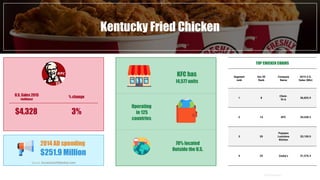

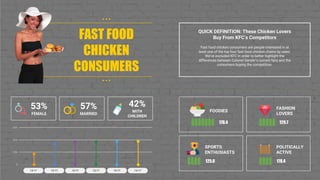

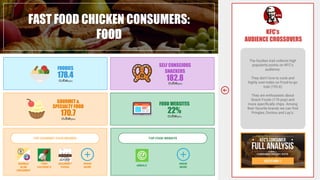

Yum Brands has initiated a review of KFC's $220 million media account, seeking a world-class agency to enhance media strategies and maximize ROI. After a decline in media spending, KFC is also undergoing a 're-colonelization' marketing campaign to revitalize the brand and improve sales, which saw a 3% increase in same-store sales in 2015. The fast food industry is experiencing rising competition, with consumer preferences shifting towards high-quality food and healthier options.