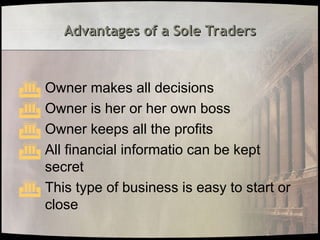

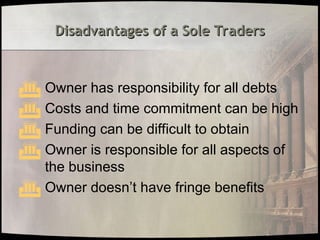

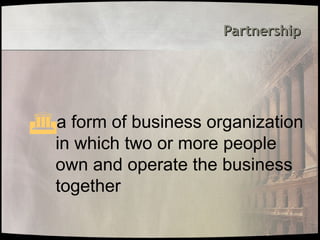

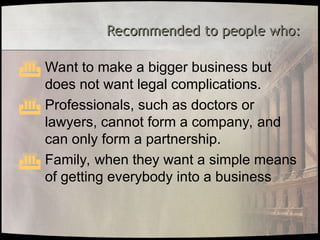

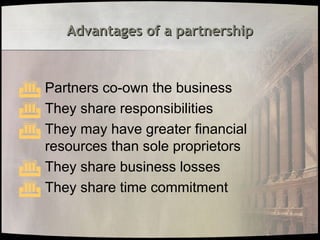

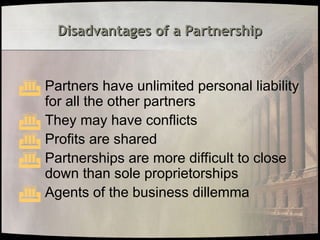

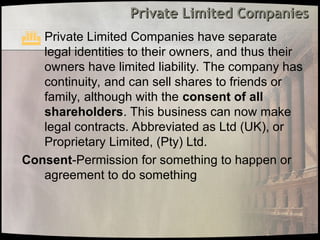

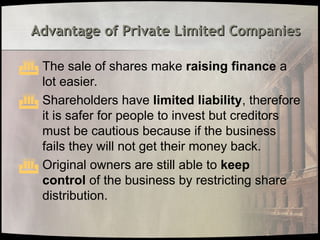

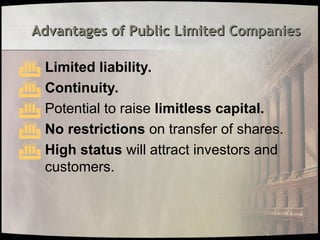

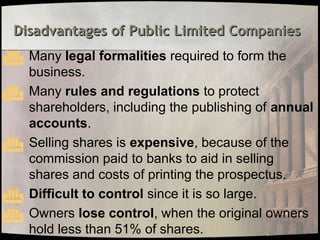

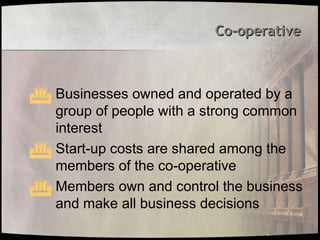

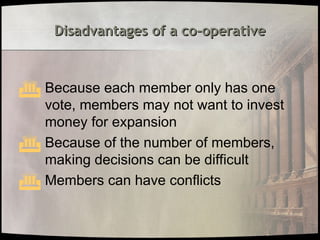

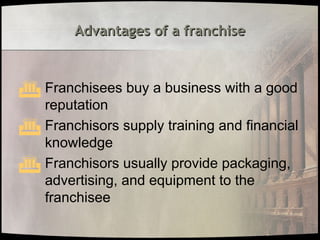

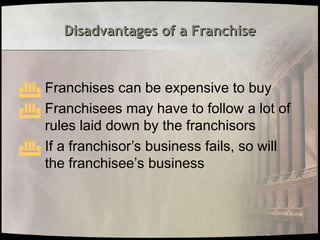

The document outlines five main forms of business organization in the private sector: sole traders, partnerships, private limited companies, public limited companies, and co-operatives. Each type has its own advantages and disadvantages, such as the ease of starting a sole trader business versus the limited liability and potential for raising capital in public limited companies. Additionally, joint ventures and franchises are explained, highlighting the shared risks and benefits of collaboration in business.