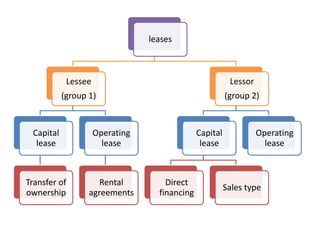

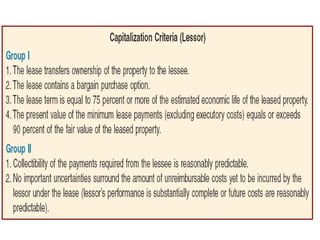

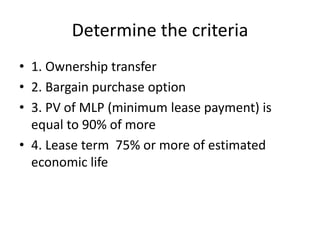

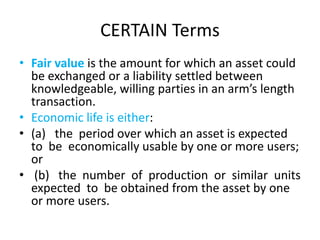

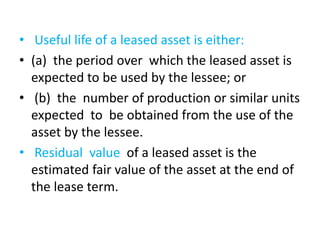

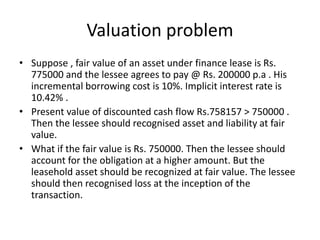

This document defines a lease and the key parties involved - the lessor and lessee. It explains that a lease conveys the right to use an asset for a period of time in exchange for periodic payments. There are two main types of leases - operating leases and finance (or capital) leases. Finance leases transfer substantially all the risks and rewards of ownership to the lessee. For a finance lease, the lessee records the leased asset and a liability on its balance sheet. The criteria for classifying a lease as a finance lease include transfers of ownership, bargain purchase options, minimum lease payments equal to 90% or more of the asset's value, and lease terms that cover 75% or more of the