Embed presentation

Download to read offline

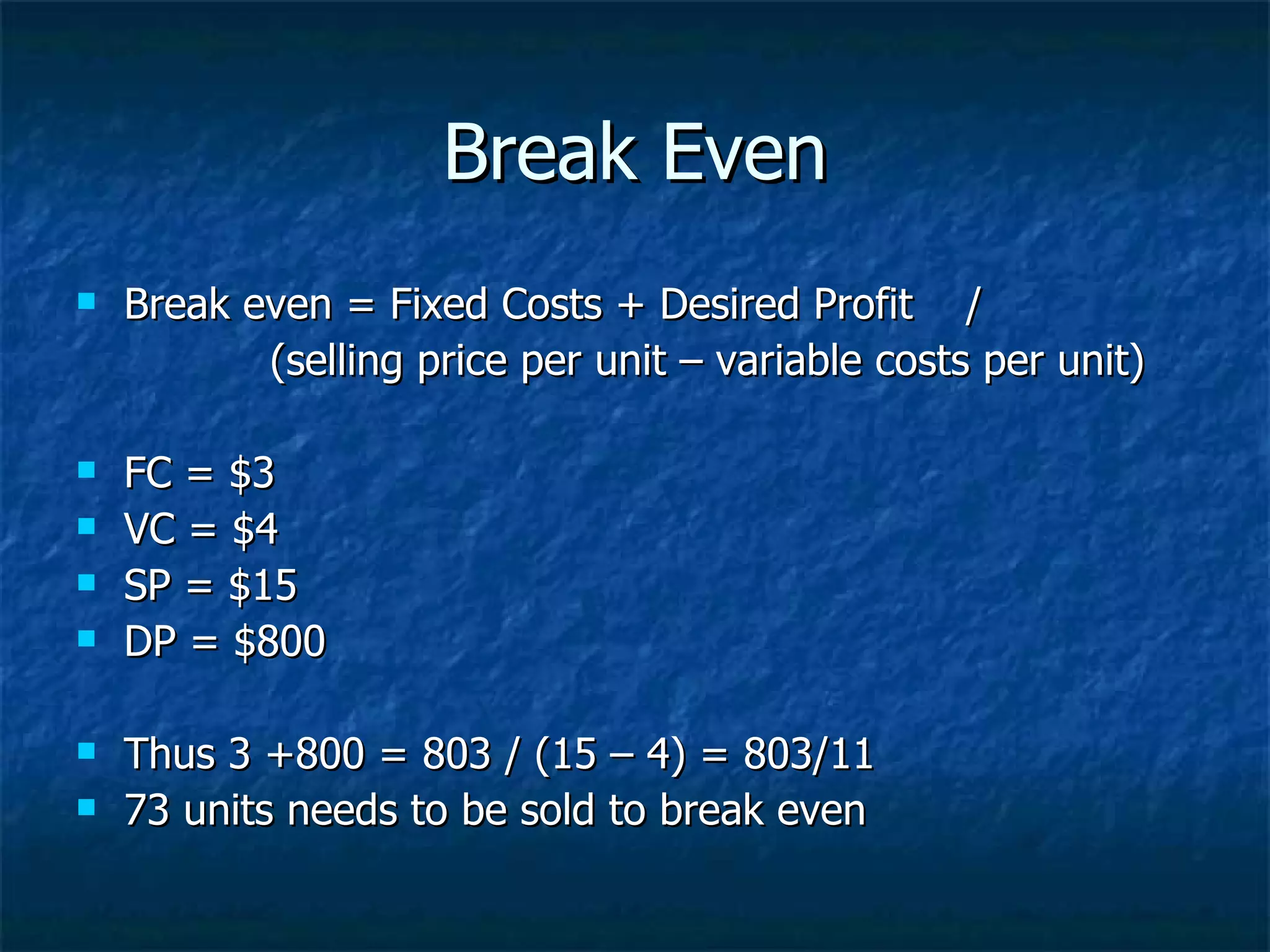

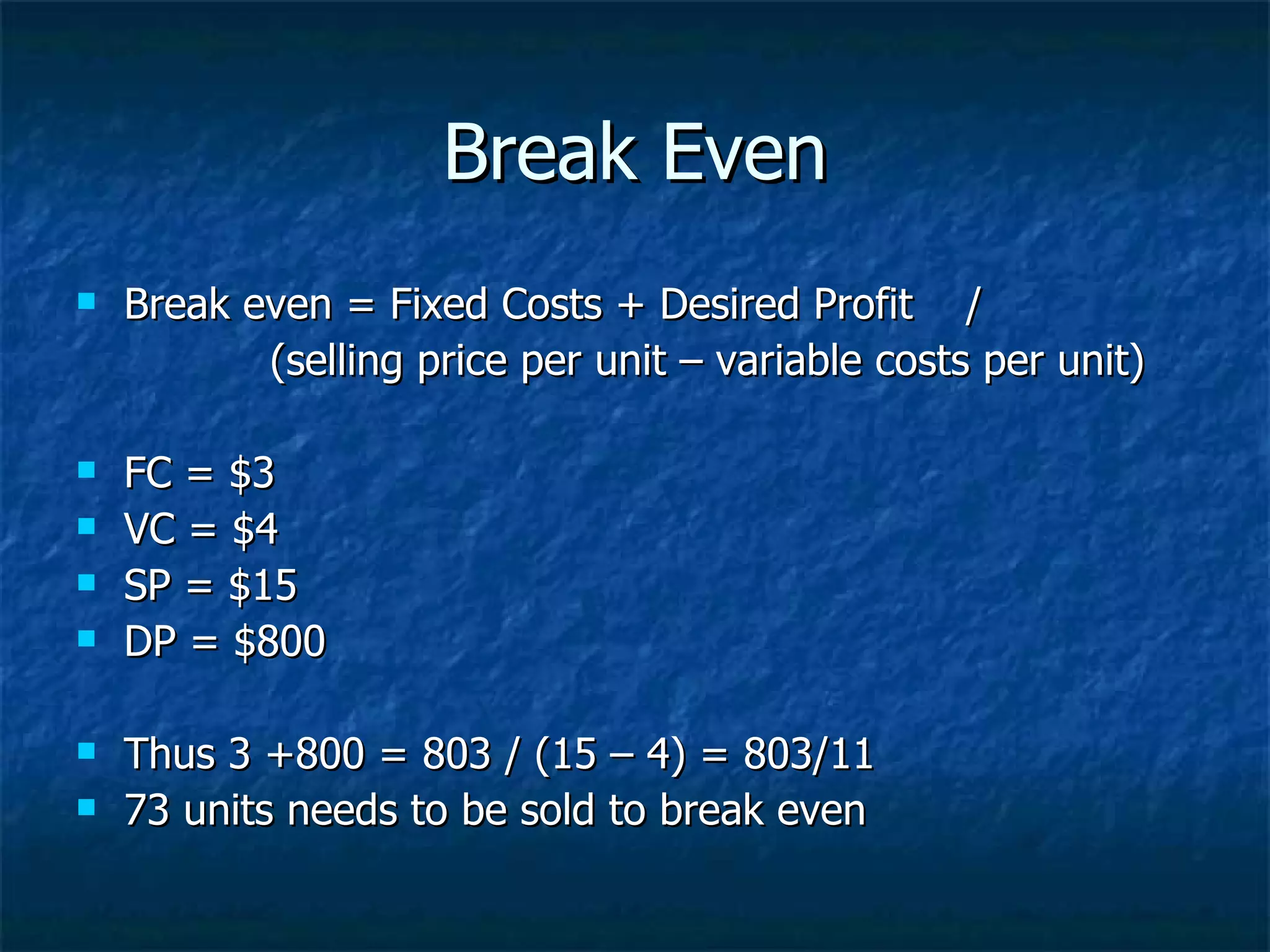

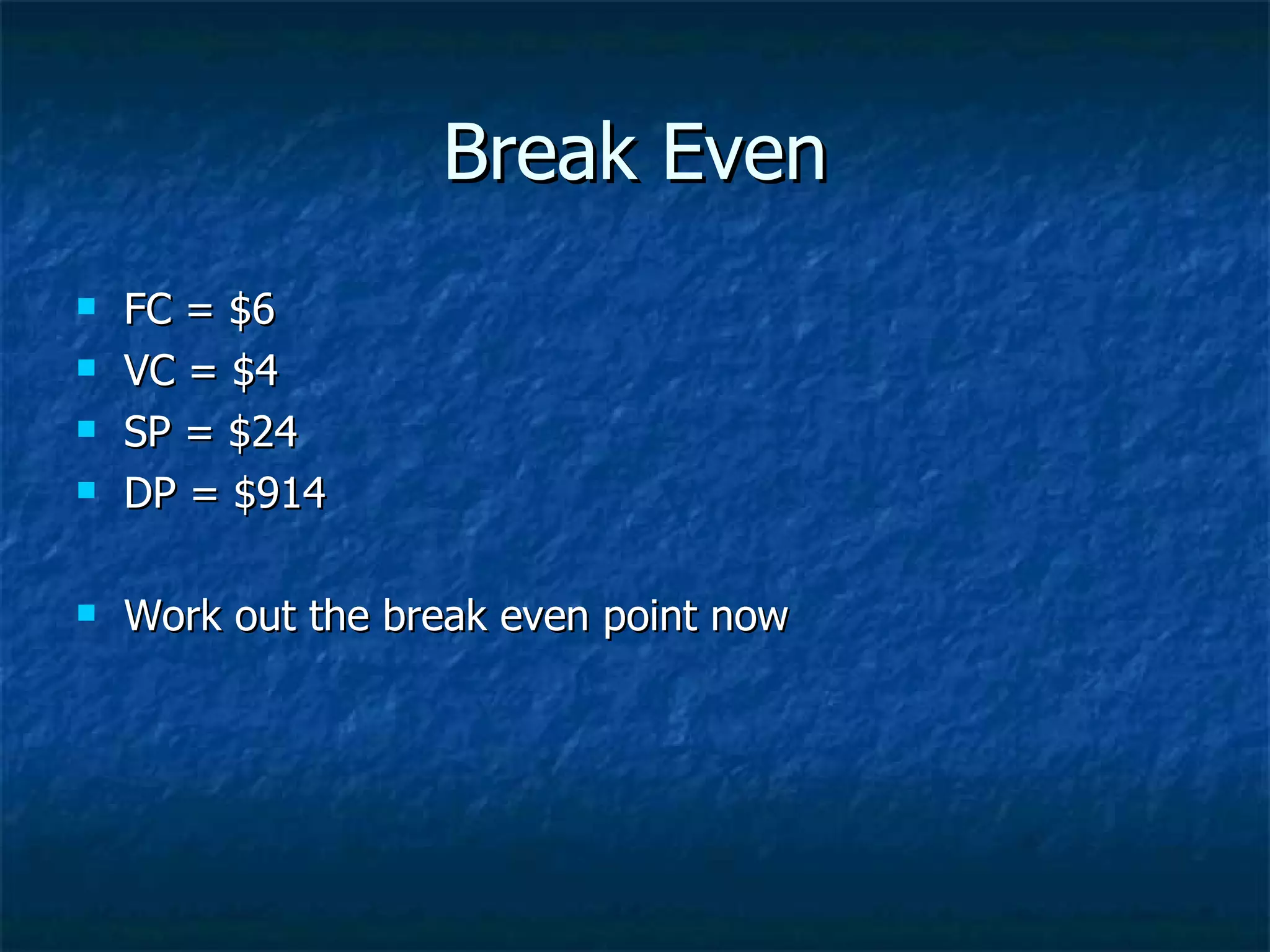

The document discusses several financial planning techniques used by investors, including break even analysis, payback period, and net present value. It provides examples of calculating break even points based on fixed costs, variable costs, selling price, and desired profit. Payback period is defined as the amount of time it takes to recover the initial financial investment based on estimated receipts. The document prompts the reader to consider practice questions related to these techniques.