Embed presentation

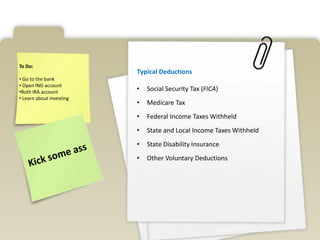

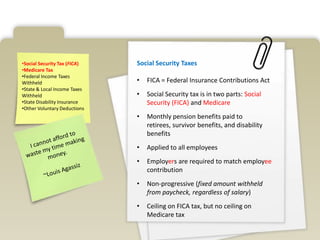

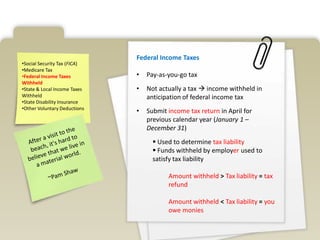

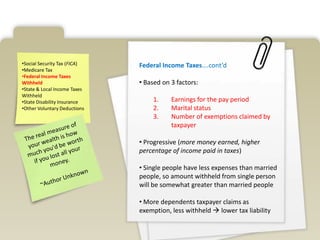

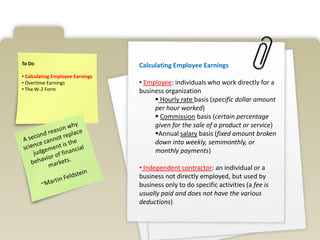

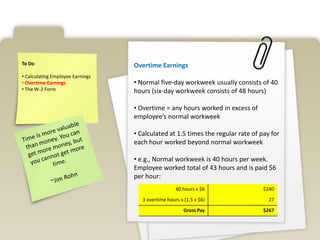

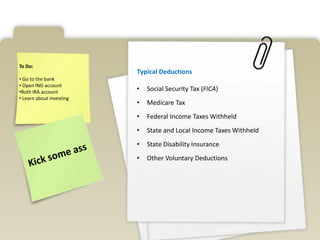

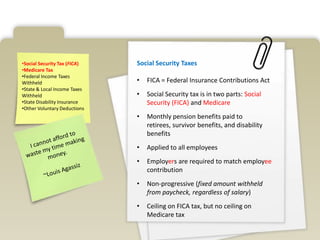

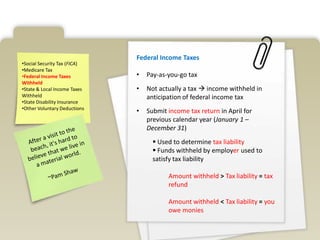

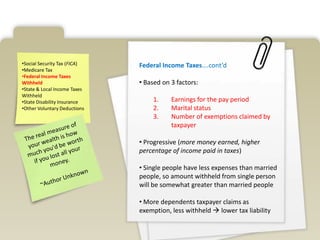

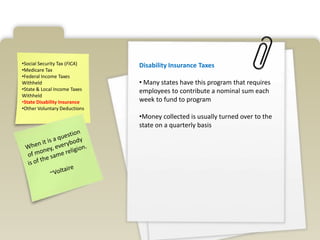

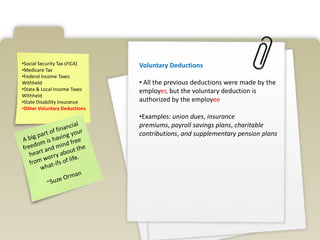

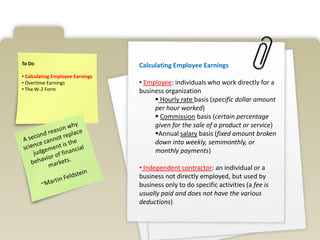

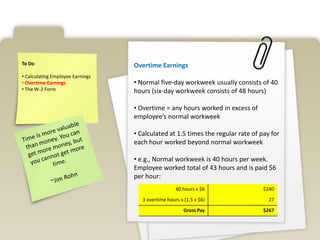

The document discusses payroll accounting and deductions. It explains that payroll is the compensation paid to employees including wages and salaries. It outlines typical payroll deductions like social security taxes, federal and state income taxes, disability insurance, and voluntary deductions authorized by employees. It also covers calculating employee earnings including hourly, salary, commission, and overtime wages as well as the W-2 form used to report total annual earnings.