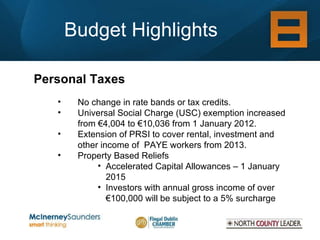

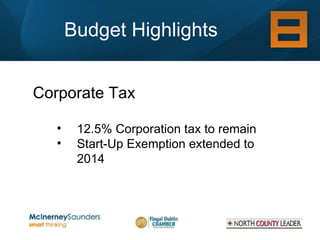

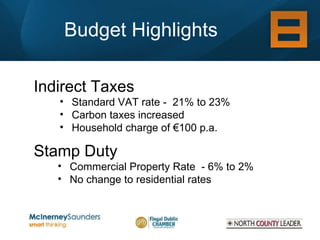

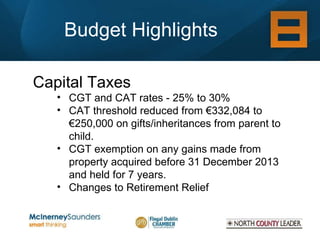

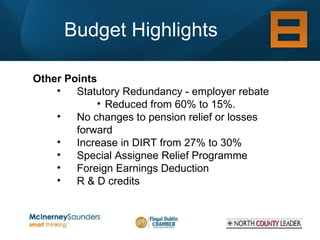

The 2012 budget outlines key tax changes including the increase of the Universal Social Charge exemption and the continuation of the 12.5% corporation tax rate. Personal tax rates remain unchanged while indirect taxes such as VAT and carbon taxes see increases; capital taxes experience adjustments including a rise in CGT rates and a reduction in CAT thresholds. Other highlights include a reduced employer rebate for statutory redundancy and updates to property reliefs and pension regulations.