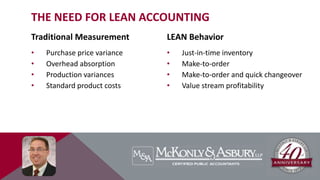

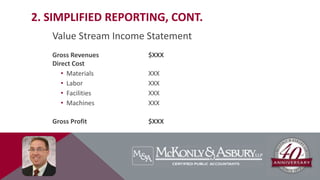

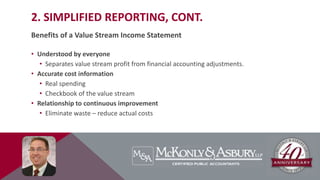

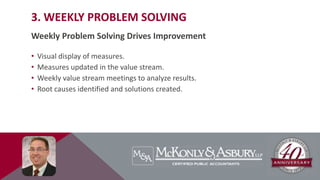

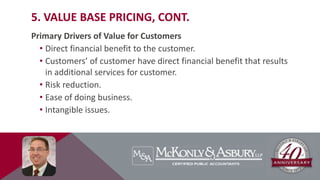

The document discusses the importance and implementation of lean accounting, which aims to replace traditional accounting methods with systems that support lean strategies and eliminate waste. It outlines key principles of lean accounting, such as customer value, value streams, and simplified reporting, focusing on how to drive improvements in financial performance and decision-making. Additionally, it emphasizes the significance of understanding customer value and the need for effective financial forecasting over traditional budgeting.