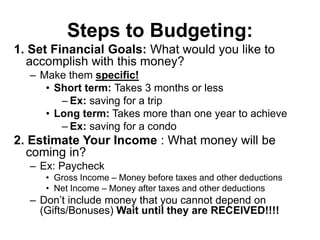

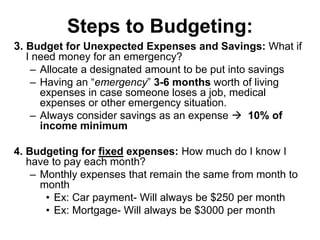

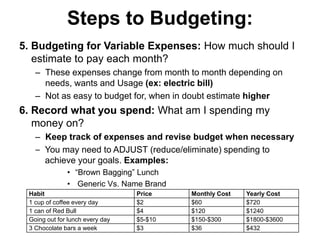

The document provides steps for proper budgeting. It begins by defining a budget and the key types of information included - needs versus wants. It then discusses the importance of budgeting to live within your means. The main steps outlined are to set financial goals, estimate income, budget for unexpected and fixed expenses, budget variable expenses, and record spending. Tips are provided such as decreasing impulse purchases, carrying less cash, and shopping smart with coupons.