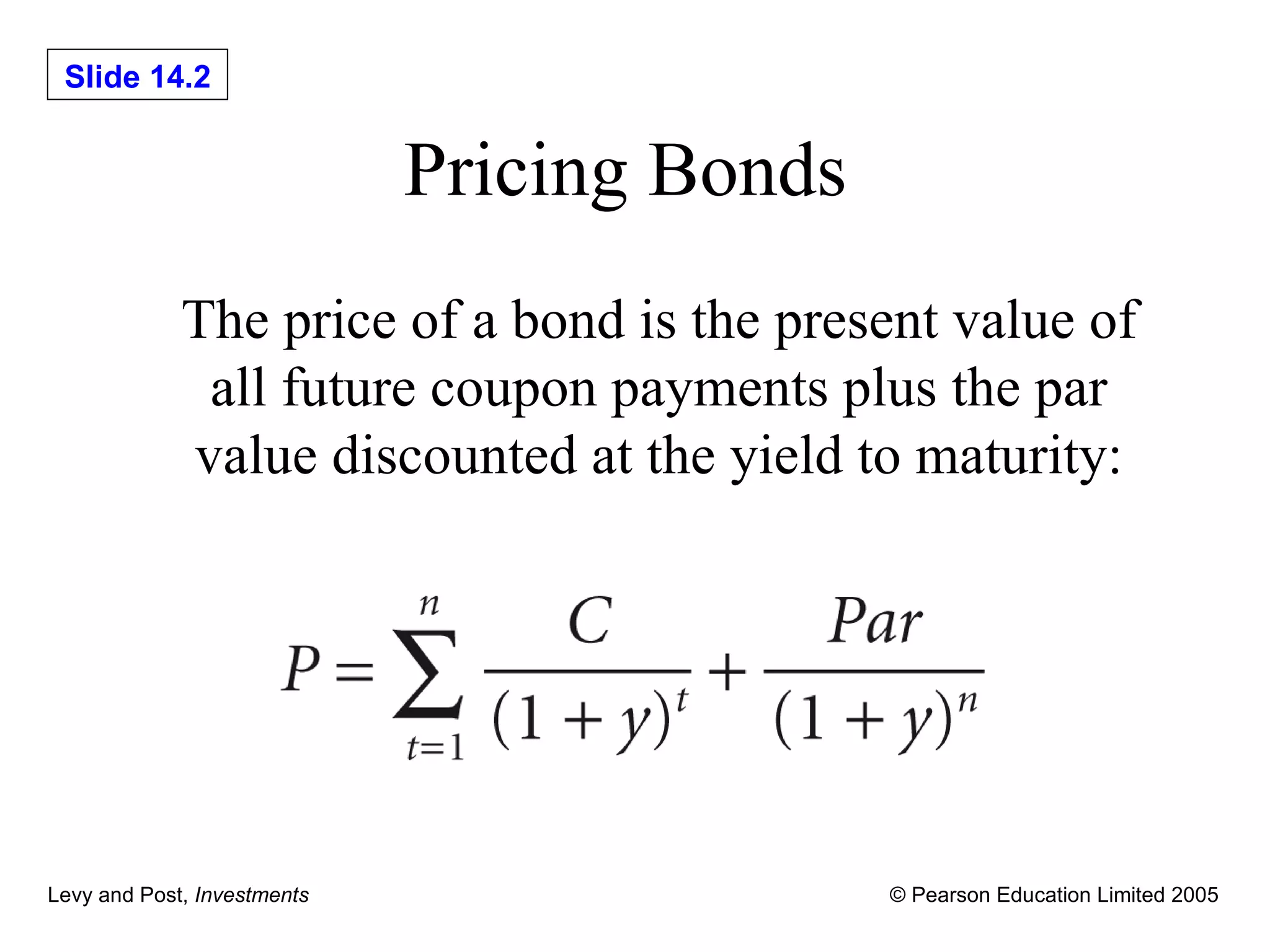

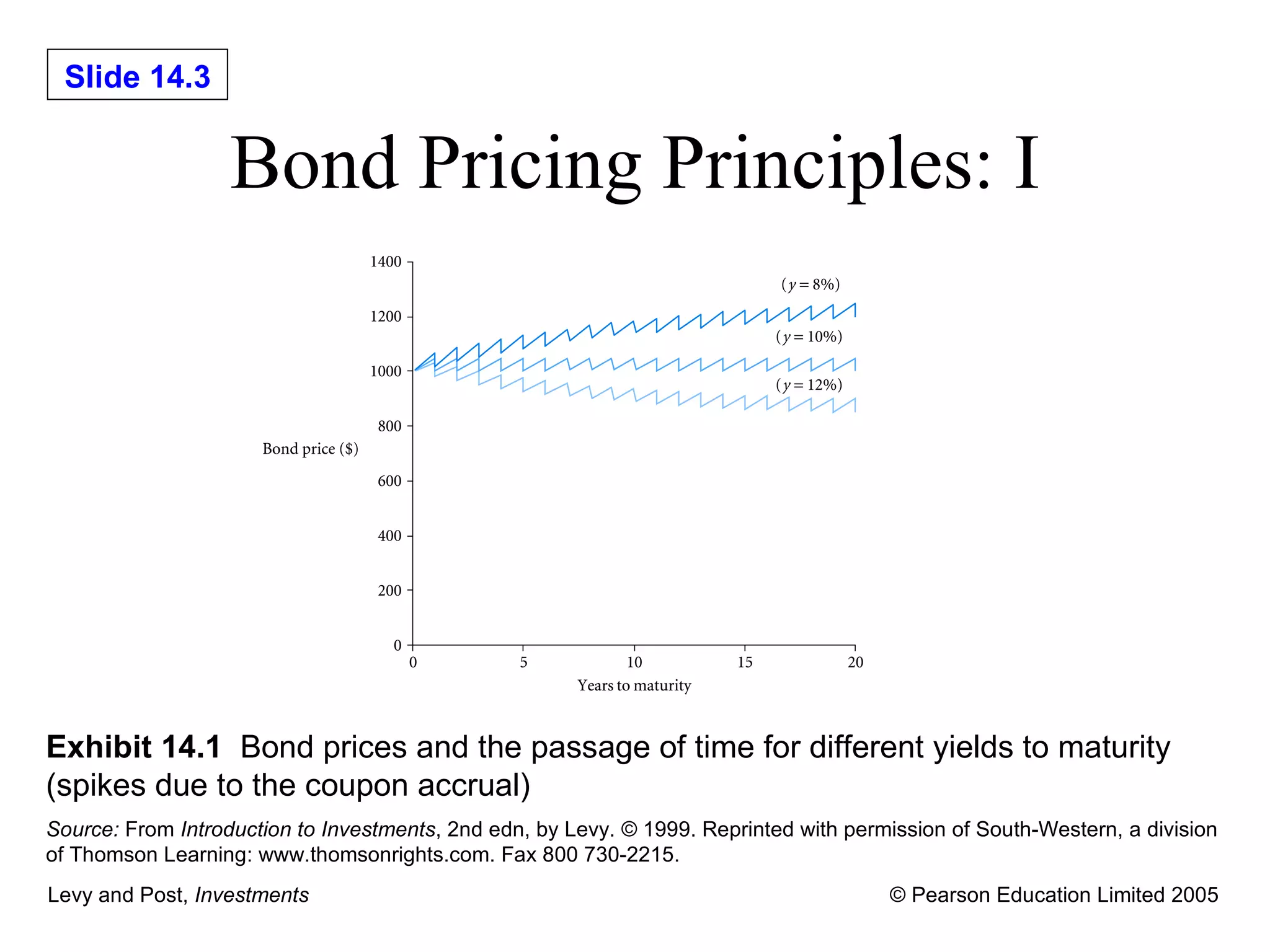

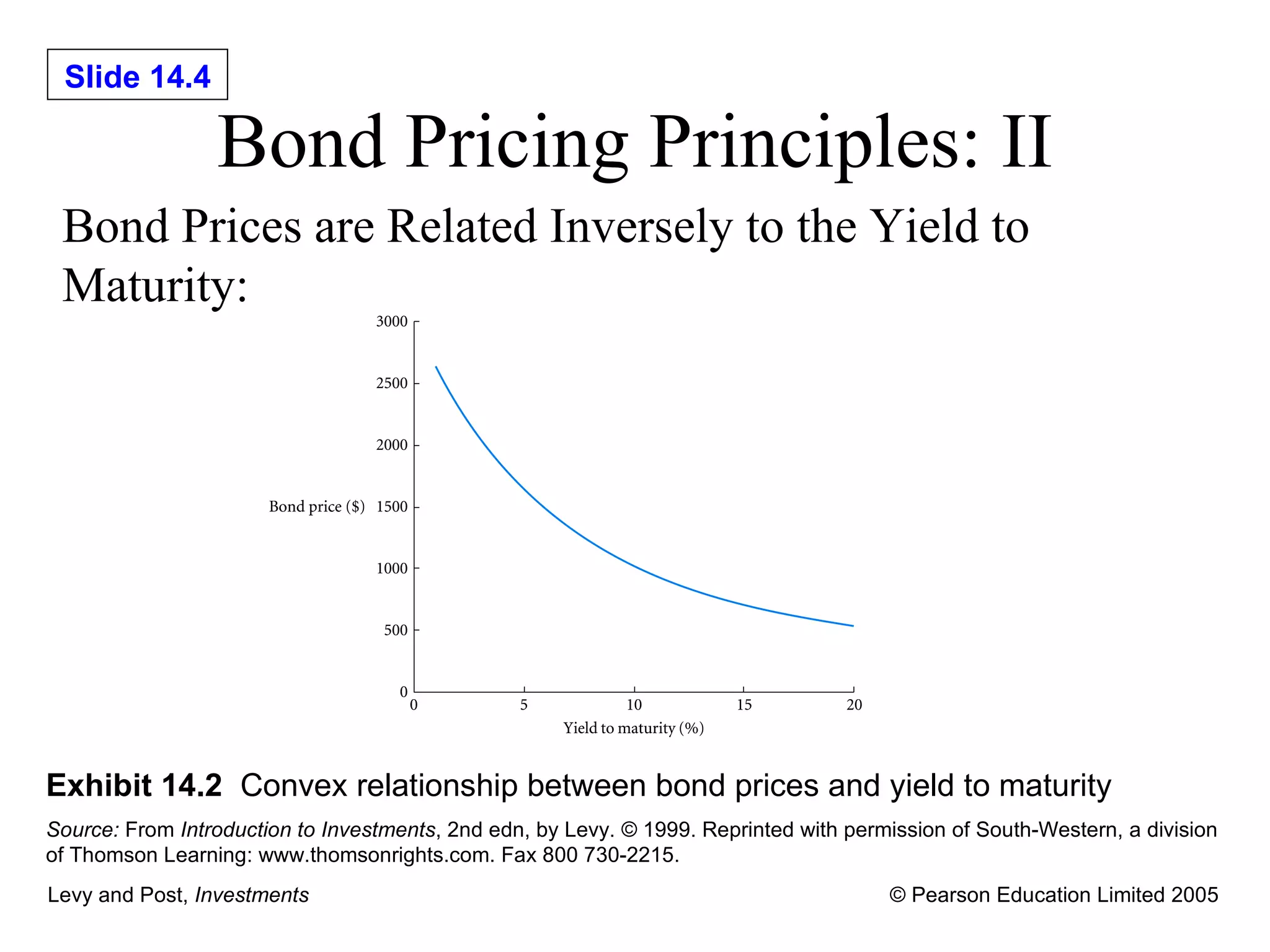

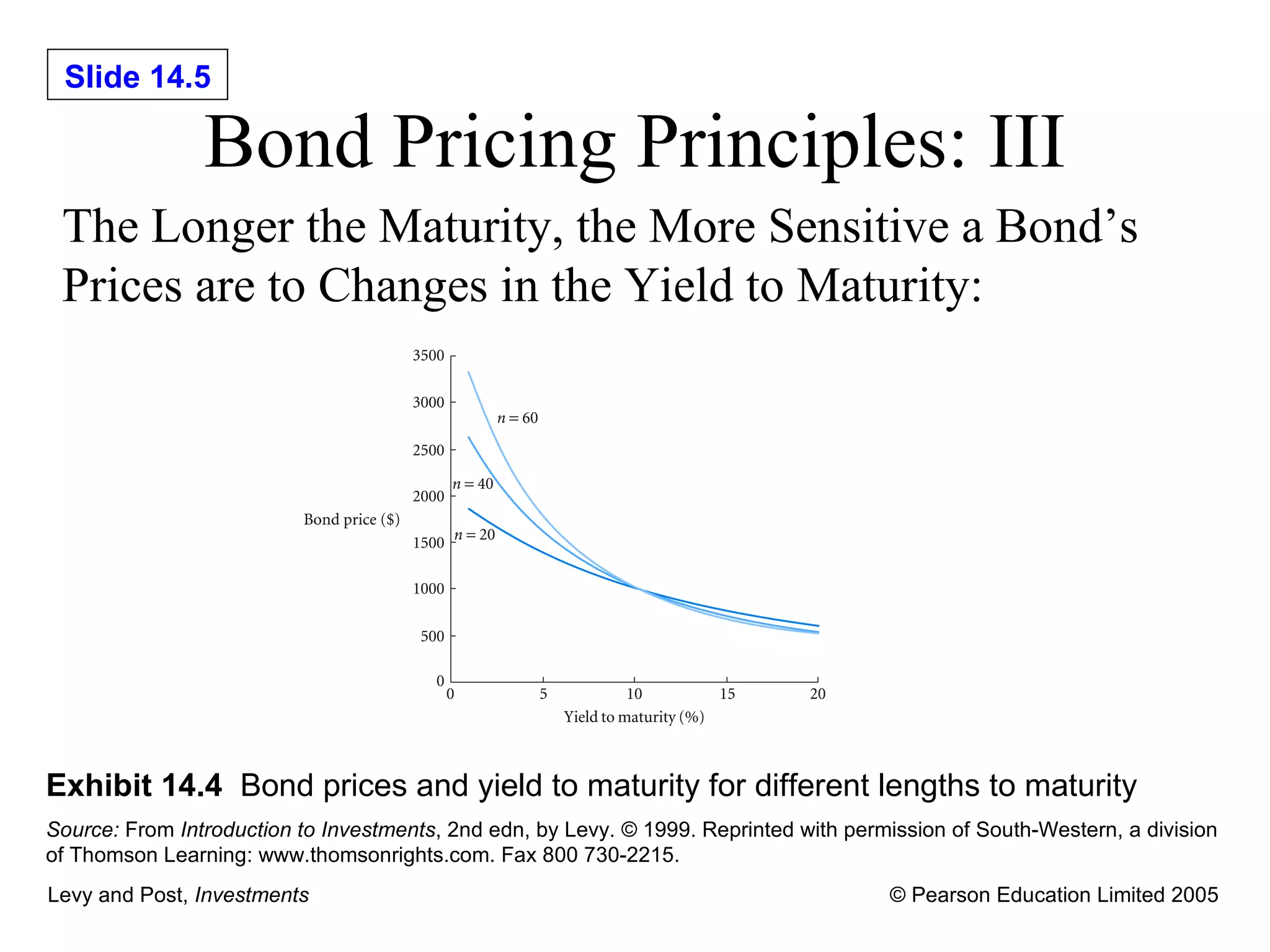

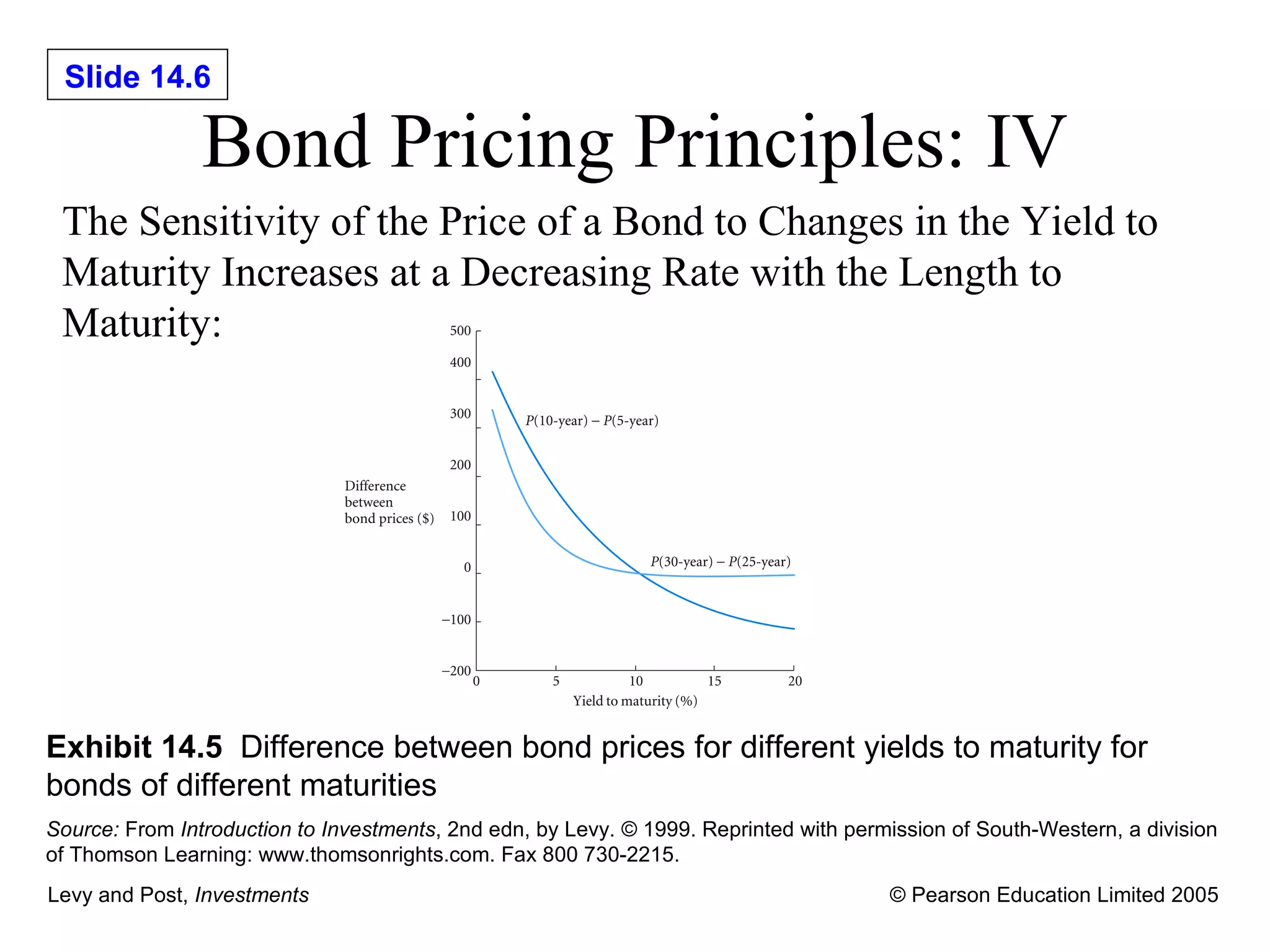

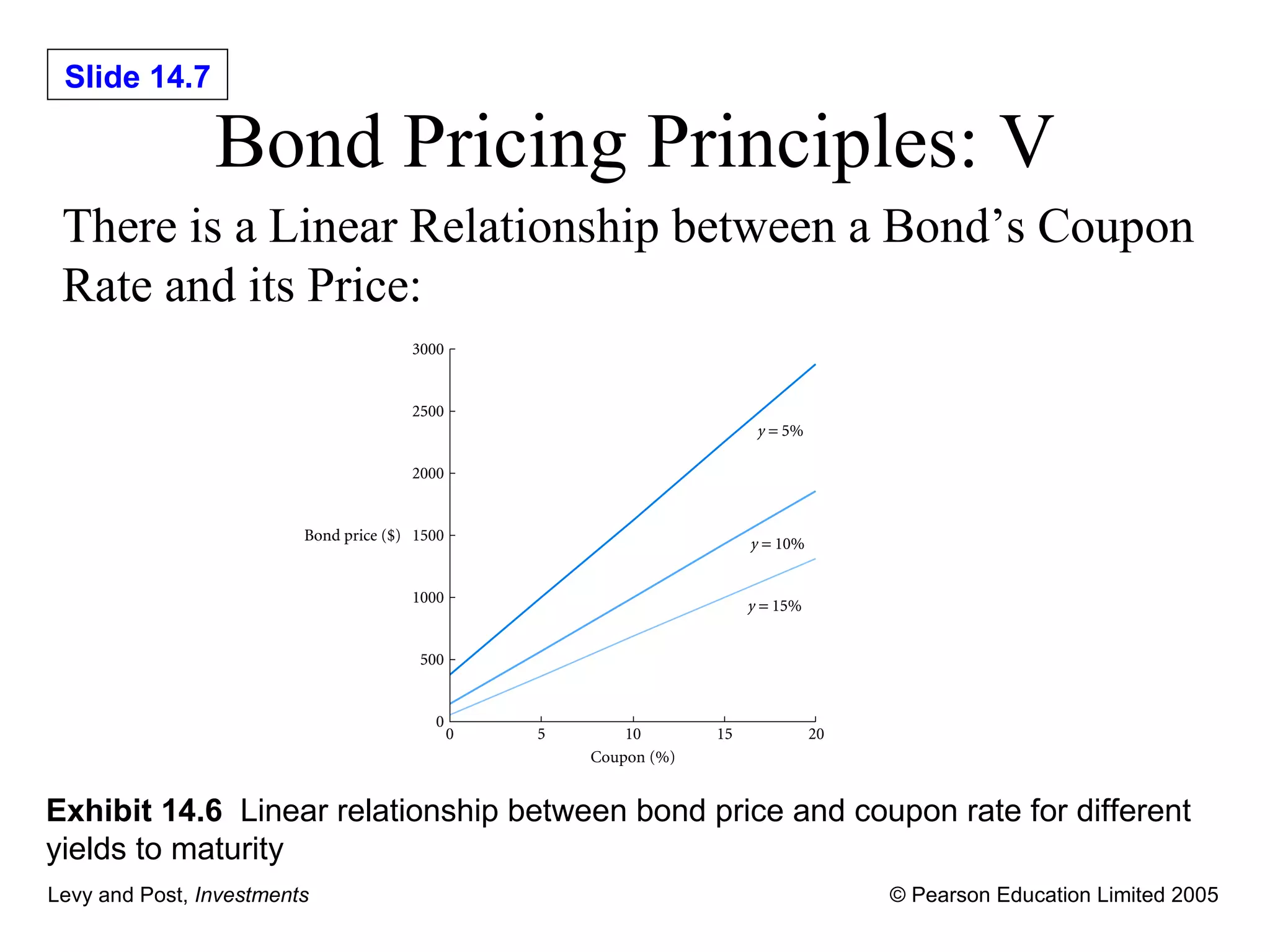

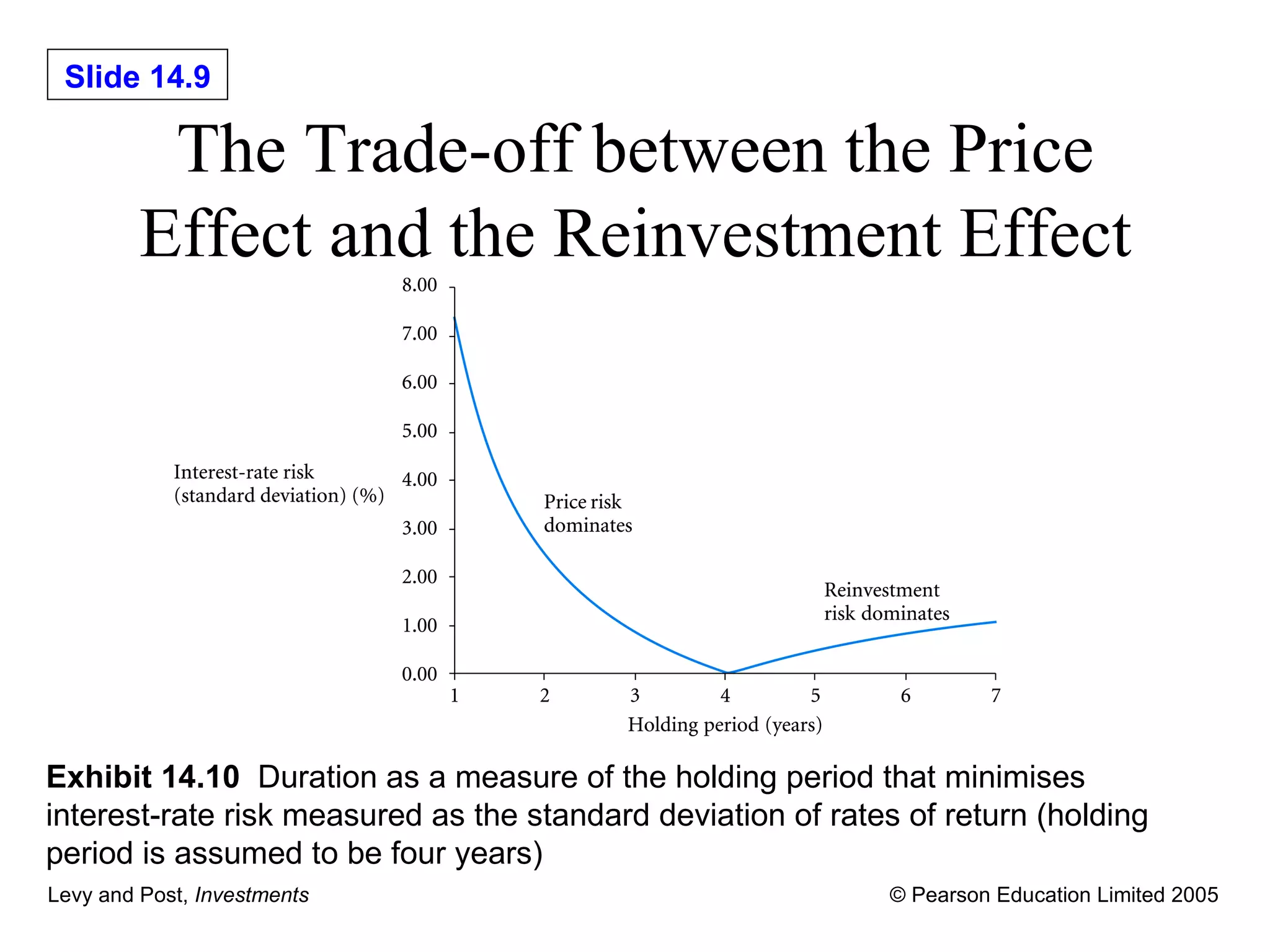

The document discusses bond pricing principles and analysis. It states that bond prices are determined by discounting the bond's future coupon payments and principal at the yield to maturity. It also explains that duration is a measure of a bond's price sensitivity to interest rate changes, and that convexity captures the non-linear nature of this relationship. The document contrasts passive bond management strategies like indexing and immunization versus active strategies that aim to identify mispriced bonds.