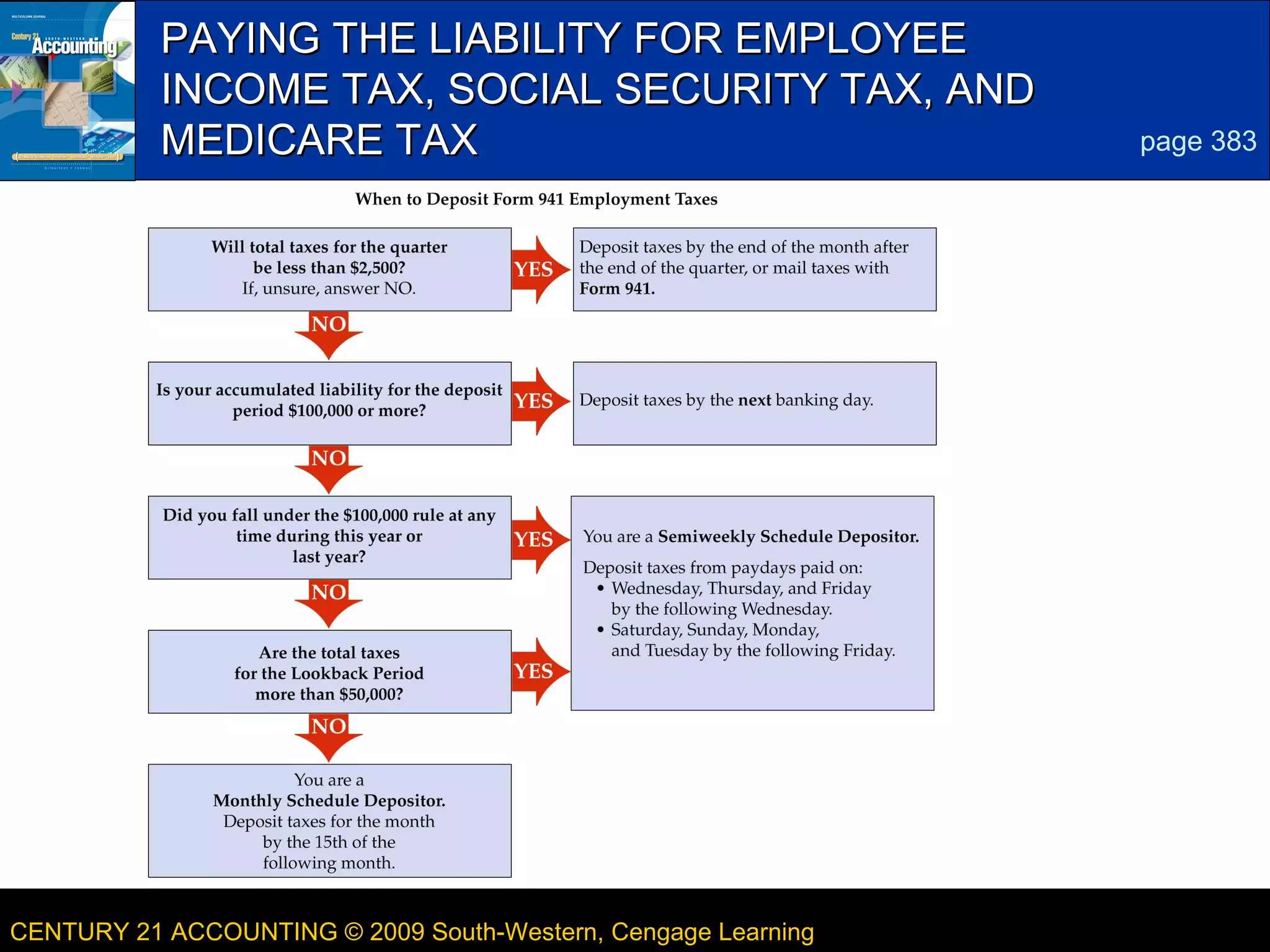

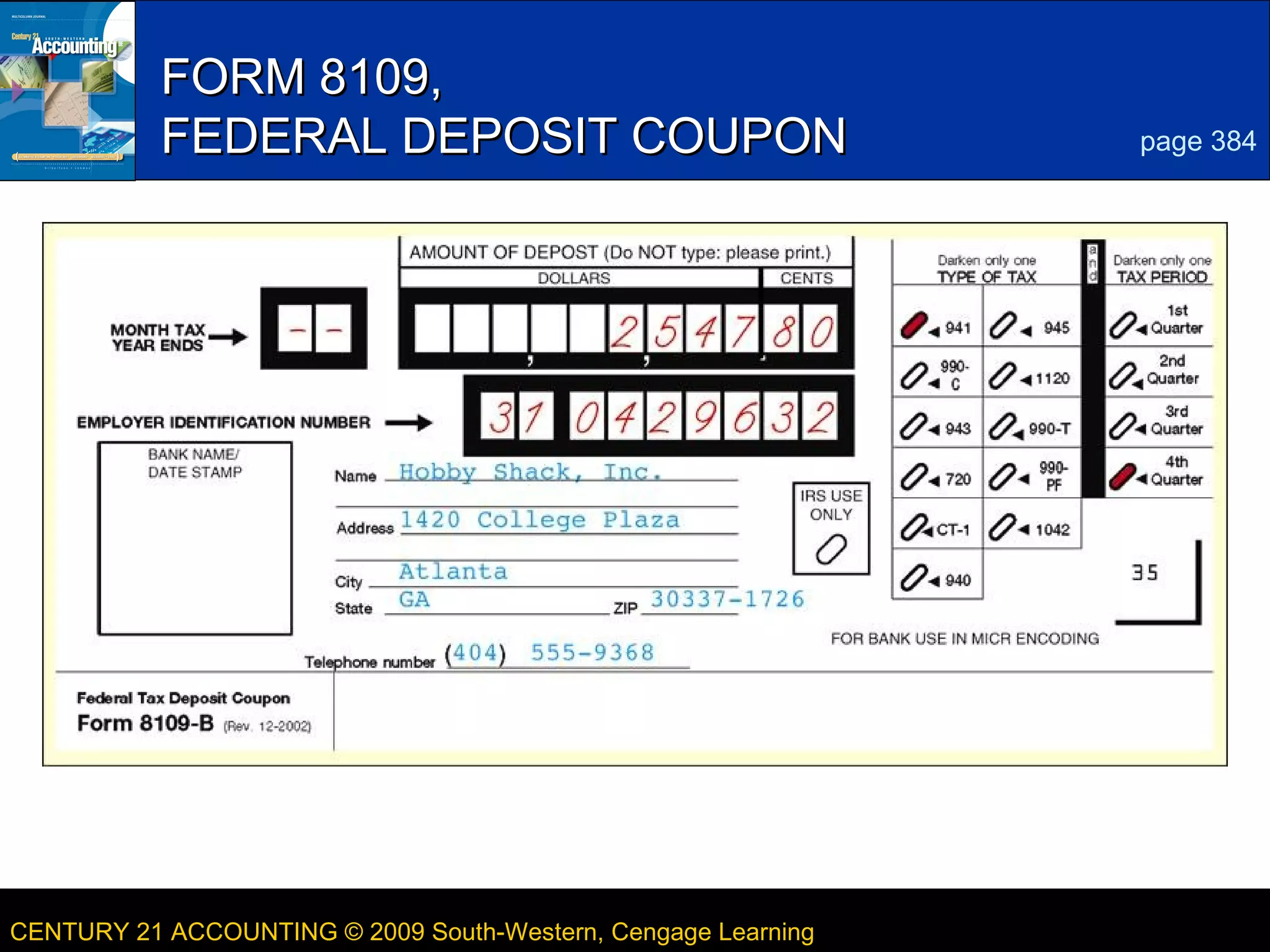

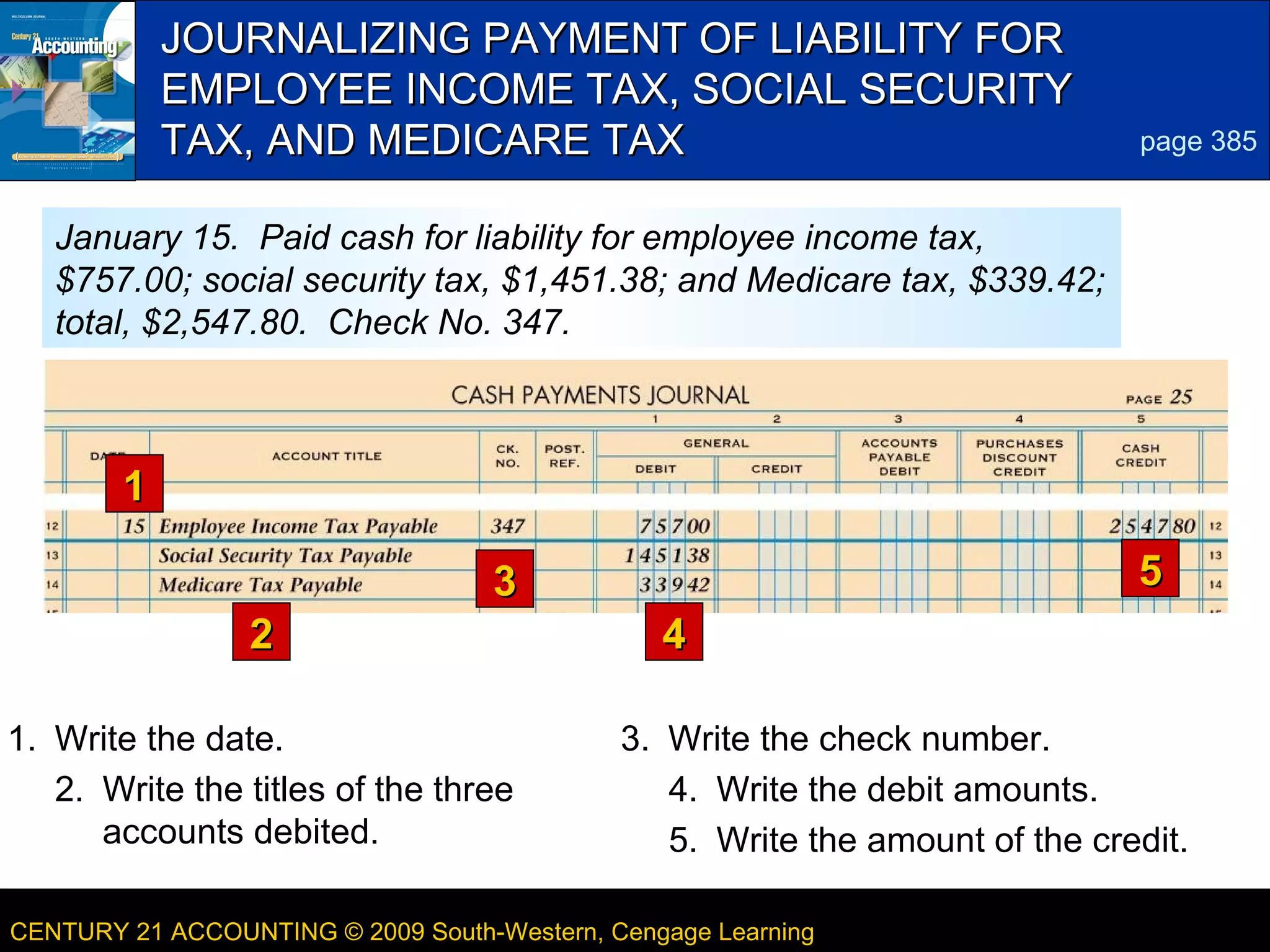

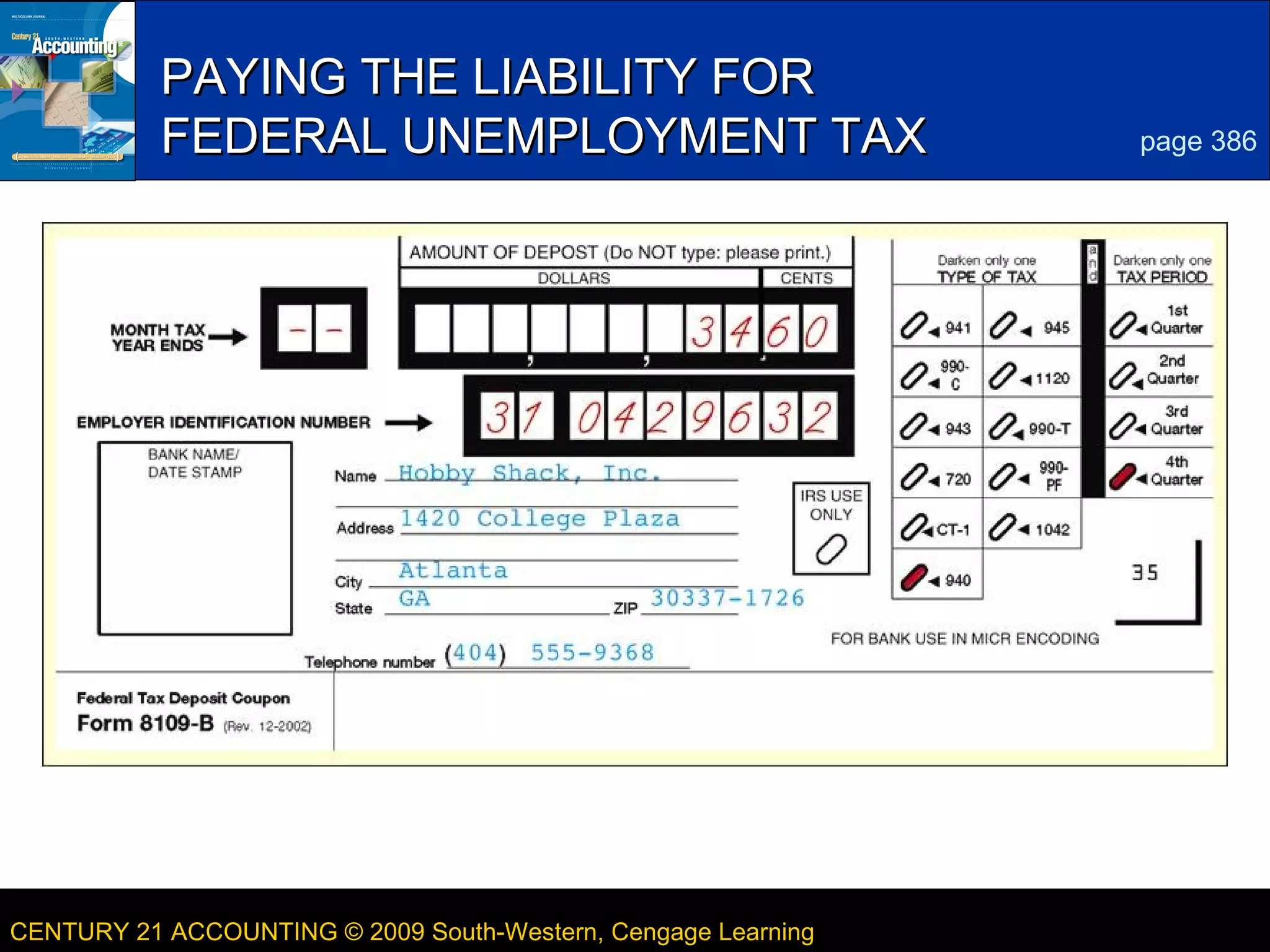

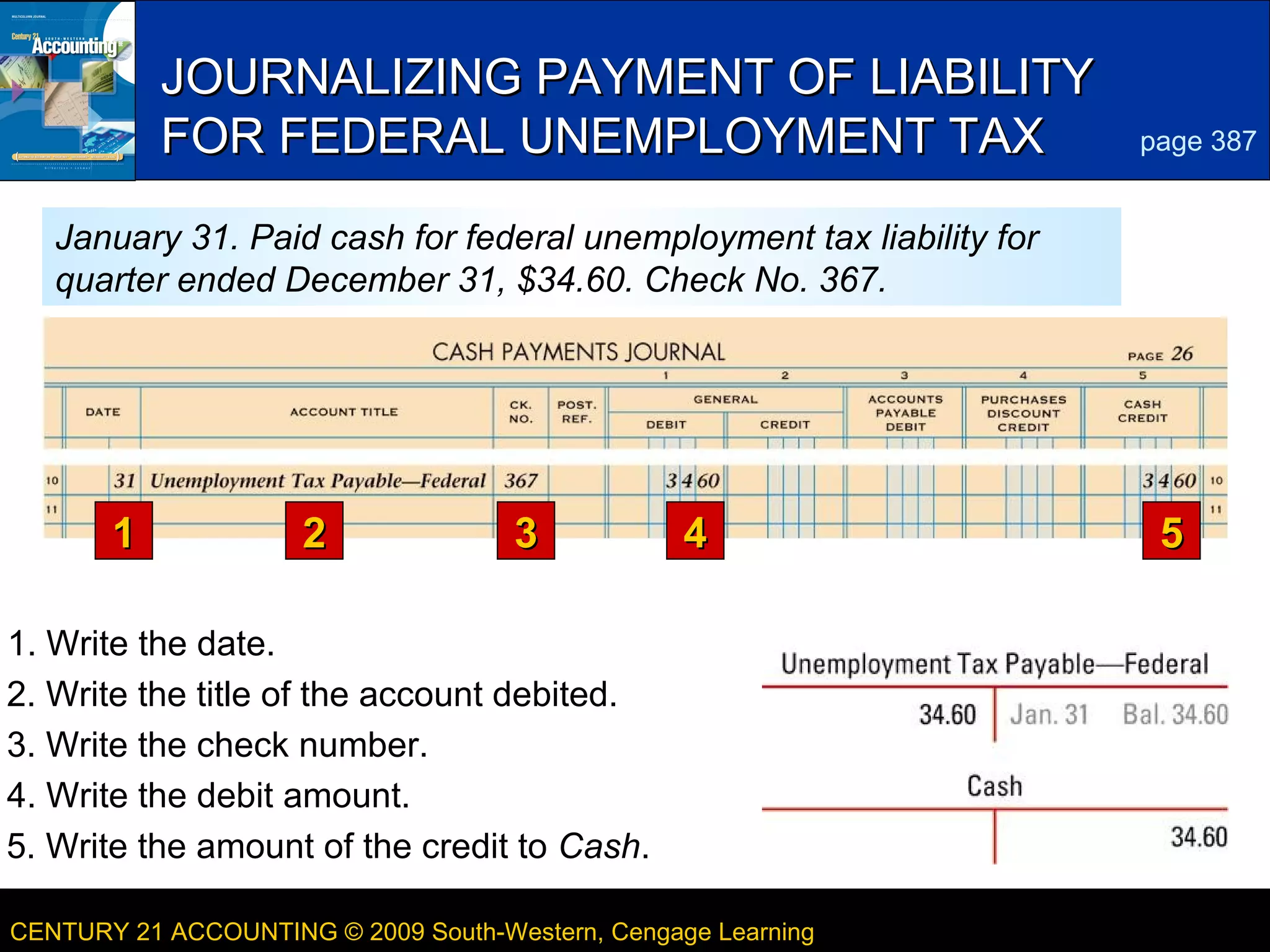

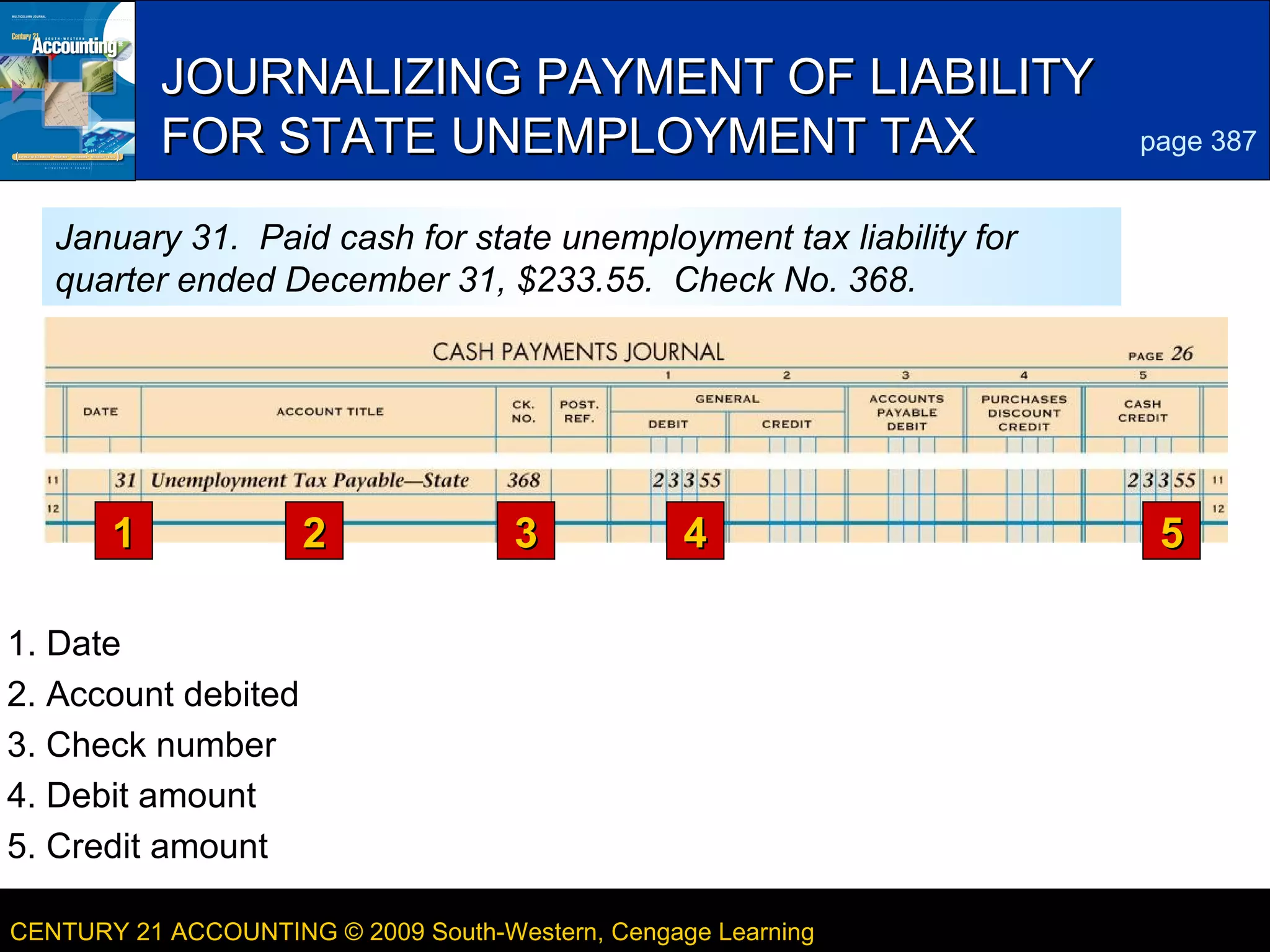

This document discusses paying payroll taxes for businesses. It provides instructions on how to pay employee income tax withholding, Social Security tax, and Medicare tax using Form 8109. It also describes how to journalize the payment of these payroll tax liabilities. Additionally, it covers paying federal and state unemployment tax liabilities and journalizing those payments. The document concludes with a terms review section defining the lookback period.