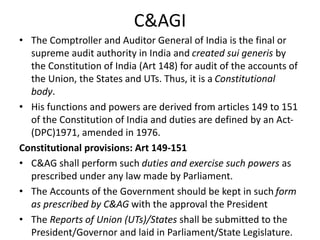

This document provides information about the role and responsibilities of the Comptroller and Auditor General (CAG) of India. Some key points:

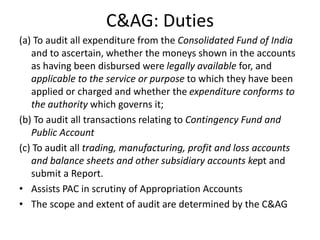

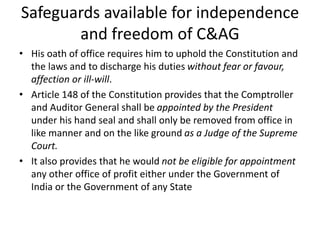

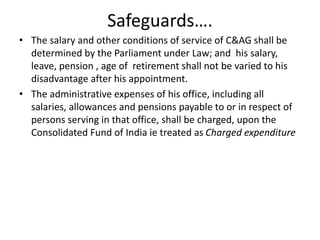

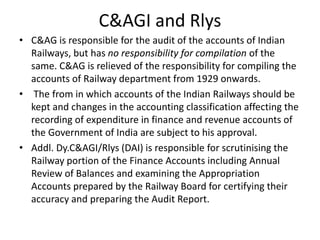

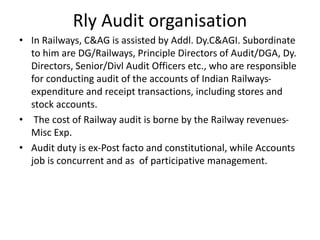

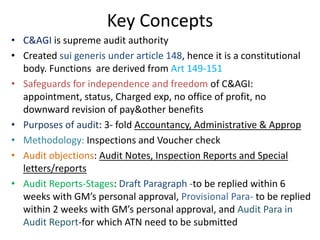

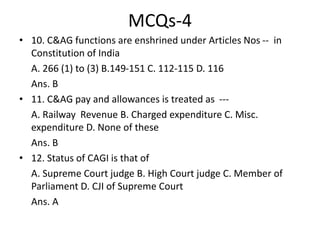

- CAG is the supreme audit institution in India established by the Constitution to audit the accounts of the Union, States and Union Territories.

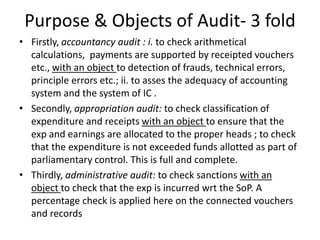

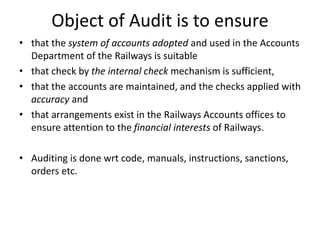

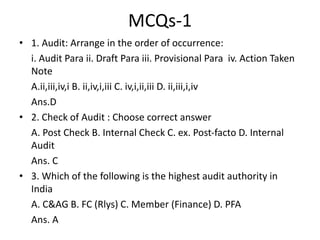

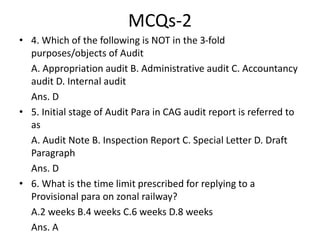

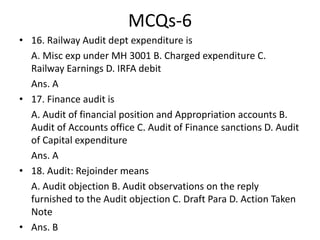

- The purpose of audit is three-fold: to check accounts and financial procedures, ensure expenditures are within approved budgets, and evaluate administrative performance.

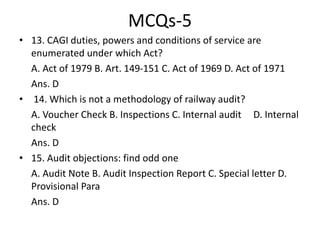

- CAG audits all government expenditures and revenues and submits audit reports to Parliament and state legislatures. These reports provide oversight of public spending and guidance for the future.

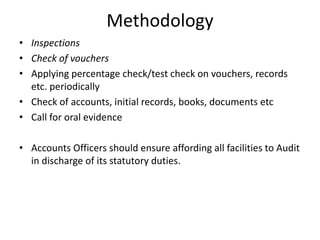

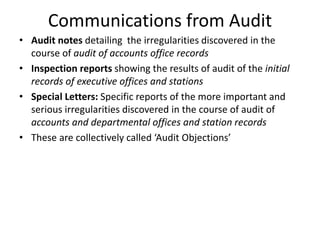

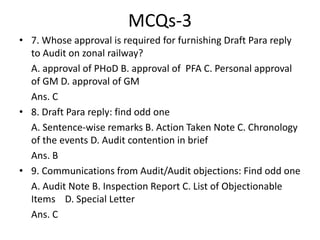

- The audit process involves draft paragraphs issued to agencies, opportunities for agencies to respond,