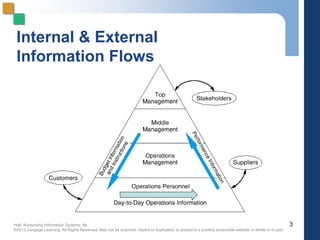

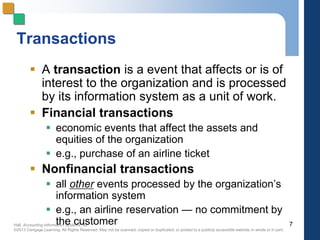

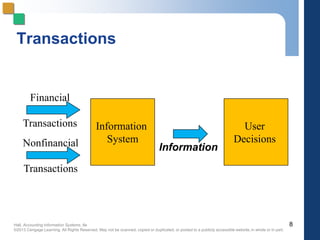

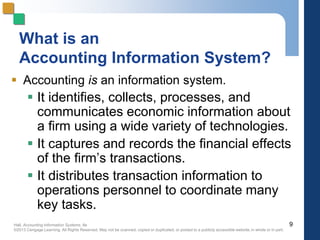

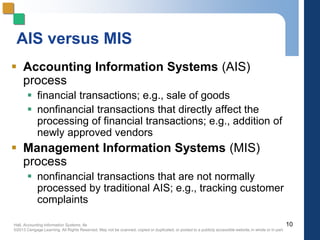

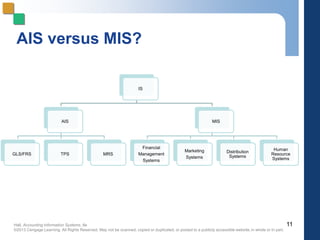

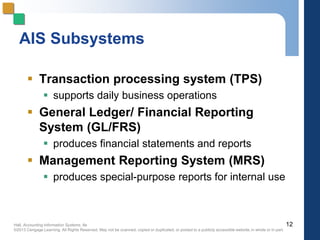

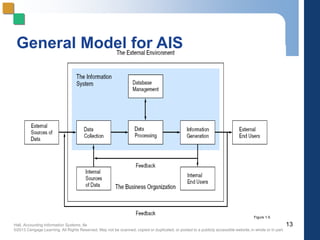

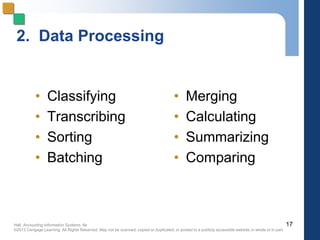

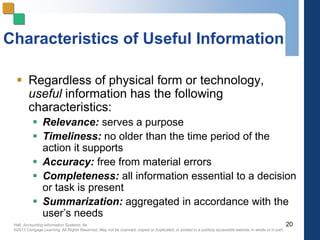

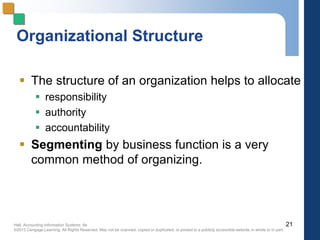

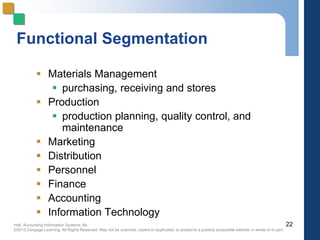

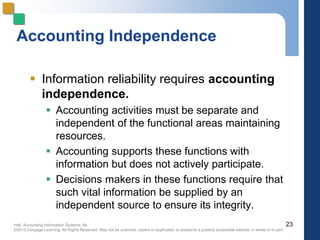

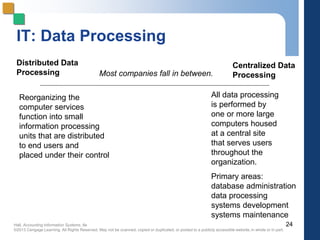

This document provides an overview of key concepts from Chapter 1 of the textbook "Accounting Information Systems" by James A. Hall. It defines accounting and management information systems, transactions, and the general model for information systems, which includes data collection, processing, management and information generation. It also describes the organizational structure of businesses and functional areas like finance, accounting and IT. Finally, it discusses the importance of accounting independence for reliable information.