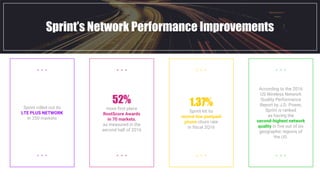

Sprint is reviewing its media planning and buying assignment, with an advertising budget of approximately $1.3 billion for fiscal 2016. The company aims to understand consumer behavior and preferences, particularly among Hispanic millennials, as it seeks to tailor its offerings more effectively. The incumbent agency Mediavest is expected to defend its position, while Sprint continues to focus on market growth and network improvements.