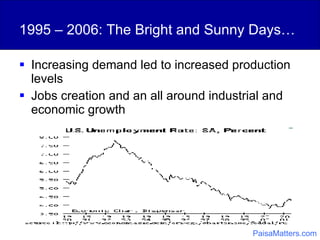

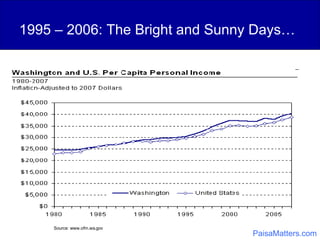

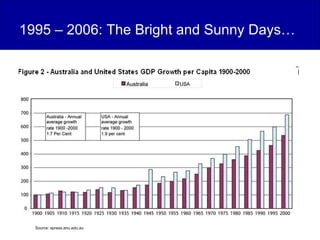

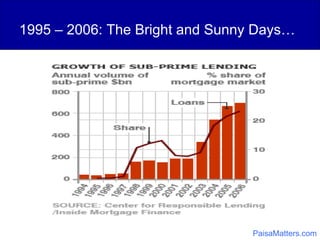

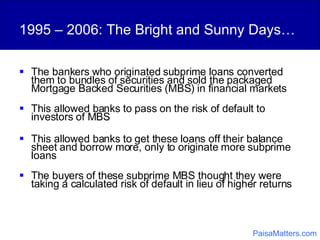

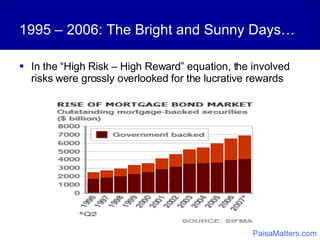

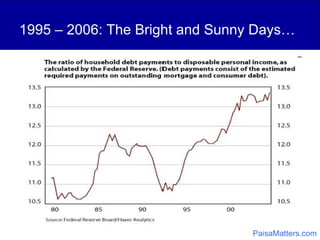

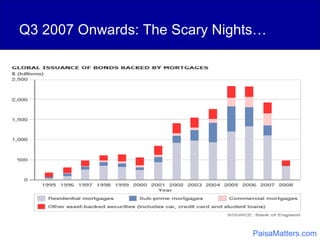

1) Between 1995-2006, strong economic growth fueled demand for homes, leading banks to aggressively offer subprime mortgages to borrowers with poor credit.

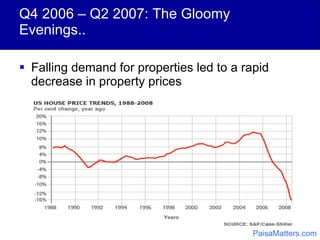

2) Starting in late 2006, defaults increased as interest rates rose and housing prices fell. Major financial institutions suffered huge losses on mortgage-backed securities tied to subprime loans.

3) By 2007, the crisis led to a broader credit crunch and global recession as banks wrote off bad loans and many financial firms collapsed.