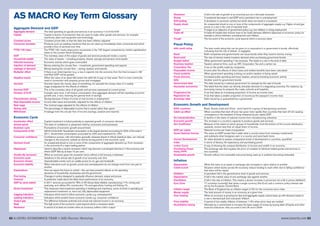

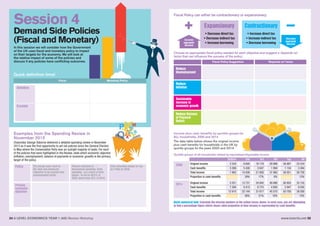

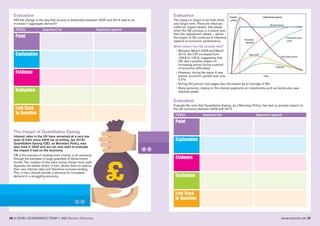

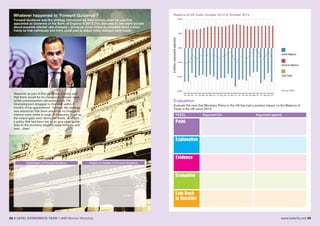

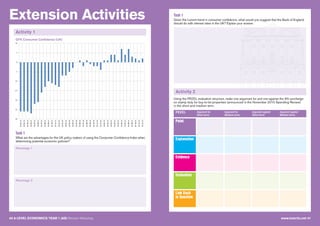

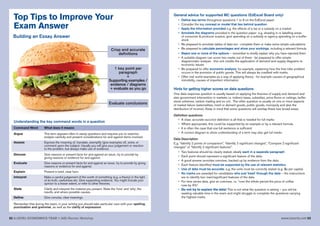

The document provides information about an economics revision workshop, including sessions on how markets work and elasticities, market failure and government intervention, measuring UK economic performance, demand and supply side policies, and policy conflicts. It gives exam advice on answering questions and provides a glossary of key macroeconomic terms.

![54 A LEVEL ECONOMICS YEAR 1 (AS) Revision Workshop www.tutor2u.net 55

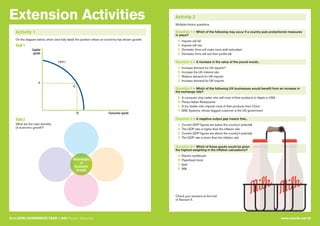

Analysis and Explanation Questions

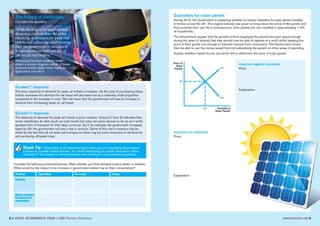

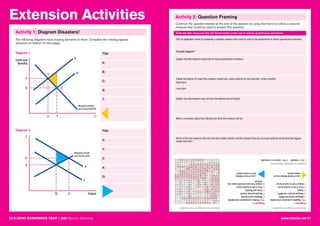

These nearly always require at least one analysis diagram to score full marks e.g. “With the help

of a demand and supply diagram.” Here are some of the key diagrams you will need to know for

AS microeconomics.

To score high marks on explanation and analysis

• Define the economic terms that are in the question

• Make good use of one (possibly more) diagrams - fully labelled with correct units on axes.

• When explaining something, there are marks for identifying a relevant factor and constructing

a logical argument linked to the factor identified

• Additional marks are awarded for relevant use of

elasticity concepts – if you change the elasticity,

often you get a different outcome (e.g. the

effects of taxation on demand for de-merit

goods)

• Carefully look at question instructions

and then attempt to answer, maintaining

relevance

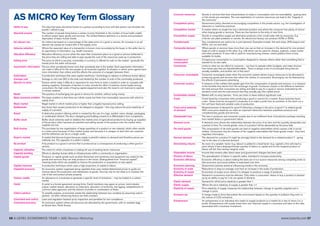

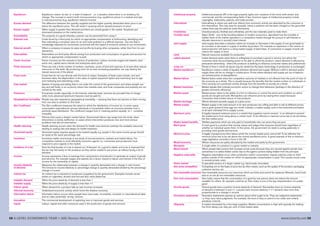

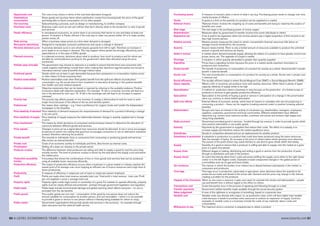

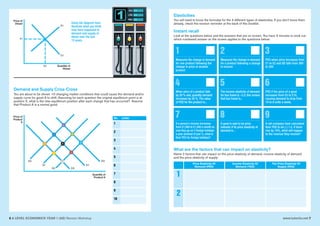

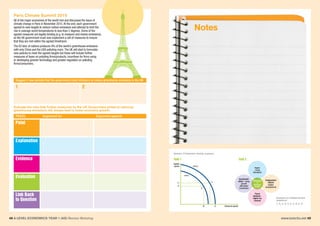

Production Possibility Curve (and shifts in) Negative externalities in production and consumption

Price elasticity of demand and total revenue Positive externalities in production and consumption

Shifts in supply and demand Economies of large scale production

Consumer and producer surplus Maximum and minimum prices

Allocative efficiency in a market Indirect taxes

De-merit goods and information failure Government subsidies for producers and consumers

Buffer stock agency schemes Elasticity of supply – different supply curves

Developing your evaluation skills

Evaluation questions carry the highest marks and ask for more from the student. For the AQA

evaluation marks are reserved for the final essay-style question. But for EdExcel, evaluation marks

are available in more questions – summarised below:

Here are some thoughts from the examiners

(i) Before you can evaluate you must analyse!

(ii) Evaluate each argument as it is introduced into the answer

(iii) Examiners like students who develop clear chains of reasoning in their answers

(iv) Try to make at least 3 “explicit” references to the data given in the question

(v) “Answers do not always have a clear, logical structure”. Hints for better marks:

a. Identify the area of economics which is being tested in the essay-style question

b. Outline the relevant theory, using a diagram if possible (they really do help!)

c. Evaluate arguments/policies as you go

d. Develop one key point per paragraph and leave a clear line between each paragraph

e. Remember to come to a ‘final judgement’ including referring back to the data

f. A conclusion is essential and should not just repeat earlier points

g. Leave yourself 5 minutes for a final judgement of 4-5 lines. This is time well spent.

Try to incorporate a new idea, e.g. how a policy may impact on different parties;

how the policy may have different short v long run effects.

• Answers should include alternative points of view and these should be clearly identified

• Some attempt should be made to consider the strengths and weaknesses of the different

viewpoints. [Rank them if possible].

• Where possible, use data to provide support for arguments or to refute a point of view

• Final judgements might be qualified by statements that include phrases such as

‘it depends on’.

• Useful evaluative words: “However, nevertheless, it is likely that, on the other hand….”

• Maintain a high quality of presentation, especially in high mark questions and with your

diagrams.](https://image.slidesharecdn.com/aseconomicsrevisionworkbook2016-160324051822/85/AS-economics-revision-workbook-2016-28-320.jpg)