1) A callable bond is a bond that the issuer can buy back from bondholders at predetermined prices on predetermined call dates, giving the issuer refinancing flexibility.

2) Callable bonds are more attractive to borrowers who can refinance when rates are low, but less attractive to lenders due to repayment risk; lenders receive higher coupons to compensate.

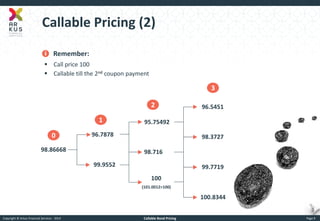

3) Pricing callable bonds involves simulating interest rate paths, calculating bond values along each path, and accounting for early repayment at the call price if rates fall below the call threshold.