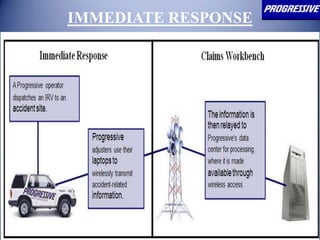

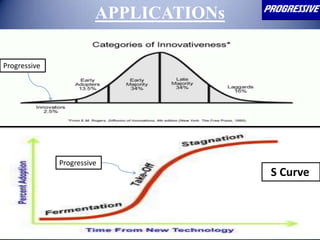

Progressive Insurance was founded in 1937 and pioneered innovations in the auto insurance industry, such as offering policies to high-risk drivers and 24/7 claims services. In the 1990s, Progressive launched further innovations like providing competitor quotes over the phone and using immediate response vehicles to quickly settle claims on-site. One major innovation was Autograph, launched in 2000, which used GPS technology to track vehicle usage and offer lower rates to drivers with good behavior. While innovations increased efficiency and customer service, they also increased costs and raised privacy concerns, so recommendations were made to expand technologies slowly and focus on research and larger cities first.