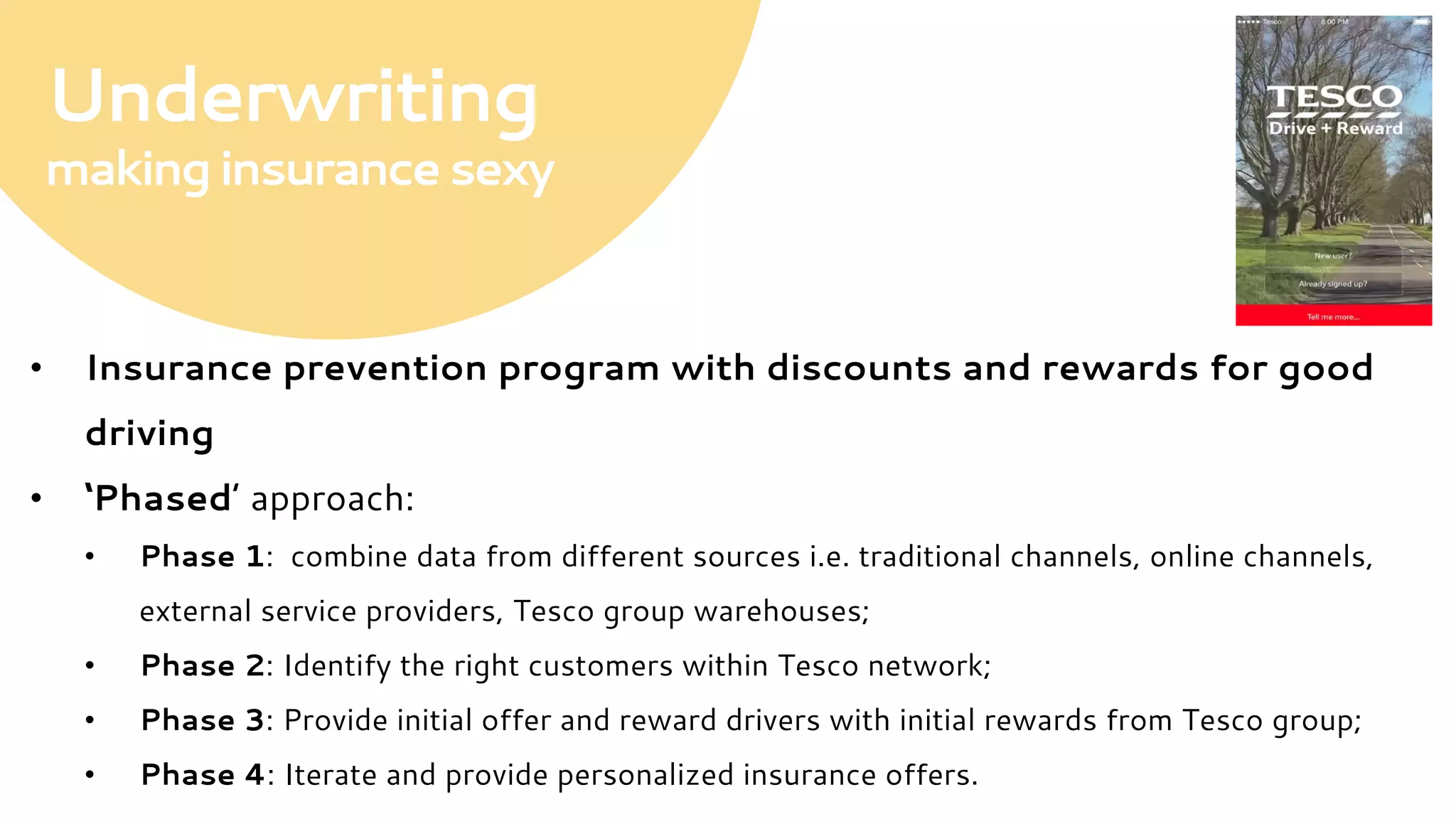

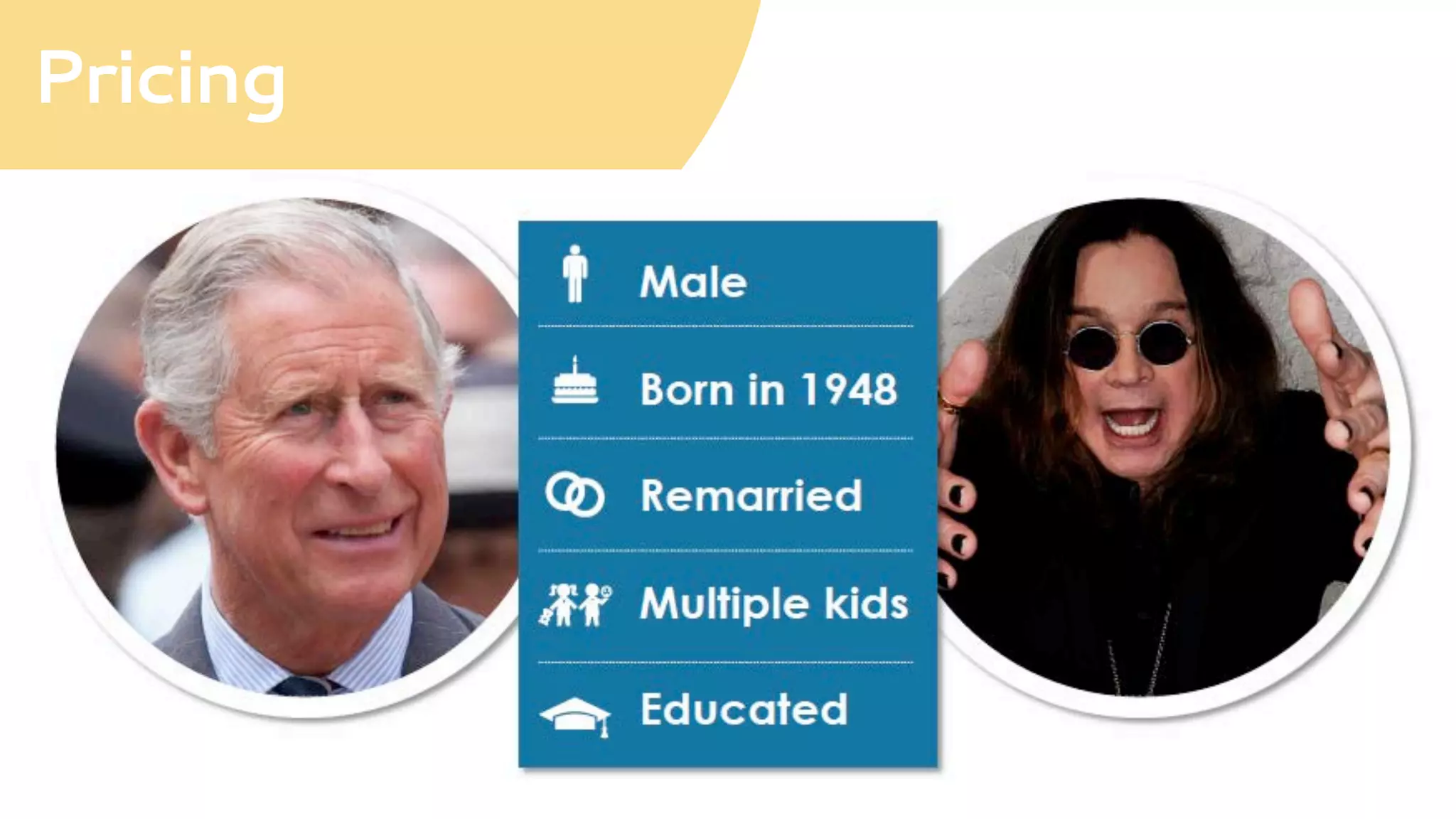

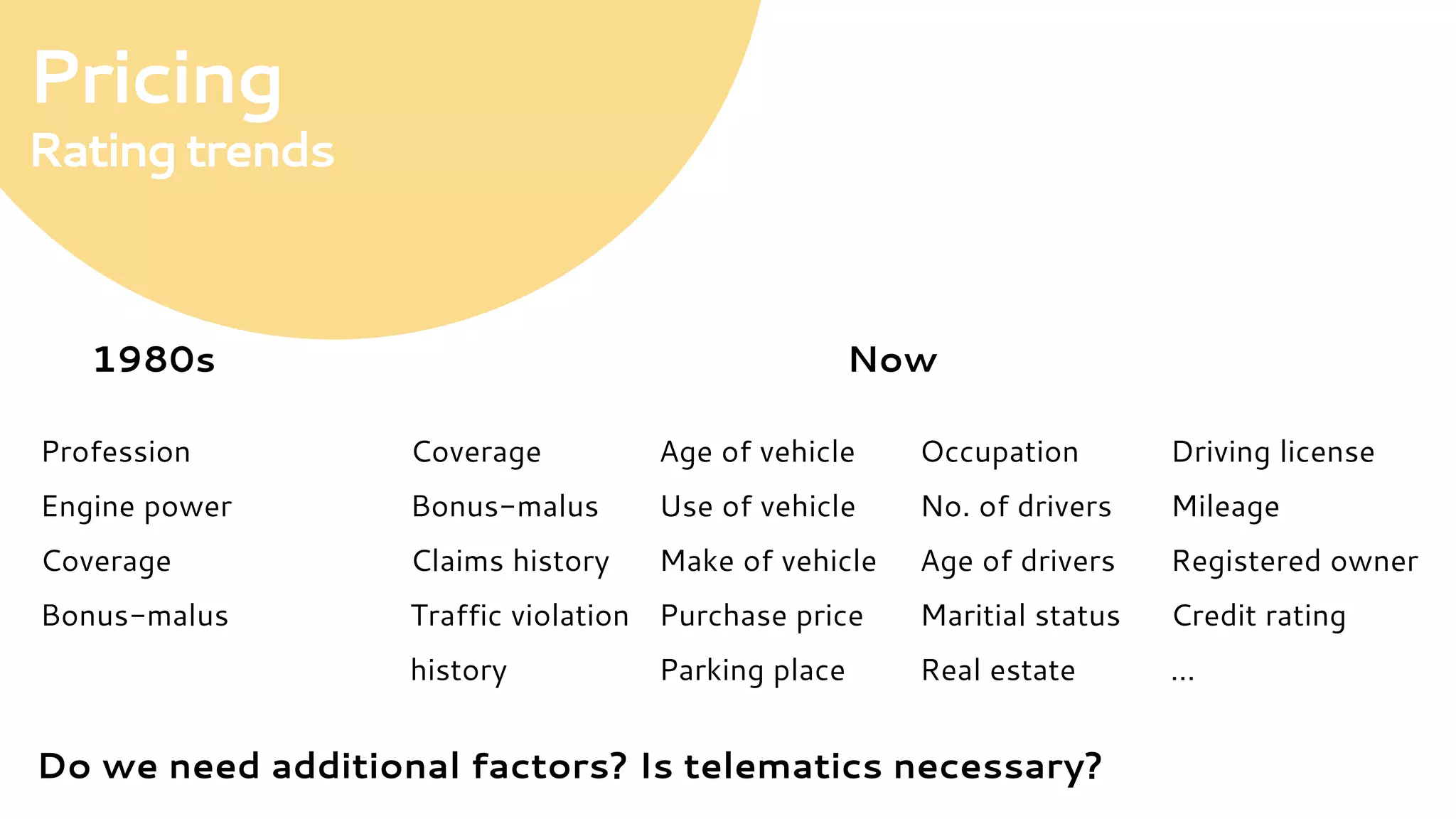

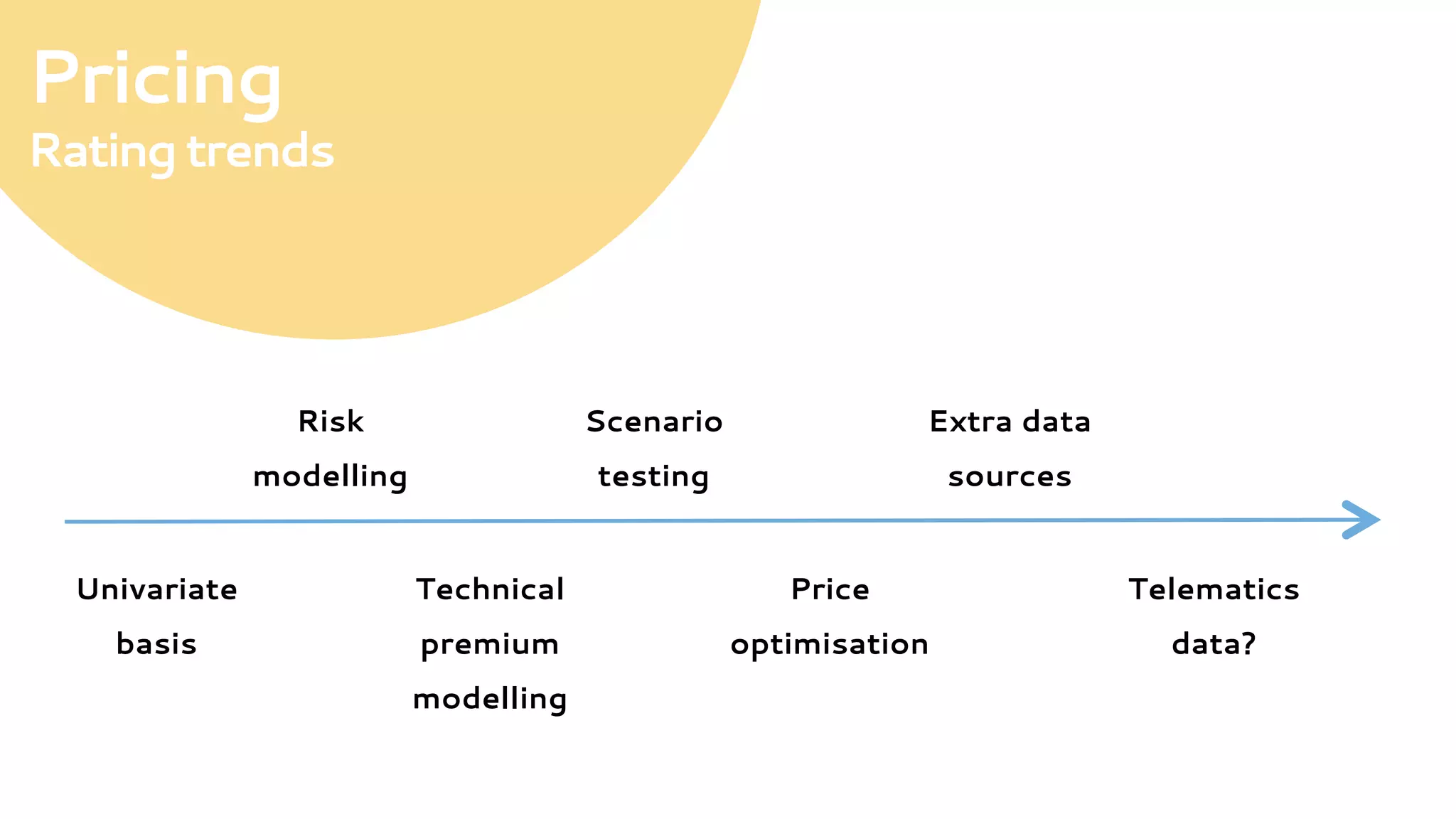

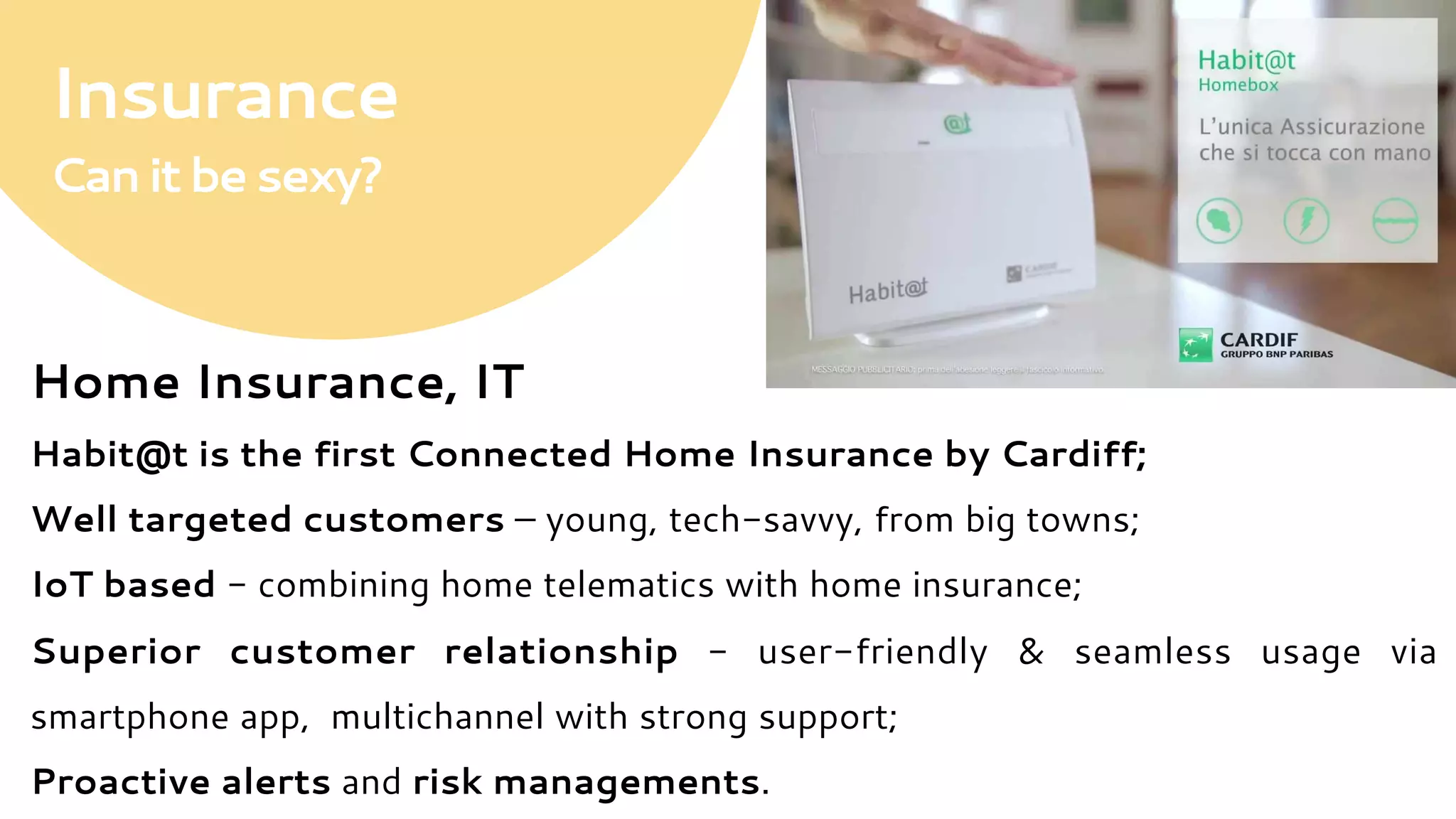

This document discusses how big data is impacting the insurance industry. It covers how insurers are using big data across the insurance value chain, from underwriting to pricing to claims management and fraud detection. Insurers are able to create more comprehensive customer profiles by combining internal and external data sources. This allows for more personalized insurance offerings and pricing models like usage-based insurance. The document also provides examples of insurers that are leveraging telematics data and innovative technologies to improve their business operations and customer experience.