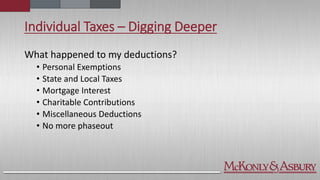

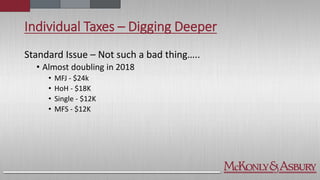

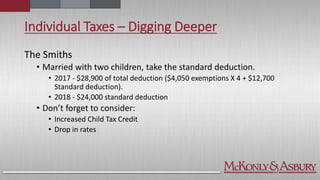

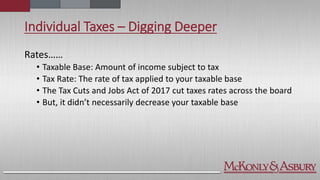

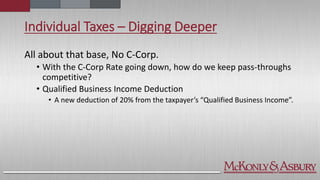

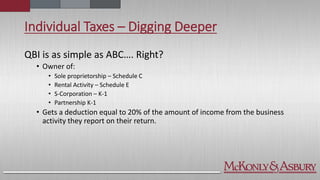

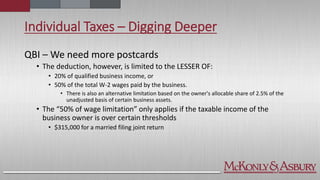

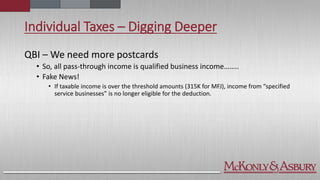

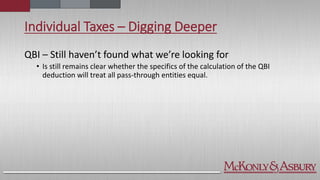

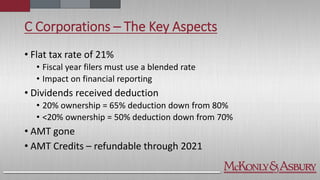

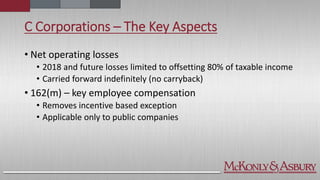

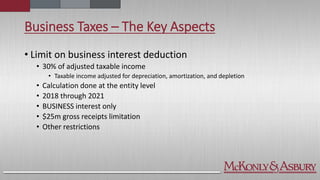

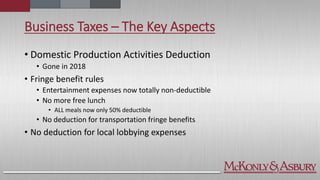

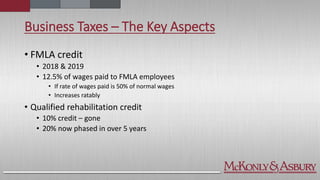

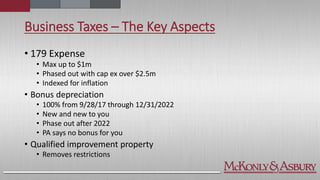

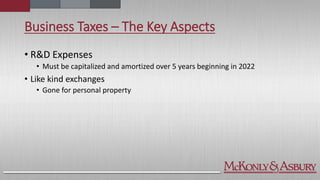

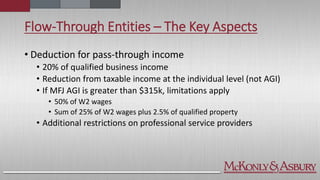

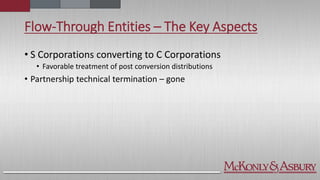

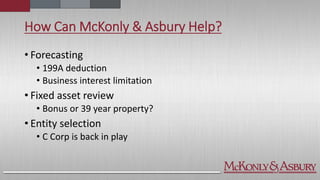

The document provides an analysis of the Tax Cuts and Jobs Act of 2017, detailing changes in individual and corporate taxes, including modifications to deductions, tax rates, and the introduction of the Qualified Business Income deduction. It outlines how these changes affect personal exemptions, standard deductions, business interest deductions, and the treatment of pass-through entities. Additionally, it highlights implications for C corporations, such as changes in tax rates and loss offsetting rules.