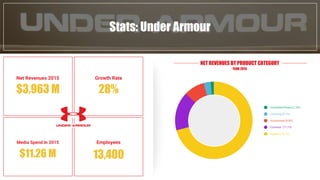

Under Armour is currently reviewing its media agency, transitioning from Omnicom Media Group's Optimum Sports, which has handled its media since 2011. The company has a significant presence in the athleisure market, competing with brands like Nike and Adidas, and has also expanded its digital fitness community through acquired apps like MyFitnessPal and MapMyFitness. Under Armour reported $3.96 billion in net revenues for 2015 with a strong focus on leveraging consumer data to inform product development and marketing strategies.