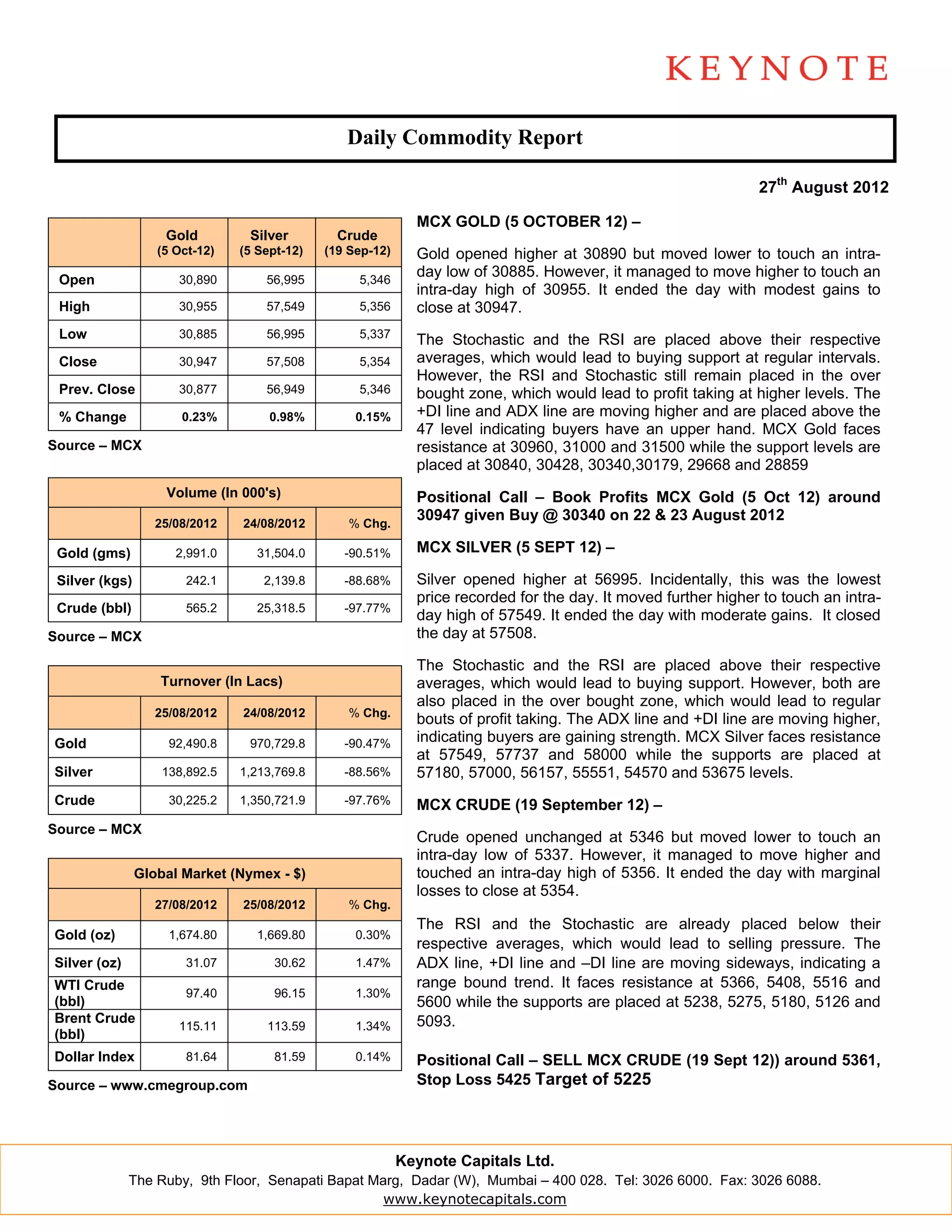

Gold opened higher but ended the day with modest gains, closing at 30,947. Silver also opened higher and closed higher at 57,508. Crude opened unchanged but closed lower at 5,354. Technical indicators for gold and silver show buying support but both metals remain in overbought zones, which could lead to profit taking. Technical indicators for crude show a range-bound trend. The report provides closing prices and levels of resistance and support for gold, silver, and crude futures contracts.