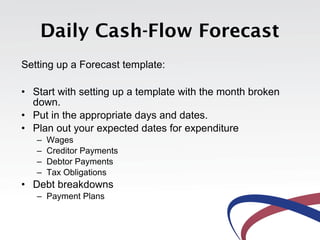

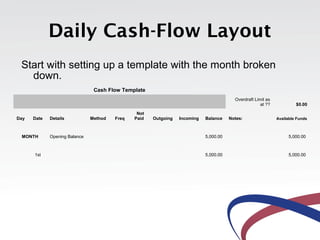

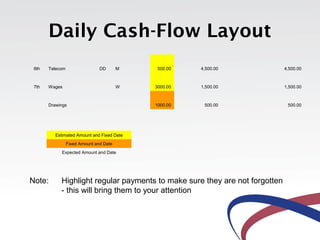

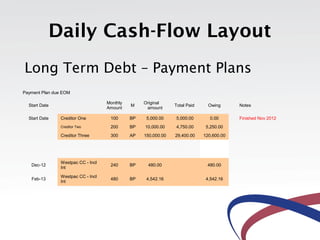

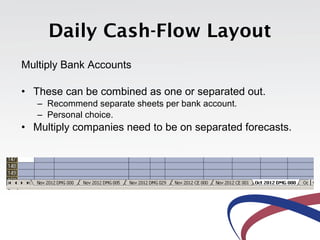

This document provides information about a workshop on cash flow management for businesses. It discusses Nicky from DMGNZ, a business support company, and her qualifications and experience. The document outlines six key areas of financial fitness: debtor and creditor management processes, budgeting systems, monthly reporting, cash flow management, and working with accountants and banks. It provides details on setting up systems for debtors and creditors, examples of monthly reports, the importance of cash flow, and a four-step cash flow management process including forecasting, tracking daily cash flow, updating forecasts, and using the forecasts to inform business decisions. An early bird special is offered for an upcoming six-month financial fitness program.