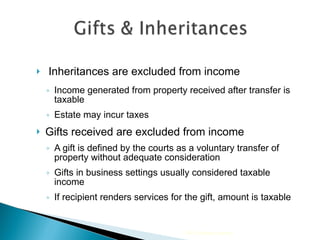

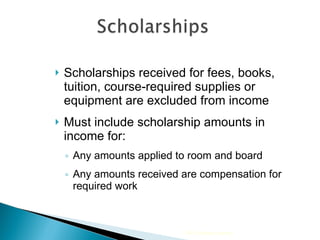

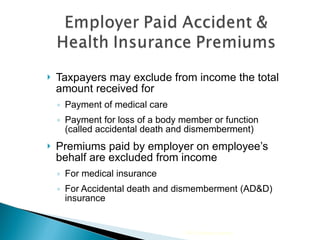

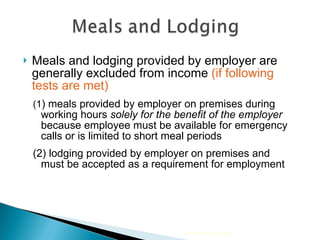

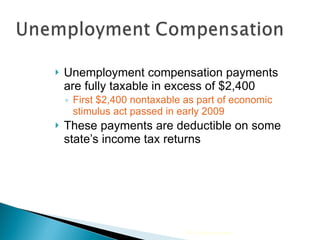

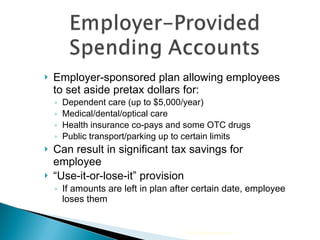

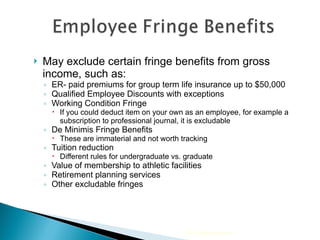

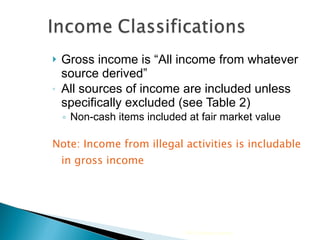

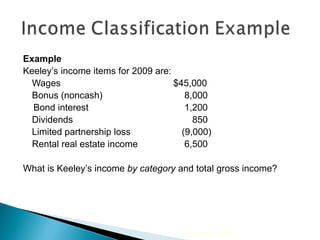

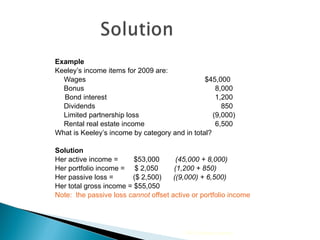

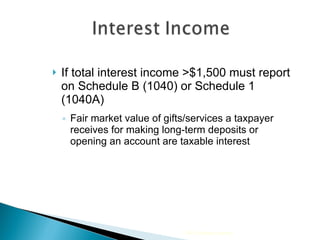

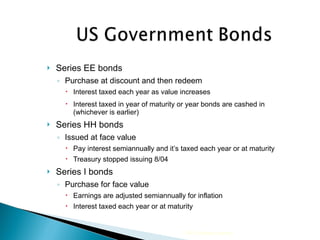

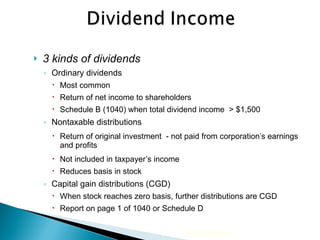

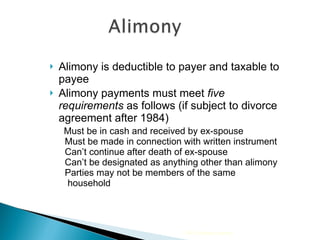

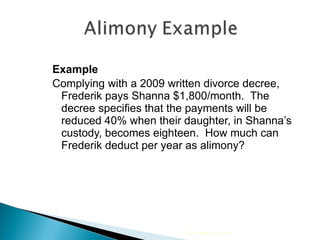

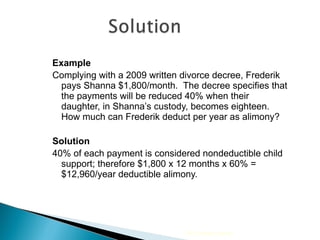

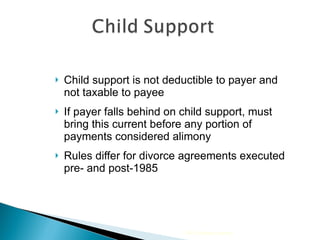

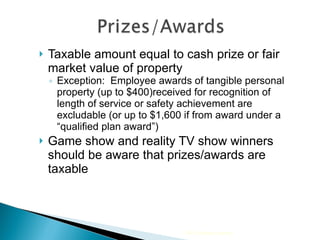

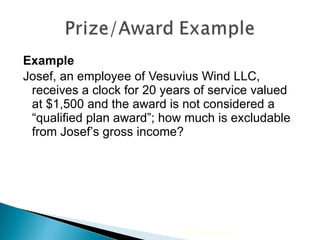

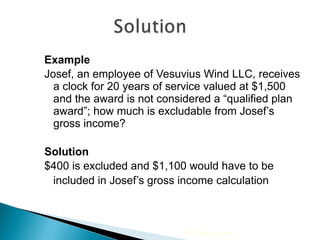

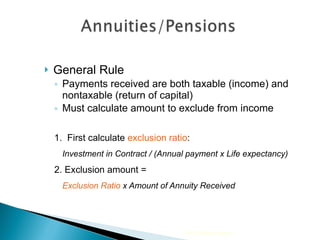

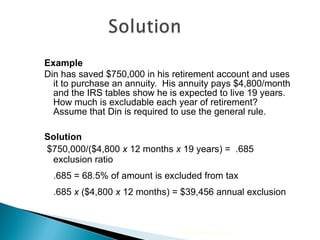

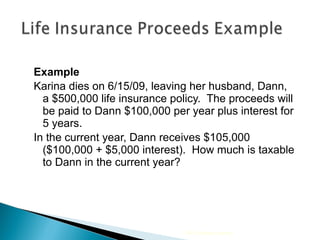

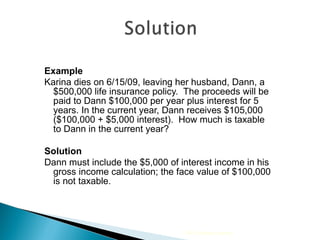

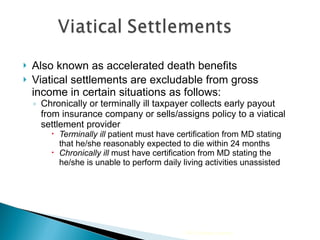

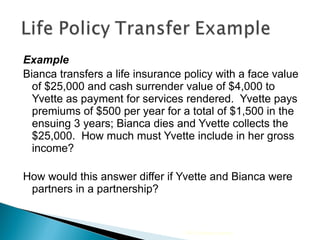

The document discusses various types of income and their tax treatment according to US tax law. It provides examples to illustrate how to calculate gross income for an individual based on different income categories including wages, bonuses, investment income, partnership losses, and rental income. It also summarizes tax treatment of other items such as alimony, annuities, life insurance payouts, and prizes or awards.

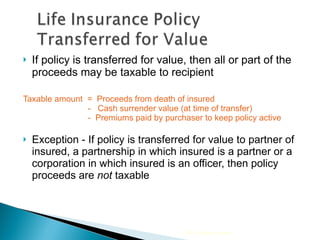

![Example Bianca transfers a life insurance policy with a face value of $25,000 and cash surrender value of $4,000 to Yvette as payment for services rendered. Yvette pays premiums of $500 per year for a total of $1,500 in the ensuing 3 years ; Bianca dies and Yvette collects the $25,000. How much must Yvette include in her gross income? How would this answer differ if Yvette and Bianca were partners in a partnership? Solution Yvette must include $22,500 in income [$25,000 – 4,000 - 1,500]. If Yvette and Bianca were partners in a partnership, the entire proceeds ($19,500) would be tax-free. 2009 Cengage Learning](https://image.slidesharecdn.com/chapter2-100628174449-phpapp01/85/Chapter-2-29-320.jpg)