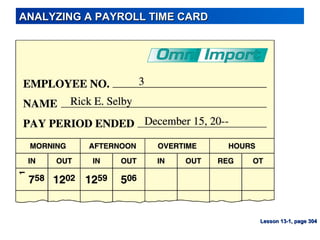

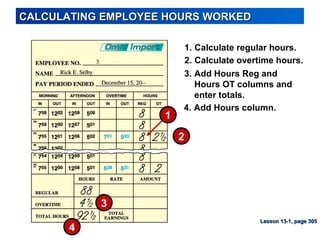

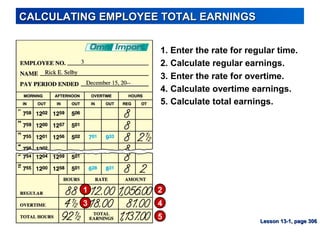

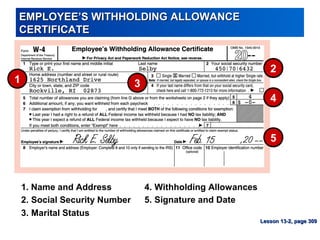

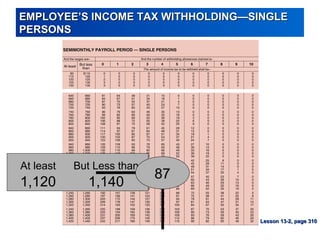

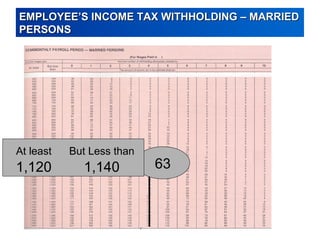

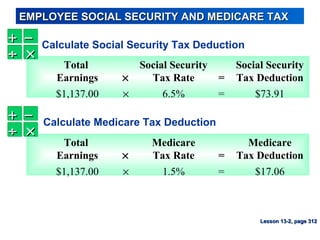

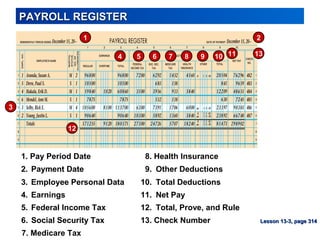

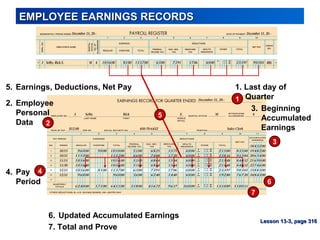

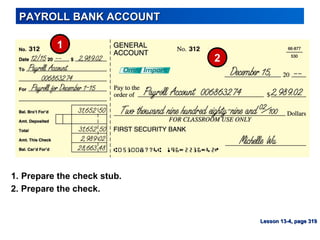

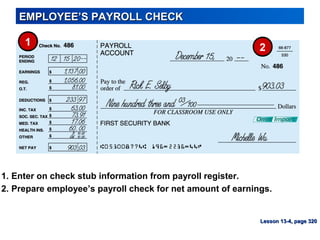

This document provides an overview of key concepts and steps for preparing payroll records and payments. It defines terms like salary, pay period, payroll, earnings and taxes. It describes how to calculate employee hours, earnings and tax deductions. It explains the purpose and components of forms like payroll registers, earnings records and withholding allowance certificates. Finally, it outlines the process for preparing payroll checks and maintaining a payroll bank account.