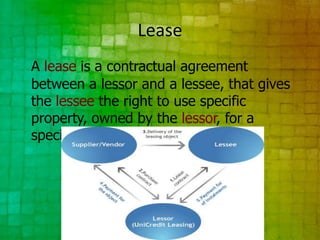

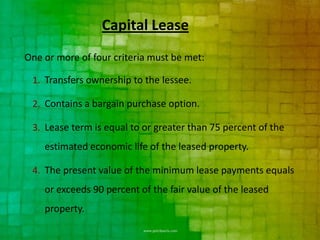

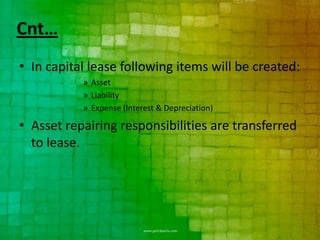

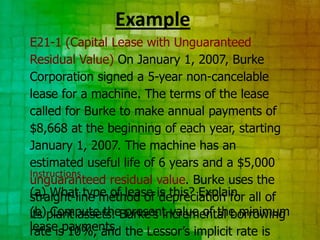

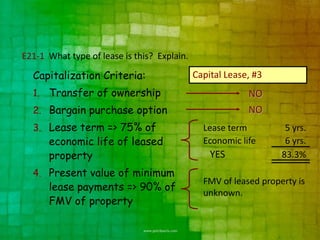

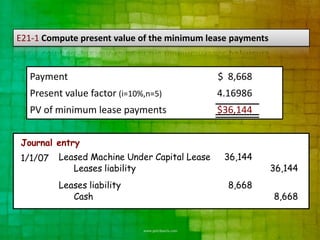

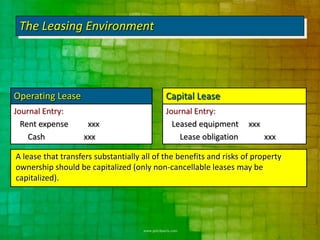

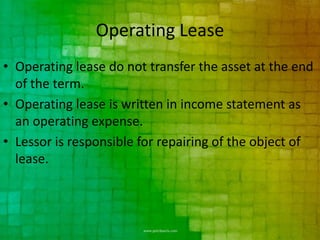

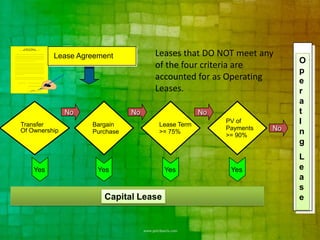

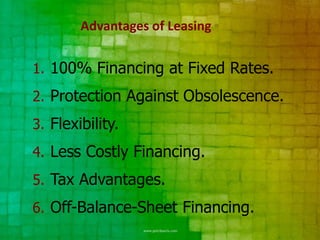

A lease is a contractual agreement between a lessor and lessee that allows the lessee to use specific property owned by the lessor for a specified period of time. There are several types of leases including operating leases, capital leases, leveraged leases, sale and leaseback, and direct leases. Capital leases meet certain criteria that require the lessee to record the leased asset and related liability on their balance sheet.