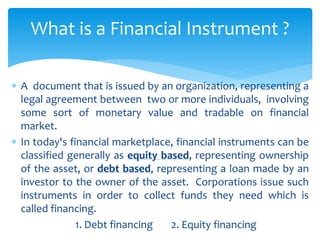

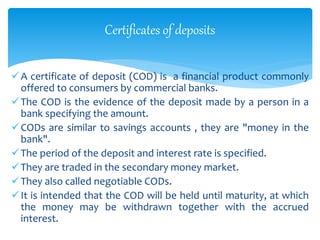

Financial instruments can be equity-based, representing ownership, or debt-based, representing a loan. They are used by corporations to raise funds. Money market instruments are short-term investments under 1 year, like treasury bills, commercial paper, and certificates of deposit. Capital market instruments are long-term investments over 1 year, such as treasury notes, bonds, and stocks. Characteristics of different financial instruments include liquidity, maturity, safety, and yield.