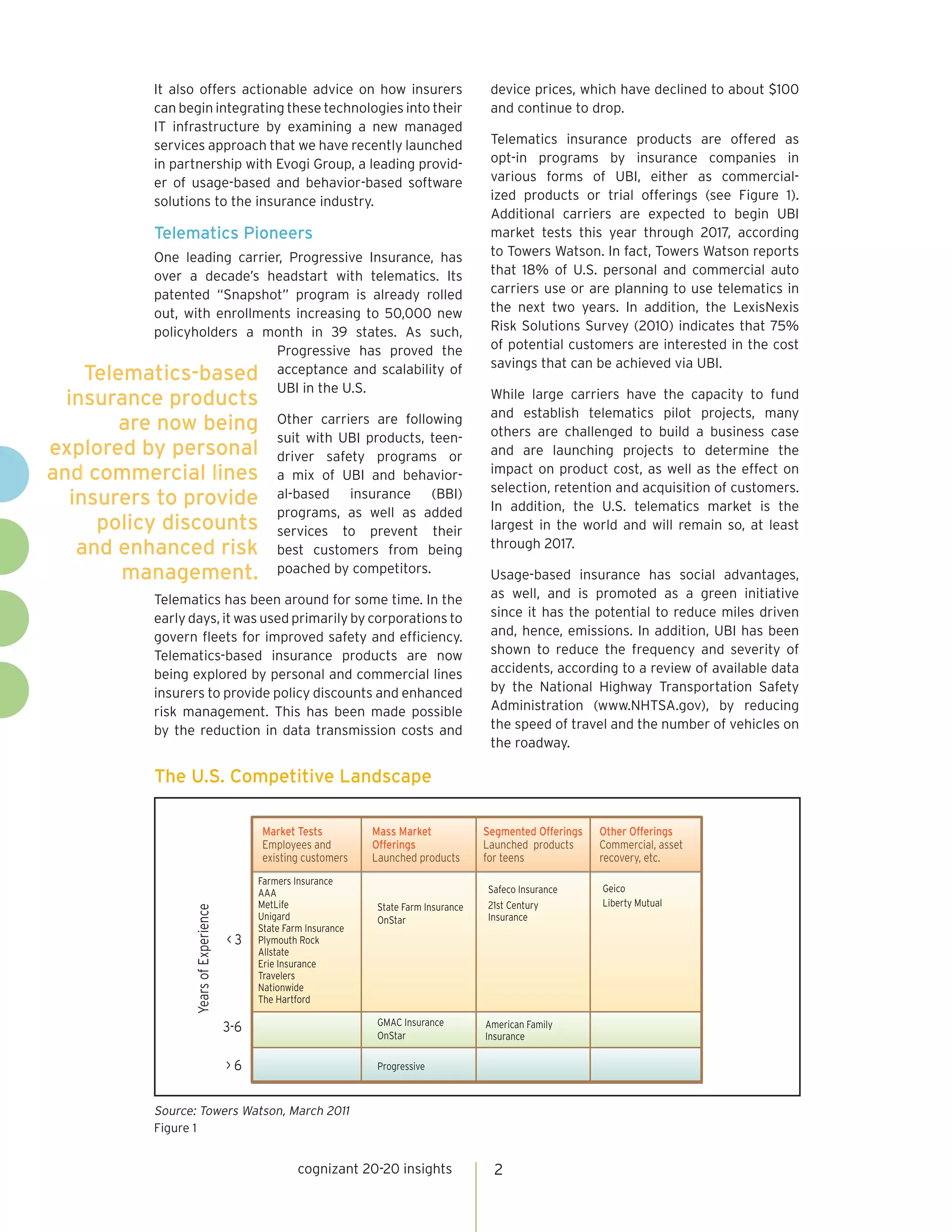

This document discusses the growth of usage-based insurance (UBI) using telematics data collected from devices installed in vehicles. It outlines how early adopters of telematics are seeing benefits from more accurate risk assessment and pricing. Telematics allows insurers to move beyond traditional factors like gender and age to price policies. The document also describes how telematics could transform claims processes by automating aspects like first notice of loss and estimating repairs. While implementation challenges remain, telematics offers potential for improved customer relationships, fraud detection, and significant returns on investment for insurers that pioneer this technology.