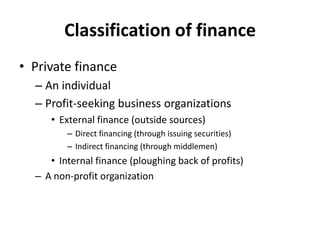

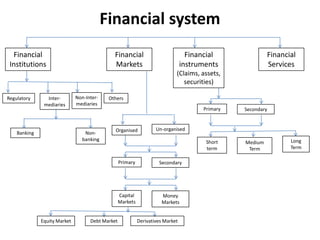

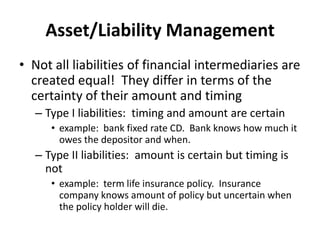

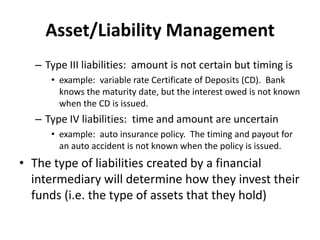

This document defines key finance terms and provides an overview of financial institutions, markets, instruments, and services. It discusses the classification of public and private finance as well as external and internal finance sources. Financial institutions are categorized as banking and non-banking, and financial markets are classified as primary/secondary and money/capital markets. The roles of financial intermediaries in managing assets and liabilities are also summarized, in addition to defining financial innovation.