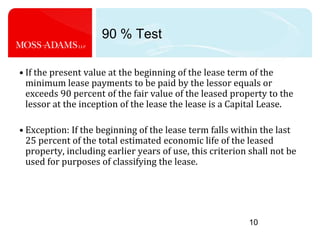

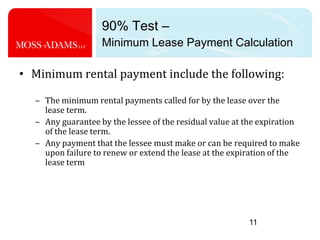

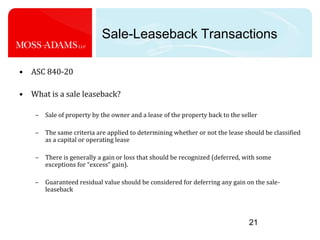

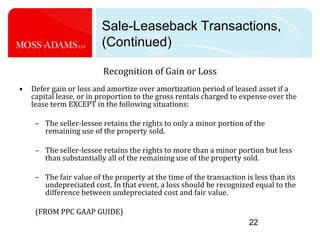

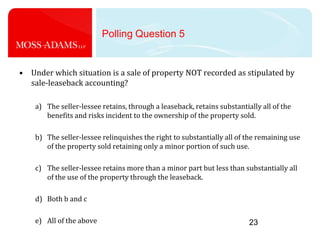

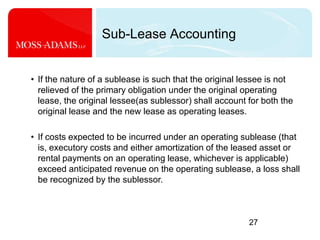

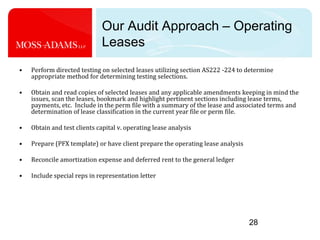

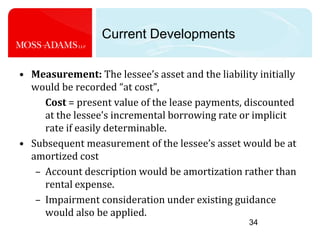

This document provides an overview and summary of key topics related to lessee and lessor accounting for leases. It discusses the classification of leases as capital or operating, accounting and reporting for both types of leases, and issues such as non-level rents, leasehold improvements, tenant incentives, and sale-leaseback transactions. It also provides an overview of the audit approach to leases and current developments regarding the FASB's proposed changes to the lease accounting standards that would eliminate off-balance sheet treatment of operating leases.