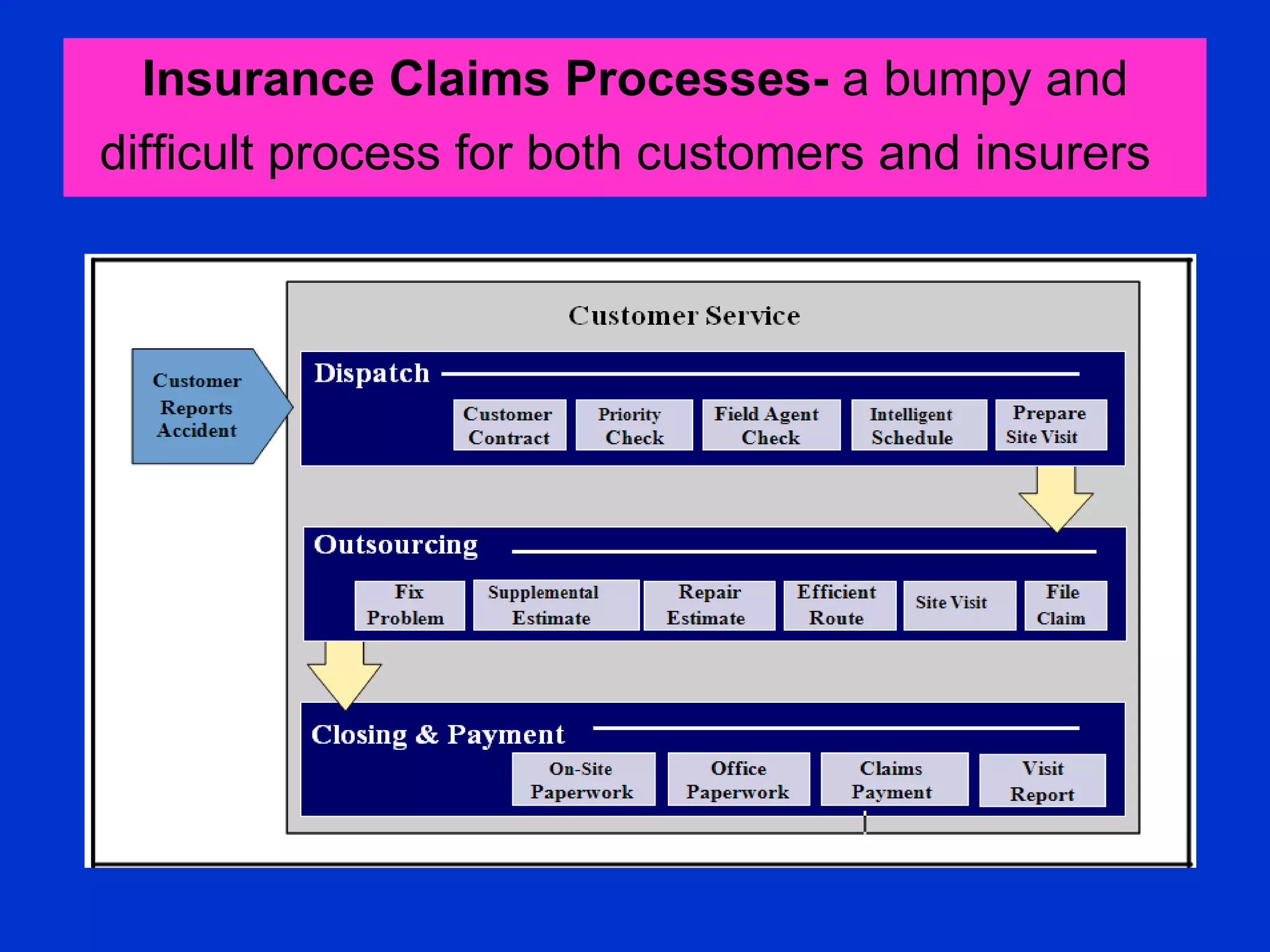

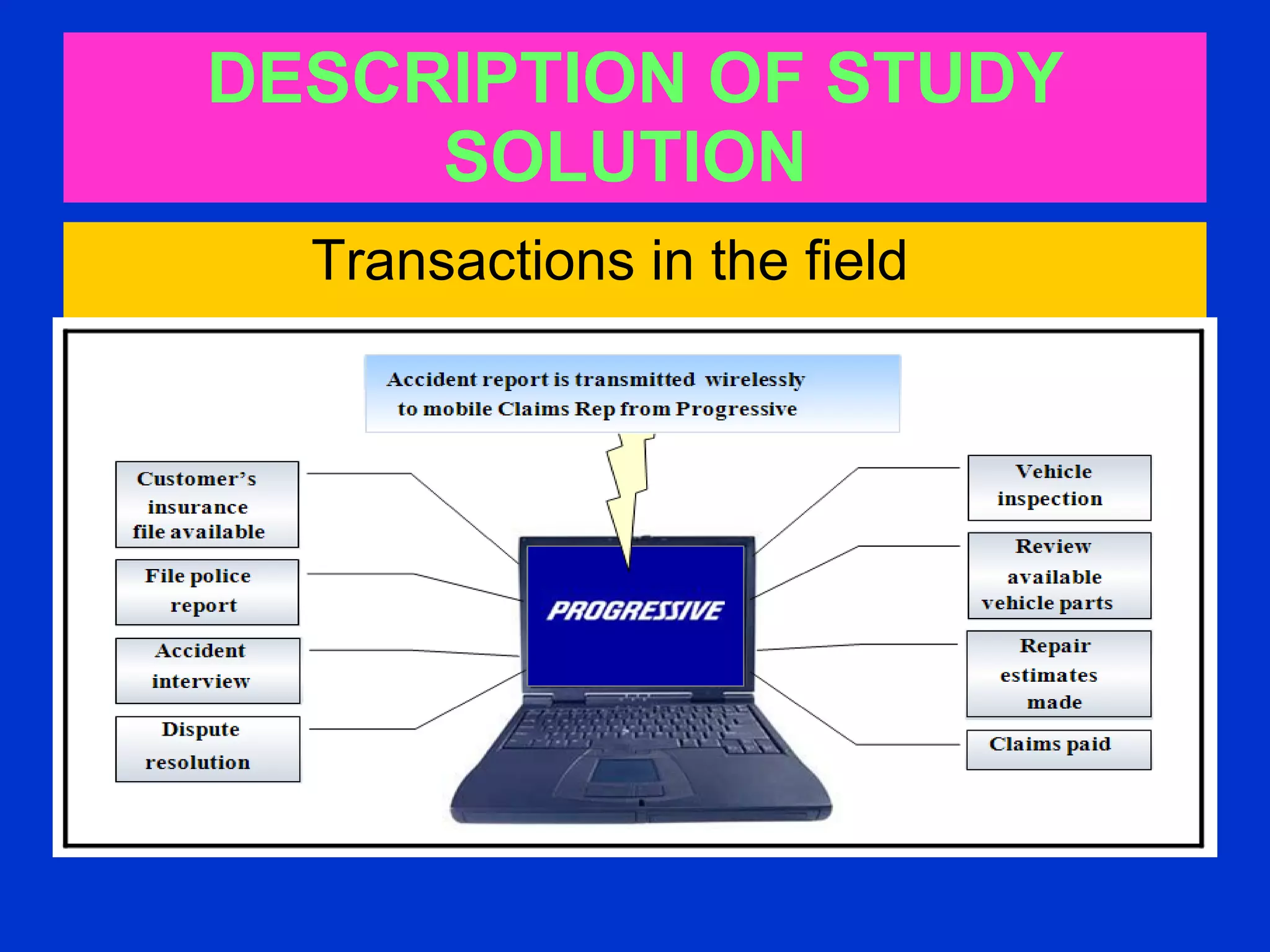

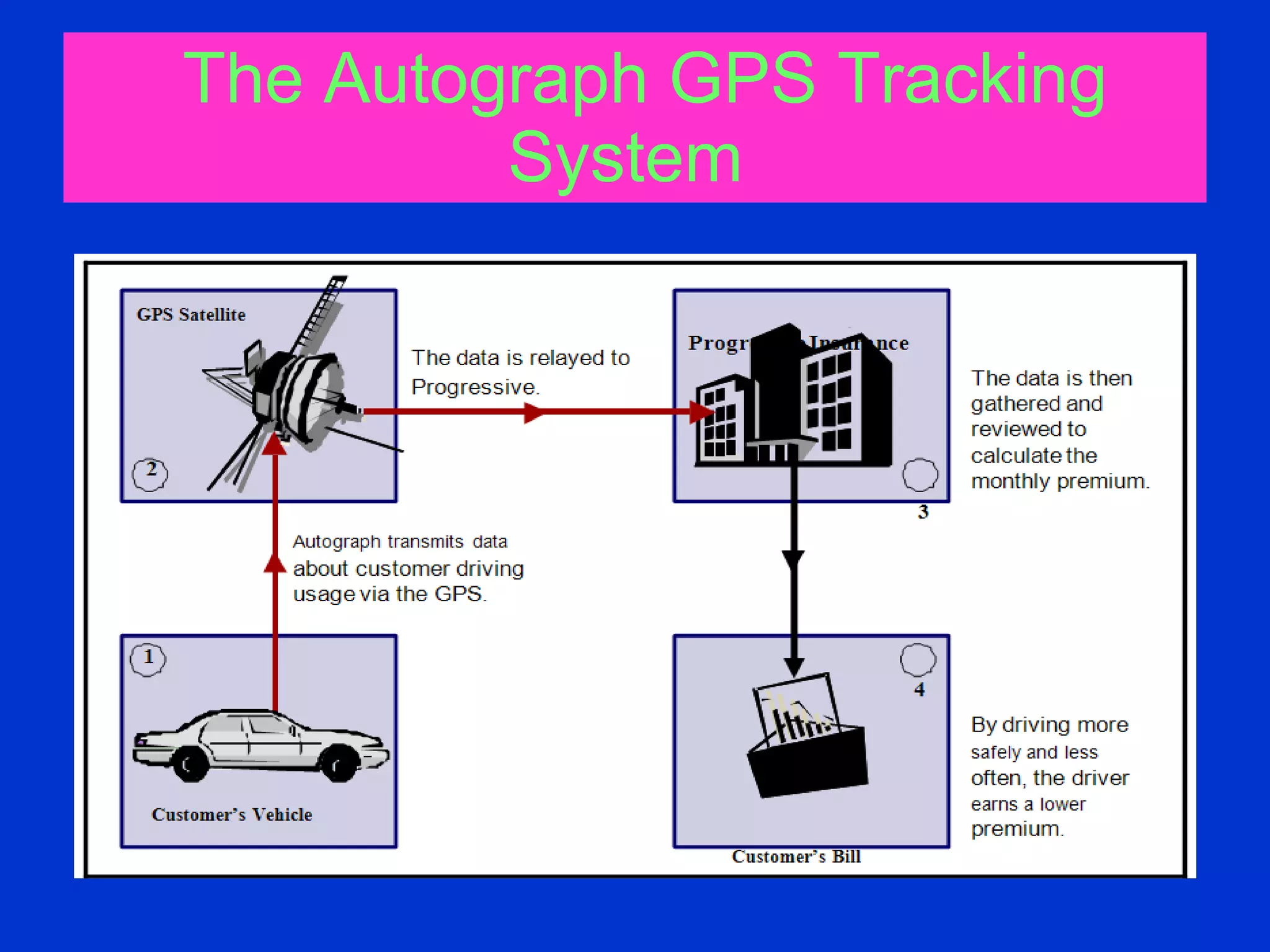

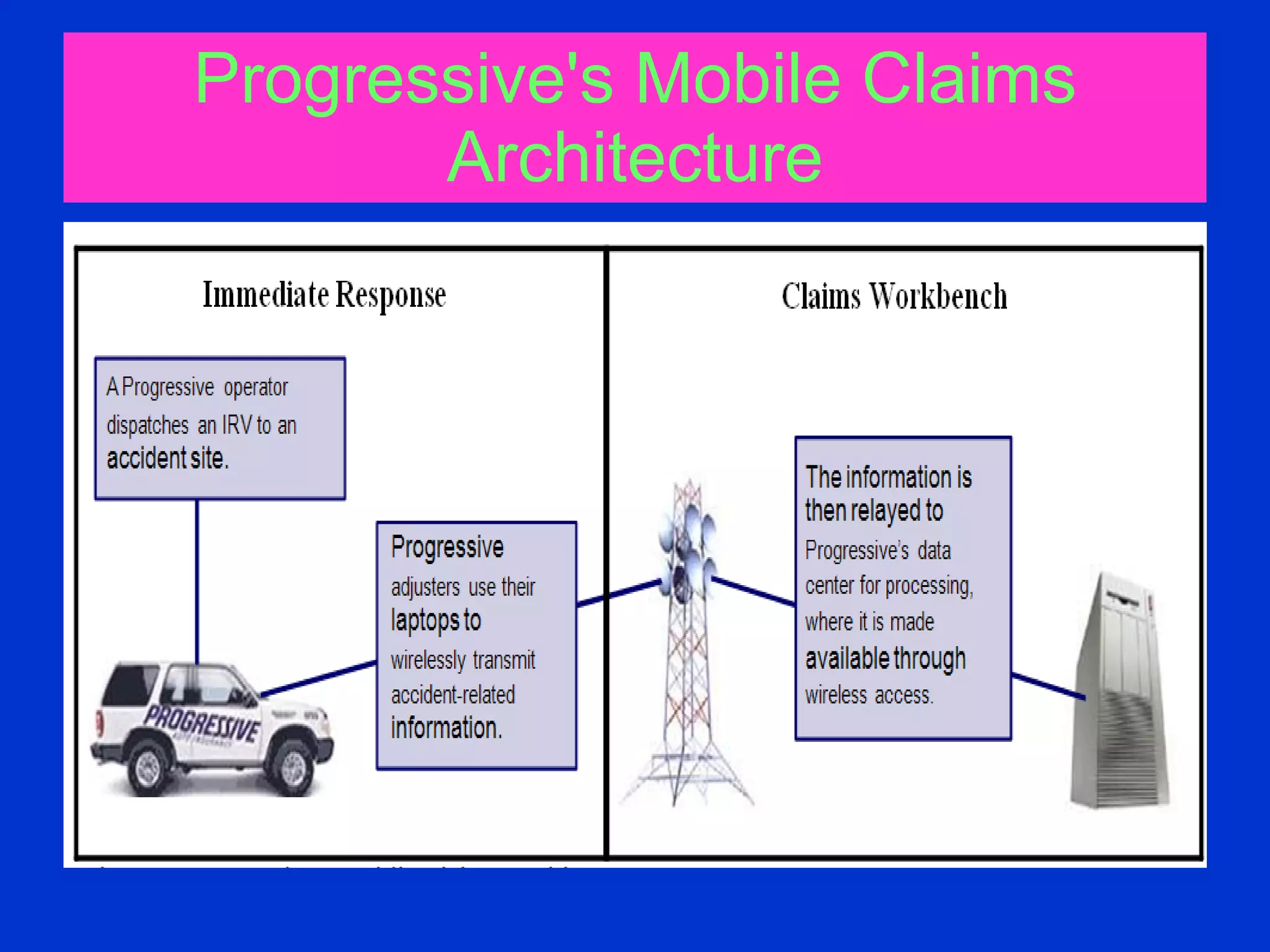

Progressive Insurance implemented mobile technology solutions to improve their claims processing and customer service. Mobile claims adjusters with laptops could complete tasks at accident scenes in hours that previously took weeks. This improved the customer experience. Progressive also used mobile apps and GPS vehicle tracking to more accurately assess risks and set premium prices. While this approach raised privacy concerns for some, Progressive argued it only used data for pricing. Overall, the mobile solutions increased efficiency, customer response times, and allowed up-selling additional policies.