The IS-LM model shows the equilibrium in the goods market (IS curve) and money market (LM curve).

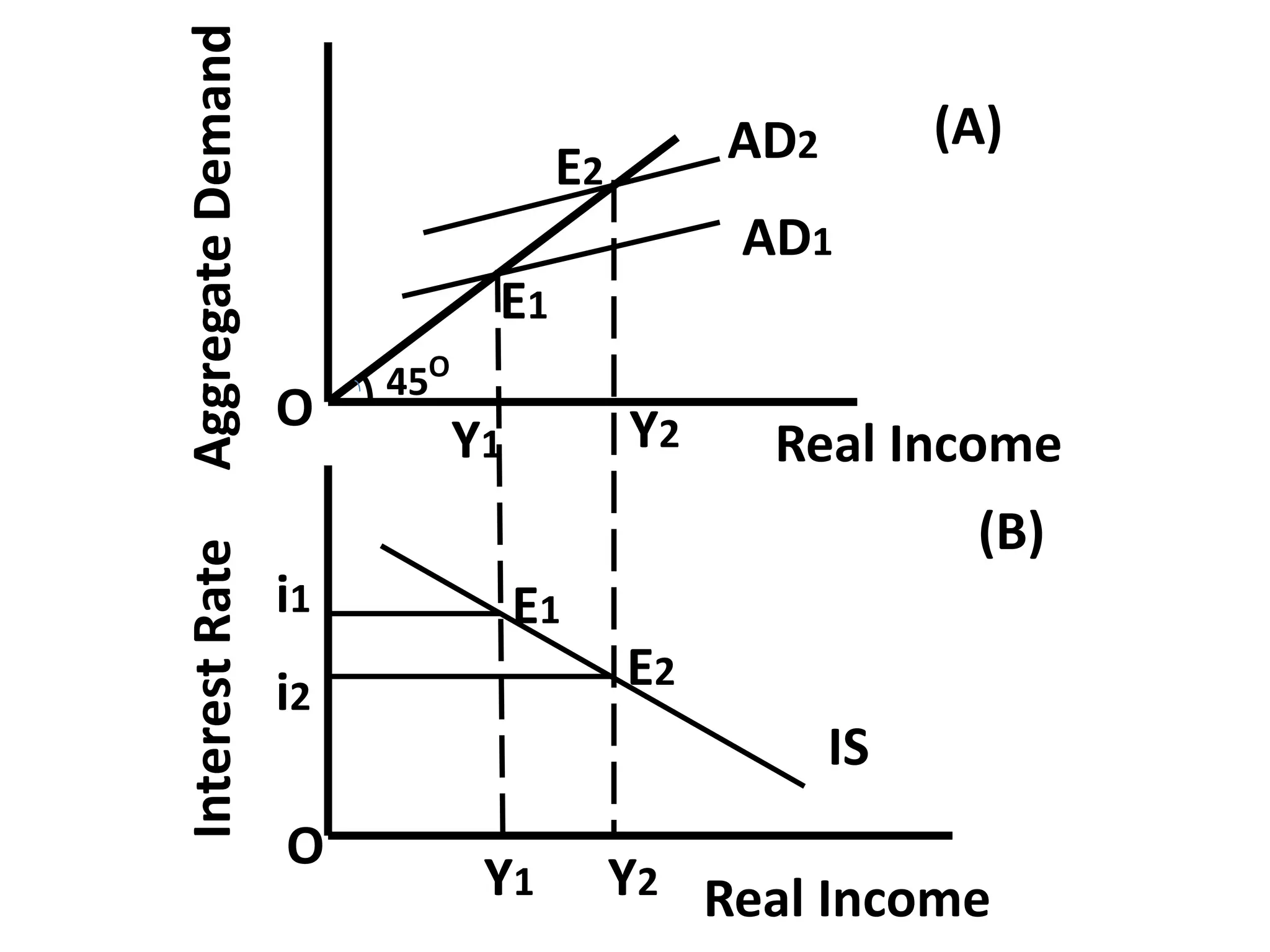

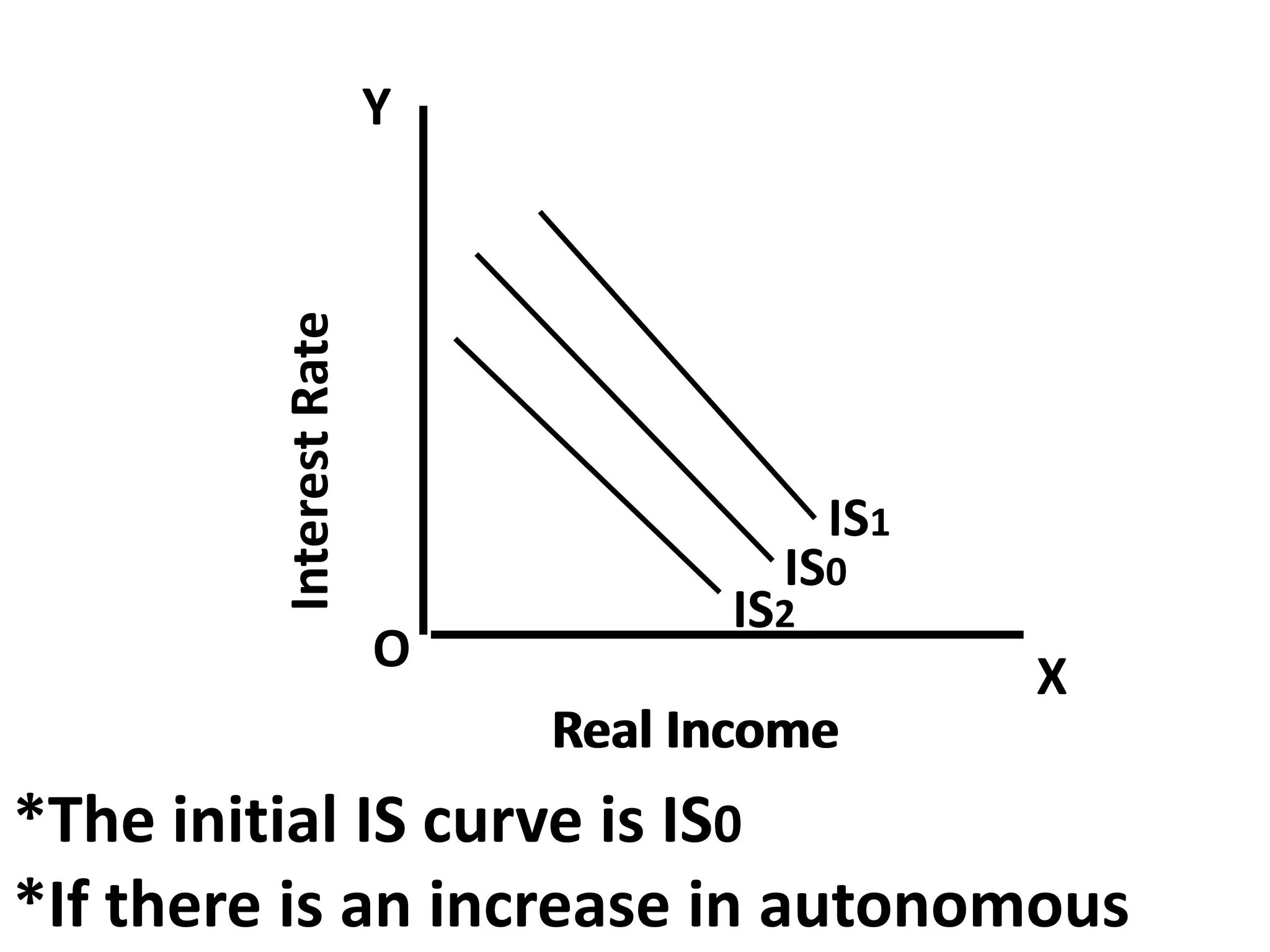

The IS curve depicts combinations of interest rates and income levels where investment equals savings. It slopes downward because lower interest rates increase investment and shift aggregate demand outward, raising income.

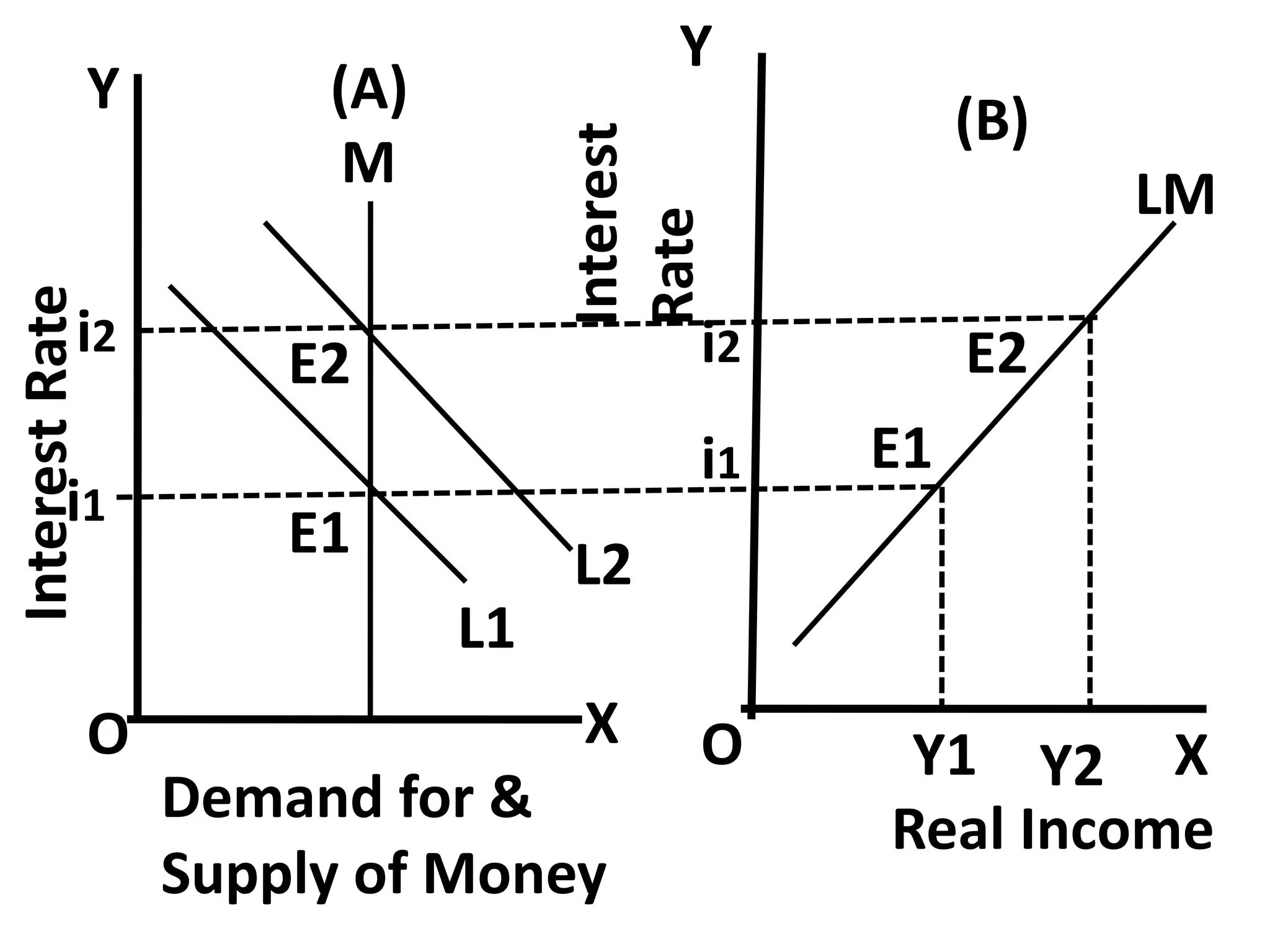

The LM curve shows combinations of interest rates and income where the demand for money equals the supply of money. It slopes upward because higher income increases money demand, shifting the demand curve right and raising the equilibrium interest rate.

Together, the intersection of the IS and LM curves indicates the general equilibrium in the economy across both markets.