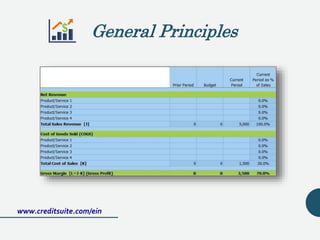

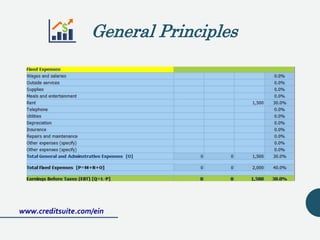

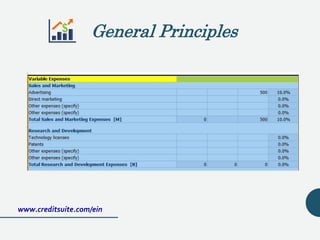

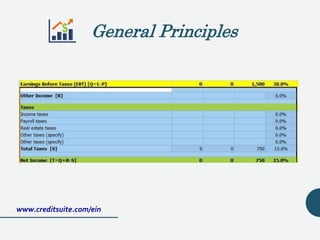

The document explains the purpose and components of a profit and loss (P&L) statement, highlighting its importance in assessing a company's financial health over specific periods. It outlines the steps to create a P&L, including calculations for gross margin, operating profit margin, and net profit margin, as well as the utility of these metrics in financial analysis. Additionally, the document emphasizes the significance of understanding financial numbers for effective business management and decision-making.

![What is a P&L?

A P&L (Profit and Loss statement) is, according to Investopedia:

“… [A] financial statement that summarizes the revenues, costs

and expenses incurred during a specific period of time, usually a

fiscal quarter or year.These records provide information about a

company's ability – or lack thereof – to generate profit by

increasing revenue, reducing costs, or both.The P&L statement is

also referred to as 'statement of profit and loss', 'income

statement,' 'statement of operations,' 'statement of financial

results,' and 'income and expense statement.'”

See: https://www.investopedia.com/terms/p/plstatement.asp

www.creditsuite.com/ein](https://image.slidesharecdn.com/howtomakeapl-180514045124/85/How-to-make-a-P-L-3-320.jpg)