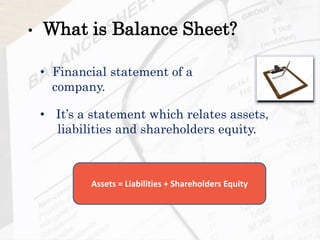

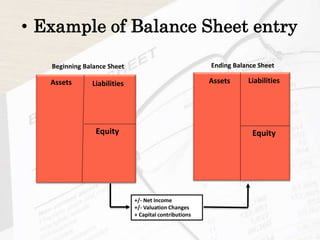

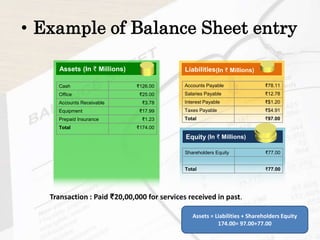

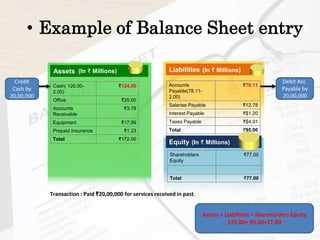

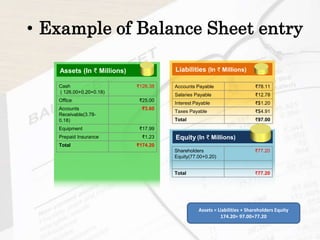

The document explains how to prepare a balance sheet, detailing its definition as a financial statement that relates assets, liabilities, and shareholders' equity. It covers the importance of balance sheets, their components, and includes examples of balance sheet entries and transactions. Additionally, it emphasizes the calculation of assets, liabilities, and equity to reflect the financial standing of a company.