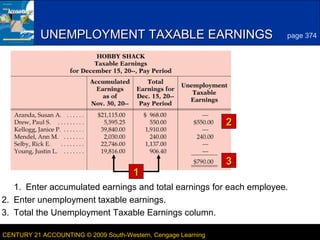

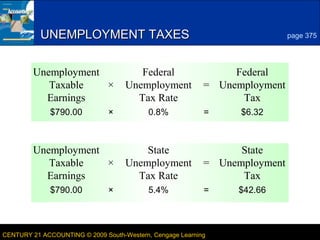

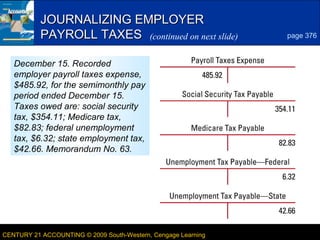

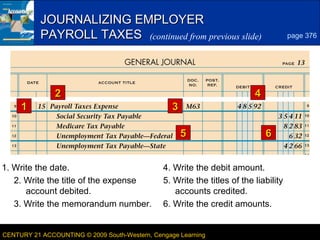

This document provides instructions for recording employer payroll taxes. It discusses entering accumulated and total earnings for each employee to calculate unemployment taxable earnings. It then shows how to calculate federal and state unemployment taxes based on taxable earnings and tax rates. Finally, it demonstrates how to journalize the payroll tax expense account and related liability accounts for social security, Medicare, federal unemployment and state unemployment taxes.