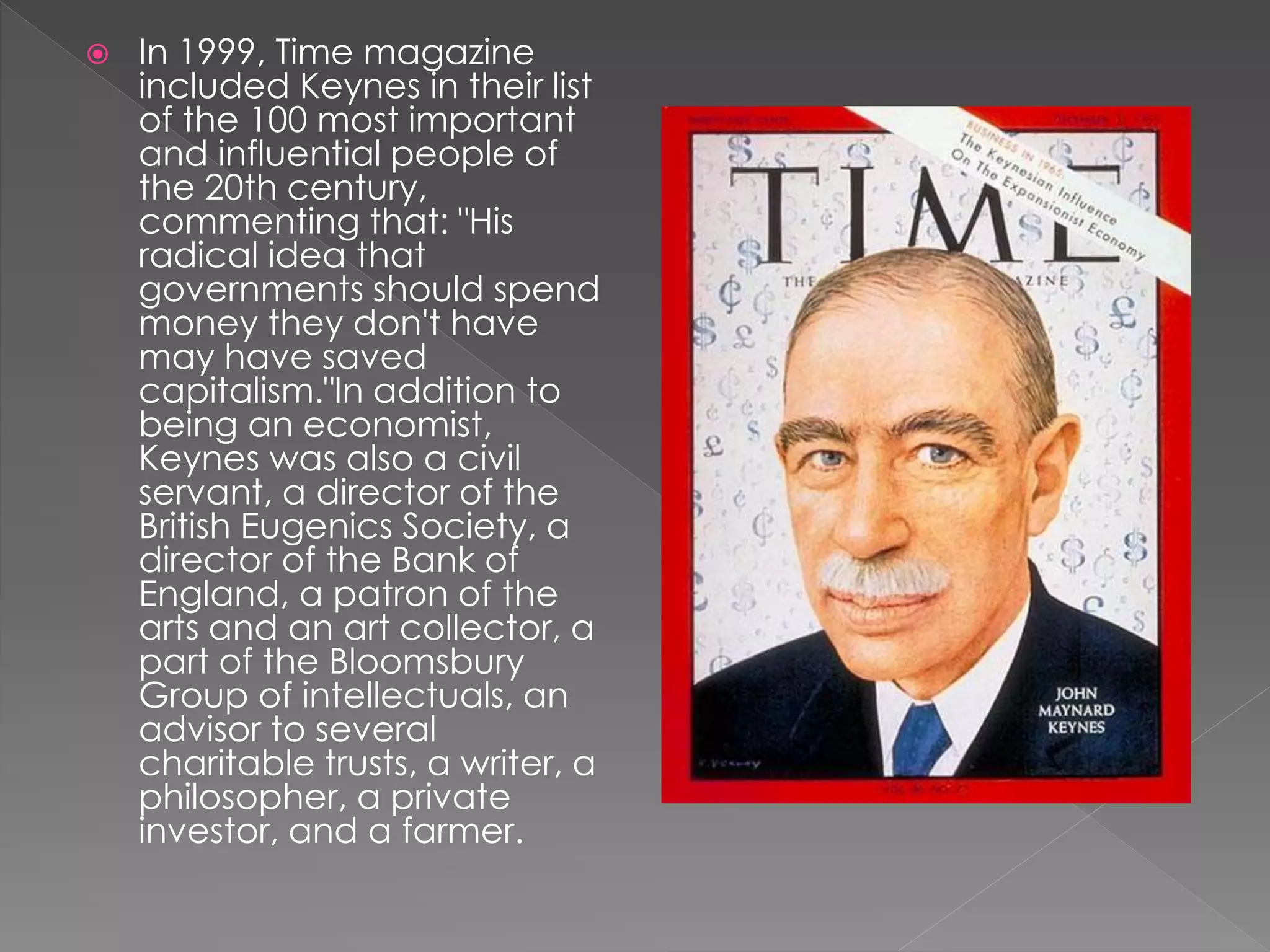

Keynes was a 20th century British economist whose ideas revolutionized economic thinking. He argued that free markets do not automatically provide full employment and that aggregate demand determines economic activity. Keynes advocated fiscal and monetary policies like government spending to mitigate recessions and depressions. His ideas were widely adopted and formed the basis of postwar economic policies that achieved strong growth and employment.