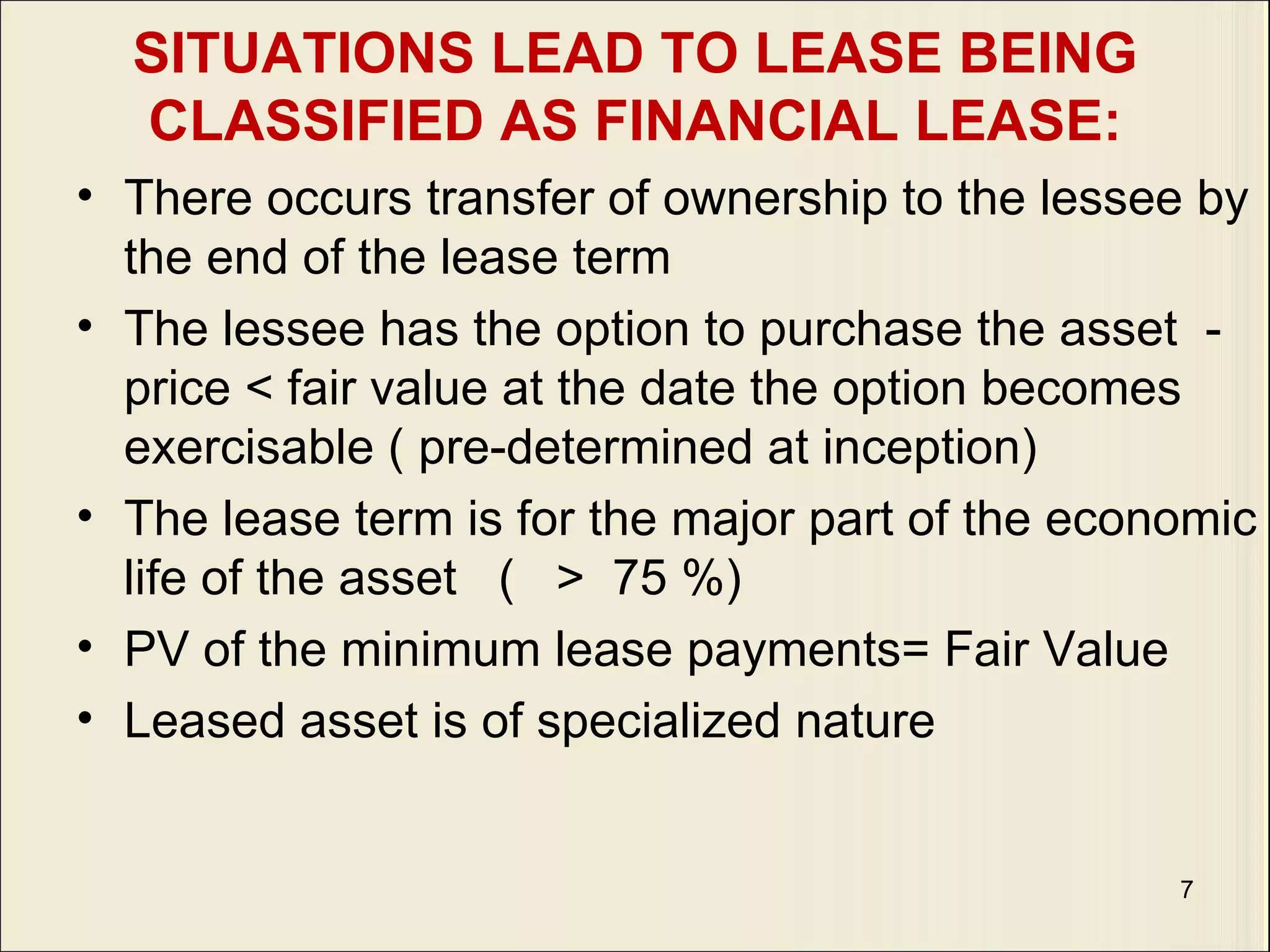

Leasing is a contract where an owner (lessor) provides an asset to a user (lessee) for a fixed period of time in exchange for regular payments (rentals). There are two main types of leases: finance leases, where the lessee is effectively the asset's owner, and operating leases, where the lessor retains ownership. Finance leases typically cover most of an asset's useful life while operating leases are shorter. Other lease types include leveraged leases which involve multiple parties, and sale and leaseback where an asset is sold and then leased back from the buyer.