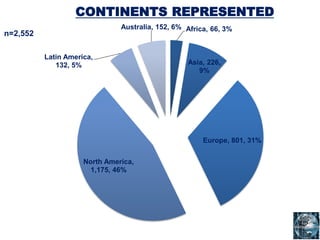

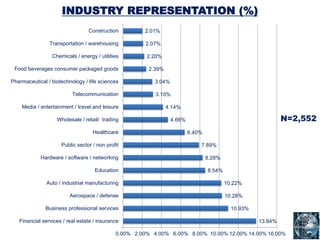

This document summarizes the results of an annual global survey on IT management trends. Some key findings include:

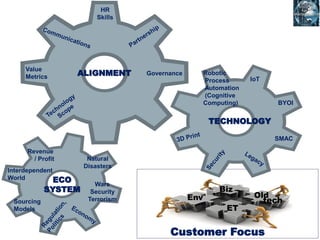

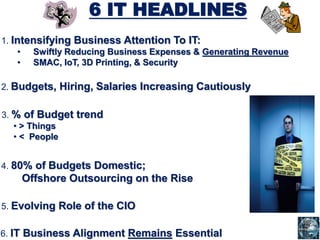

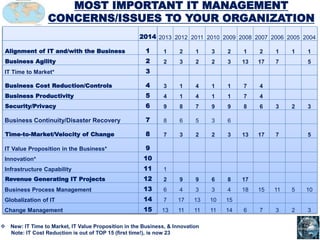

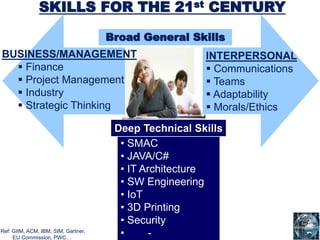

- IT alignment with business goals remains a top concern for organizations. Emerging technologies like SMAC (social, mobile, analytics, cloud) are also getting more business attention and investment.

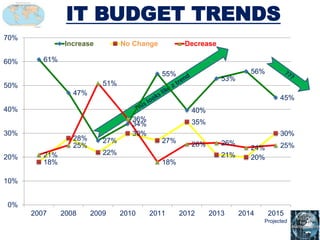

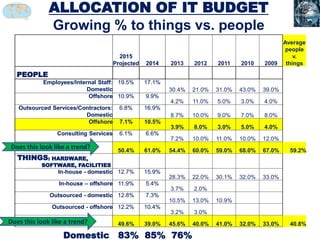

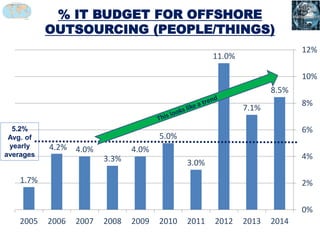

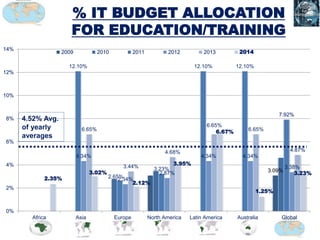

- IT budgets are increasing cautiously after years of cuts and cost-saving pressures. More budget is being allocated to "things" like infrastructure over "people".

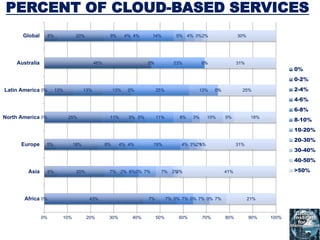

- Cloud computing, analytics/BI, and application development are receiving the largest IT investments. Security and big data are also growing areas of focus.

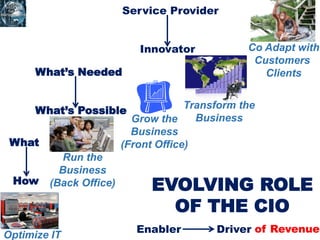

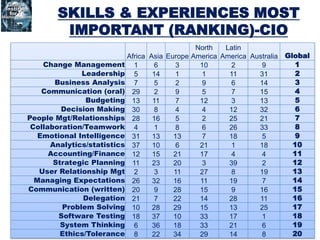

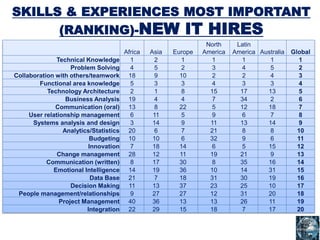

- Skills shortages remain a challenge as IT roles continue to evolve and require both business and technical