The document analyzes the financial performance of British Land Company from 2005-2008 across several key metrics:

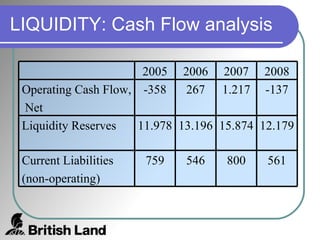

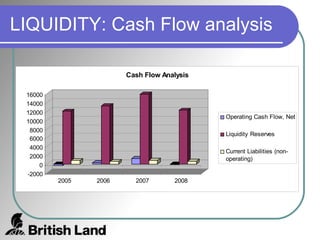

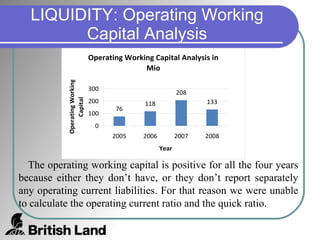

- Liquidity was positive as the company was able to pay short-term debts from operating cash flows and liquidity reserves.

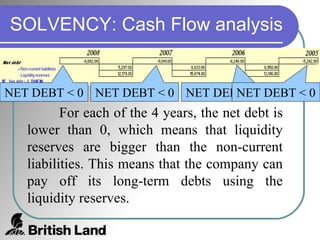

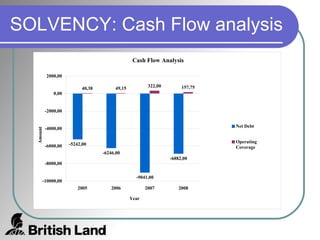

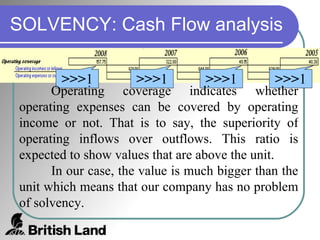

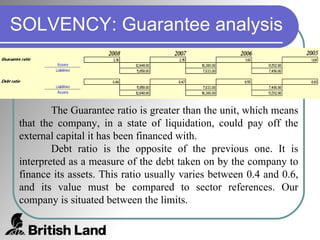

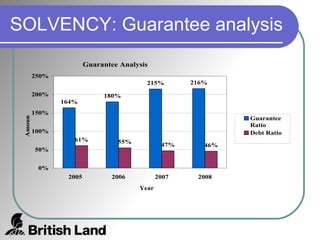

- Solvency ratios were strong with low net debt and high operating coverage.

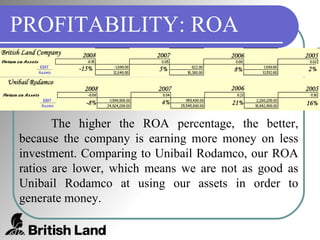

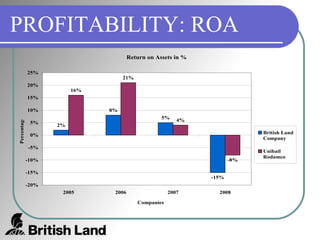

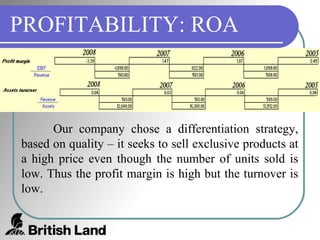

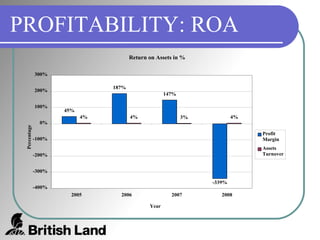

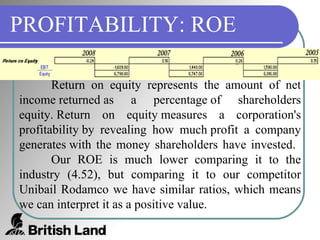

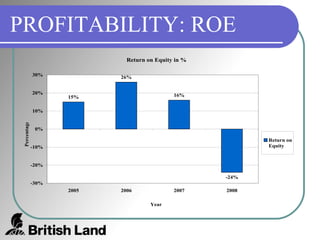

- Profitability as measured by ROA and ROE was lower than peers but consistent over time due to the company's differentiation strategy.

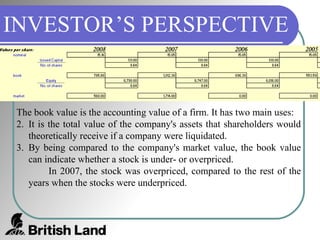

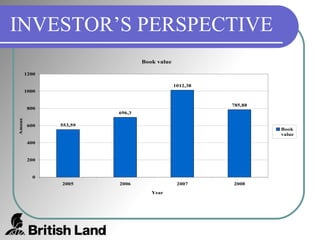

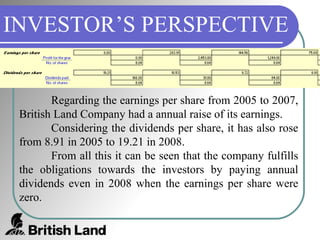

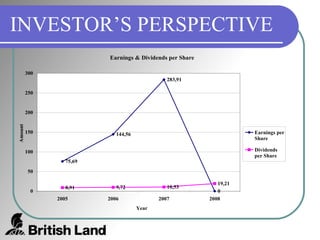

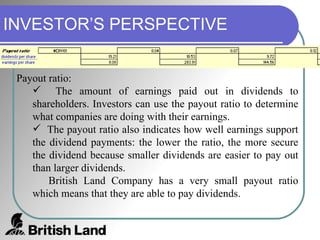

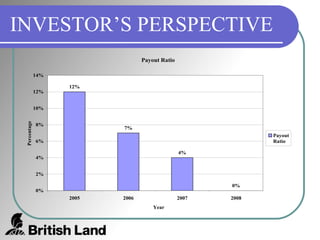

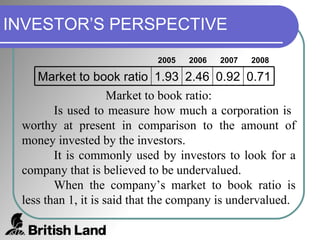

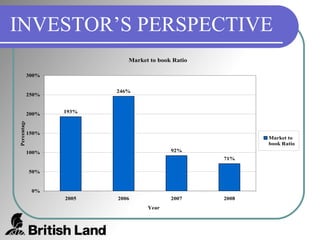

- From an investor's perspective, earnings and dividends grew annually though the stock was sometimes under or overpriced relative to book value. Overall ratios indicate the company is well-positioned in the real estate industry.