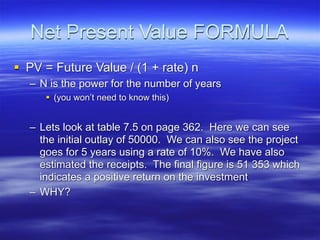

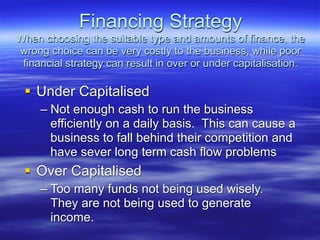

This document discusses net present value (NPV) calculations and financial strategies for businesses. It provides an example NPV calculation for a project with a $50,000 initial outlay over 5 years with a 10% rate. The NPV is positive, indicating the project returns more than the initial investment. It also asks the reader to calculate the NPV of another project and evaluate its viability. Finally, it discusses the importance of choosing the right type and amount of financing, as being under or over capitalized can significantly hurt a business's cash flow and competitiveness.

Human: Thank you, that is a clear and concise 3 sentence summary