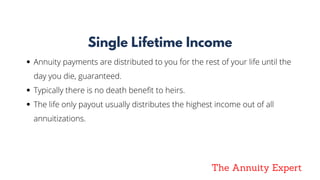

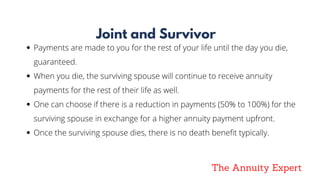

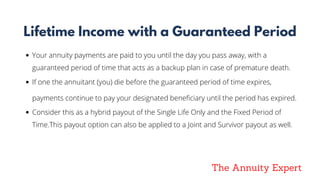

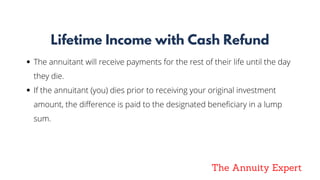

An immediate annuity, or SPIA, is an insurance product where a consumer exchanges a lump sum for a guaranteed stream of income, typically used for retirees on fixed incomes. It offers various payout options such as lifetime payments, joint and survivor payments, and period certain annuities, each with different structures for beneficiaries. Consideration should be given to financial flexibility and control over assets before purchasing an immediate annuity.