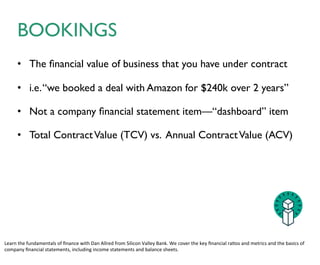

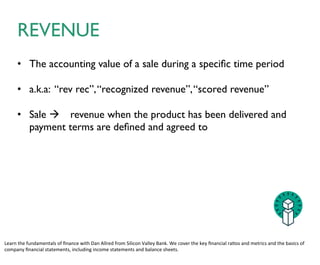

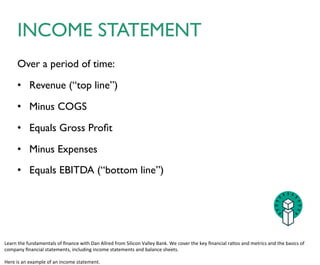

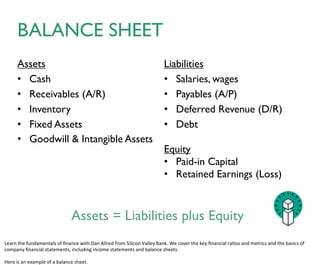

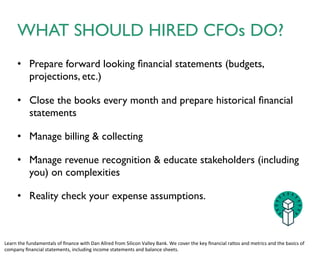

The document provides an overview of key financial concepts for startups presented by representatives from Silicon Valley Bank. It defines important metrics like revenue, costs of goods sold, expenses, and cash flow. It explains financial statements including the income statement and balance sheet. It recommends that founders become comfortable with basic financial language and tracking their progress towards milestones. It also outlines the additional responsibilities of hired chief financial officers, such as preparing financial projections and statements.