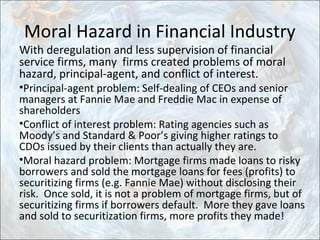

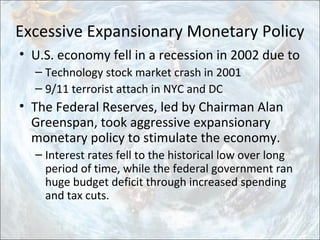

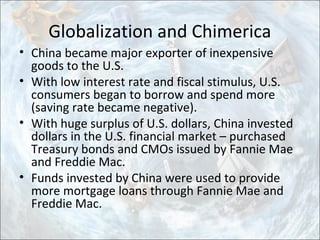

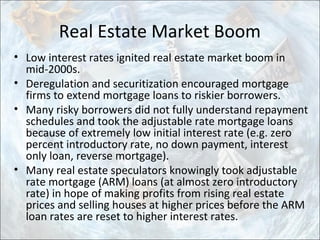

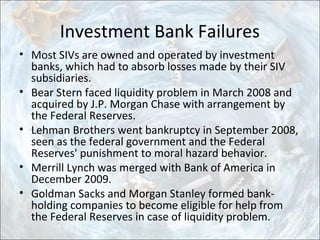

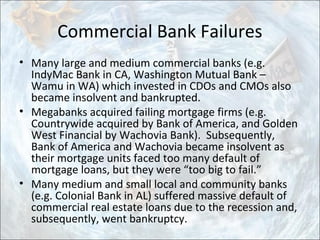

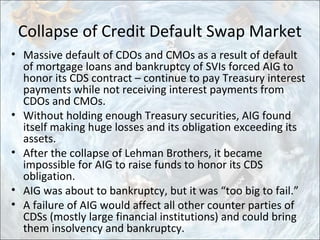

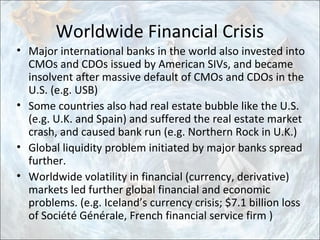

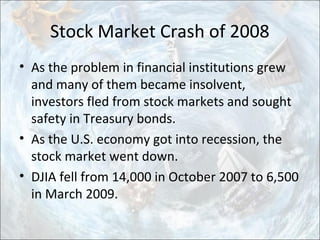

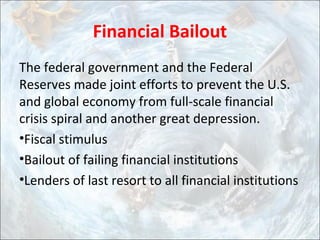

The financial crisis of 2008 originated from the collapse of the US housing market and subprime mortgage crisis. Risky mortgage loans were bundled into securities that were given high credit ratings and sold widely. When housing prices declined and mortgage defaults increased, the value of these securities plummeted. This caused the failure of major financial institutions, a stock market decline, and a recession around the world.