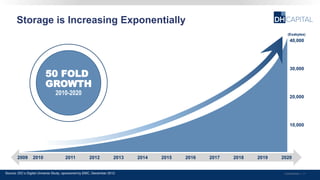

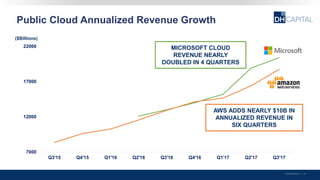

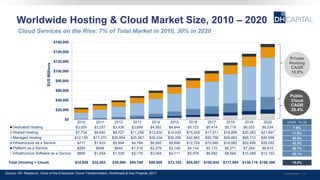

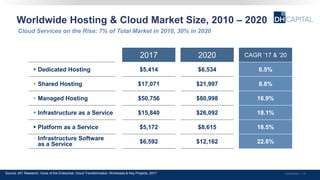

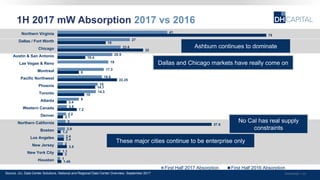

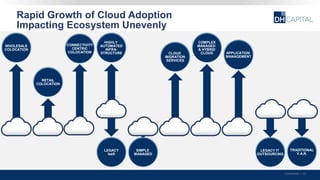

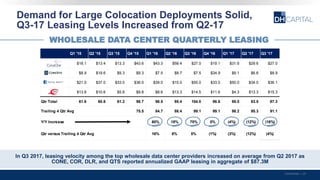

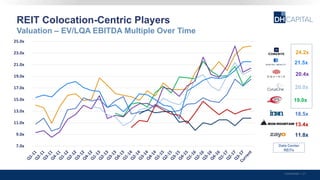

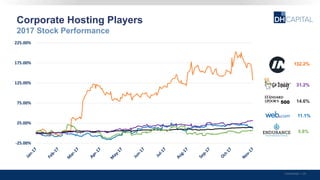

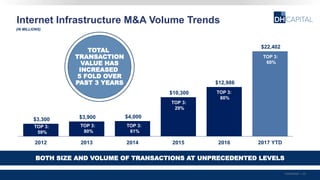

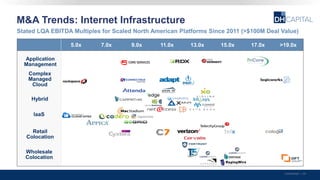

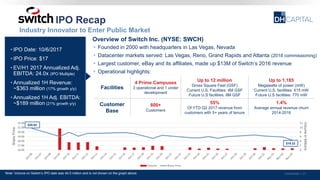

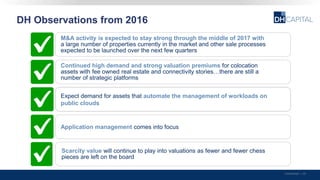

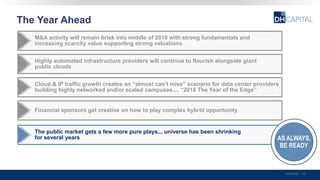

The document outlines key industry trends in the internet infrastructure sector, highlighting the explosive growth in cloud adoption and the strong performance of mergers and acquisitions (M&A) in this area. It reviews financial performance data, market trends, and the activities of major players, indicating a competitive landscape with significant capital investments. Overall, 2017 was marked by unprecedented M&A activity and substantial growth across cloud services and related sectors.