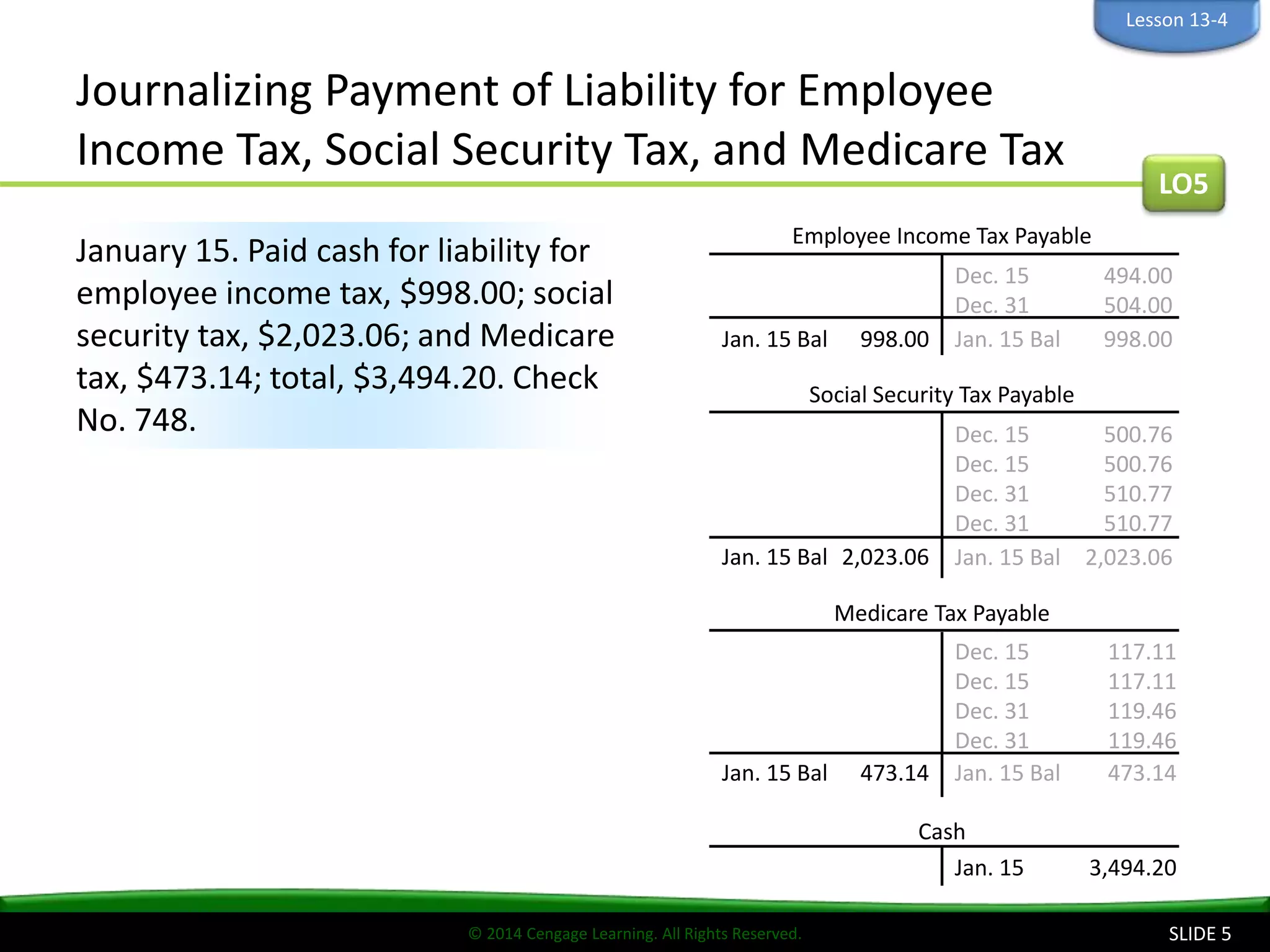

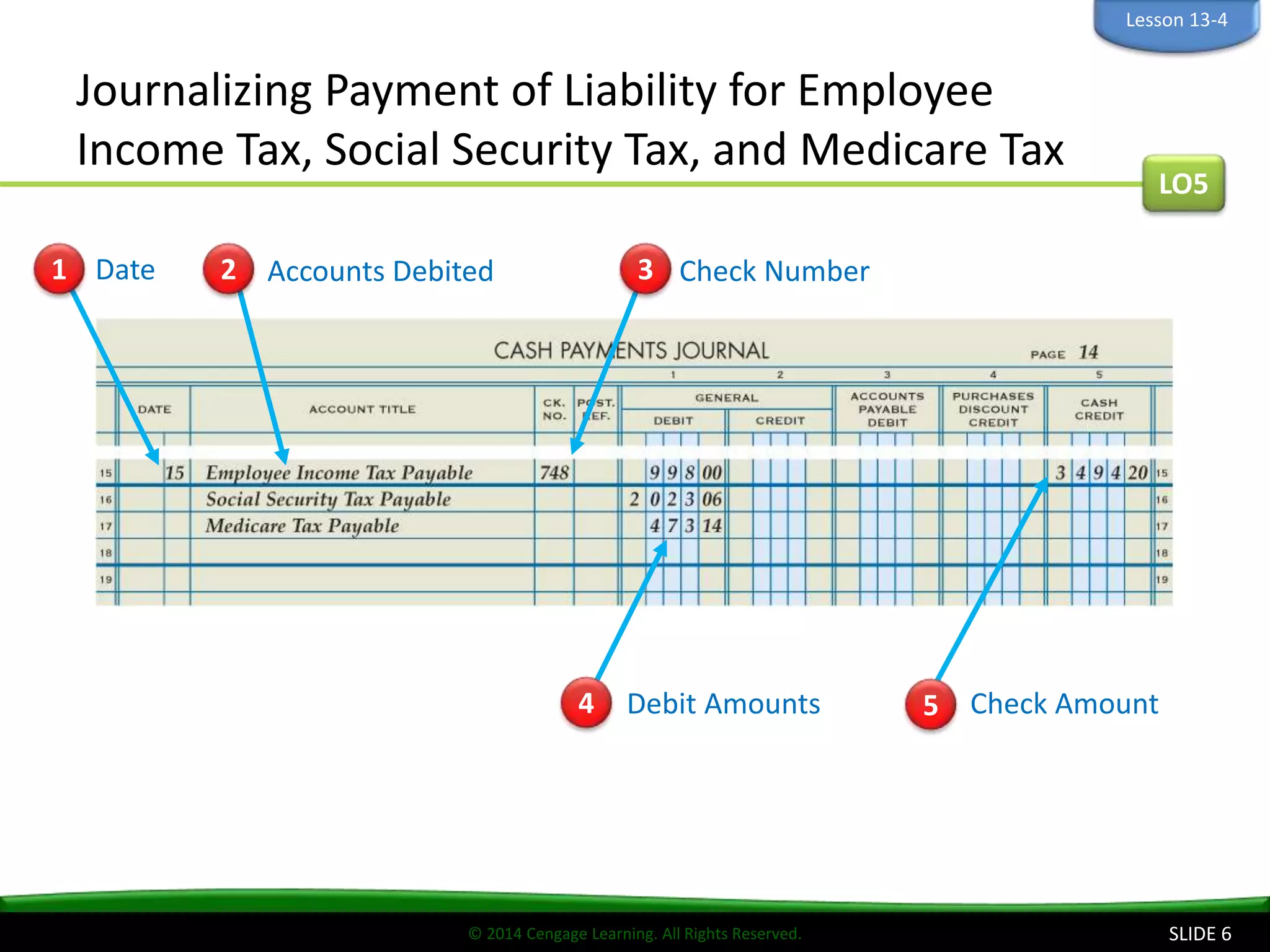

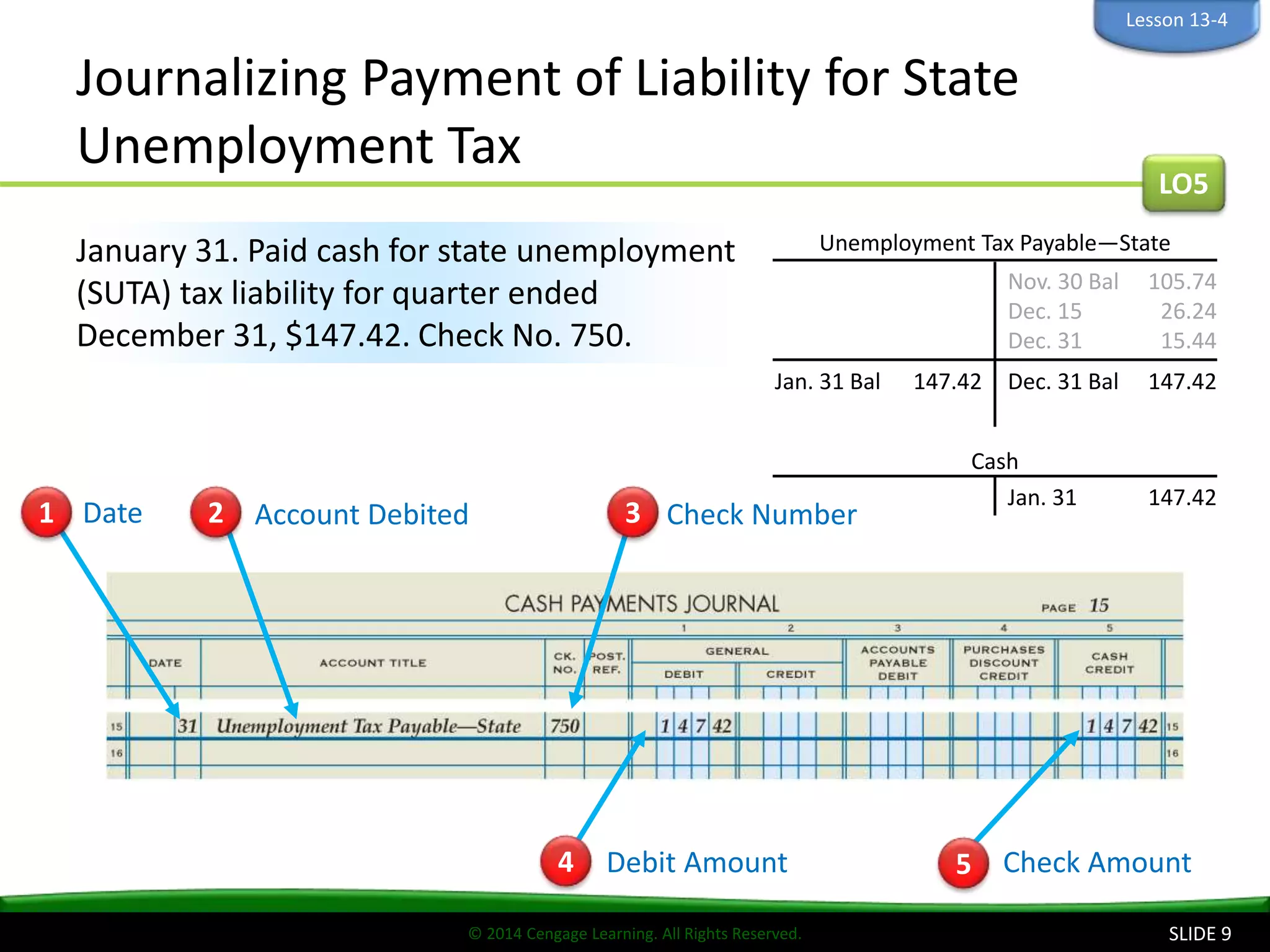

- Employers must pay payroll taxes withheld from employees as well as employer payroll taxes to federal, state, and local governments. These payments are referred to as deposits.

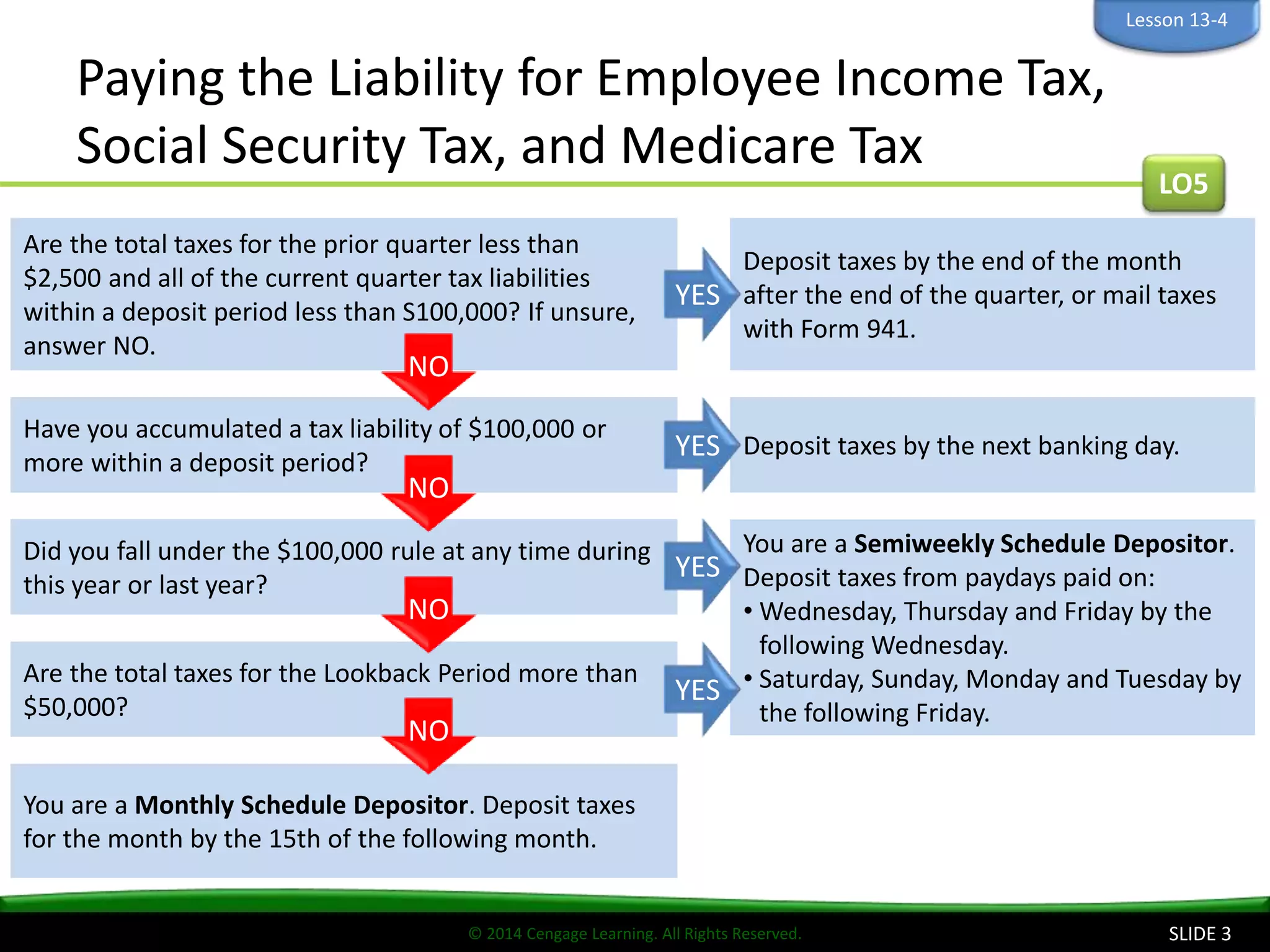

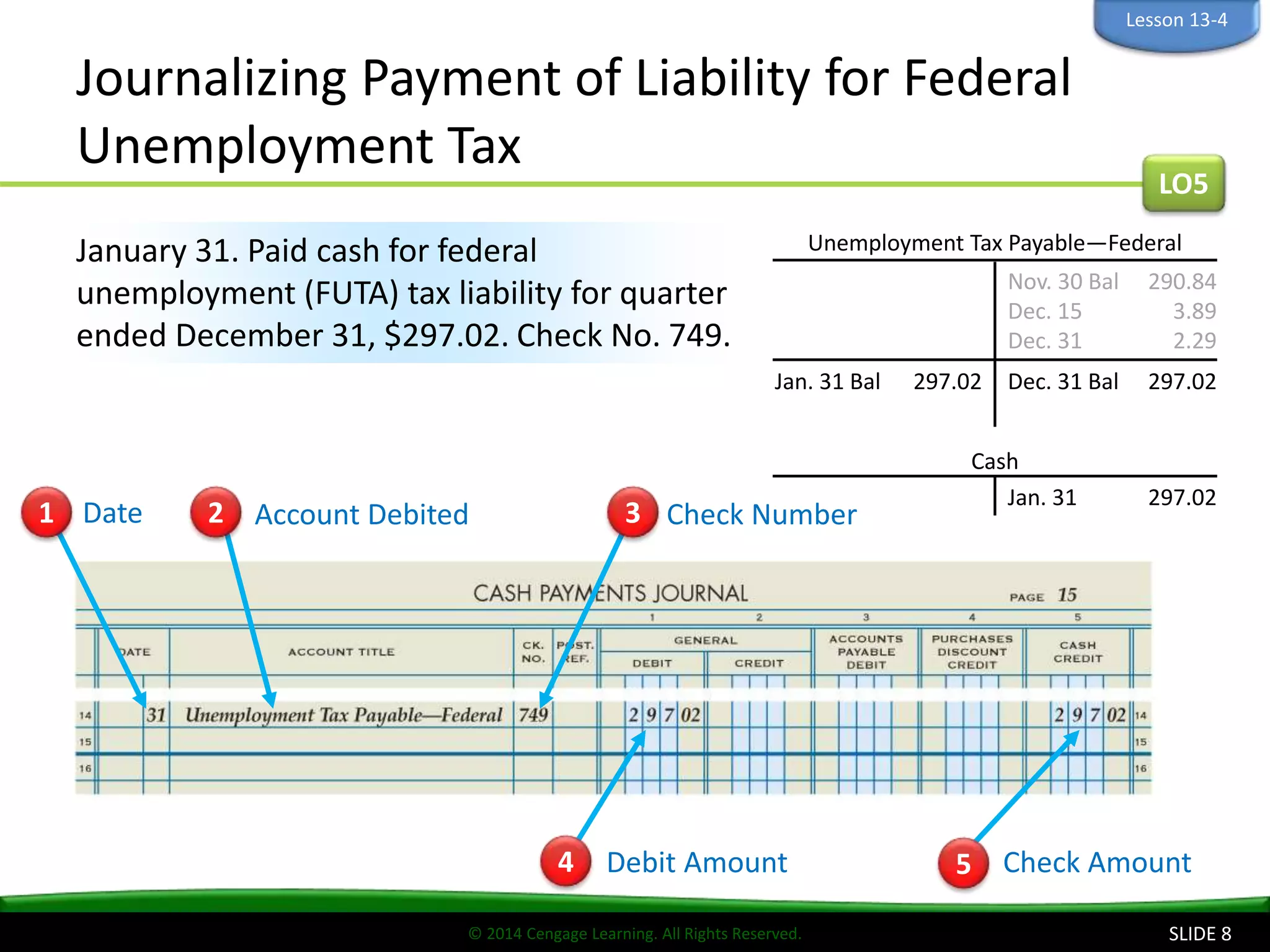

- The frequency with which a business must make deposits is determined by its lookback period, which is the prior 12-month period ending June 30. Businesses may be monthly, quarterly, or semiweekly depositors depending on their tax liability in the lookback period.

- Federal tax deposits must be made electronically, such as through the Electronic Federal Tax Payment System. Tax rules are also subject to periodic changes.